Harnessing Growth: Investing in Africa’s Digitization Innovators

September 03, 2020

Read Time 7 MIN

Africa’s Digitization: Unique Play in a Massively Underpenetrated Continent

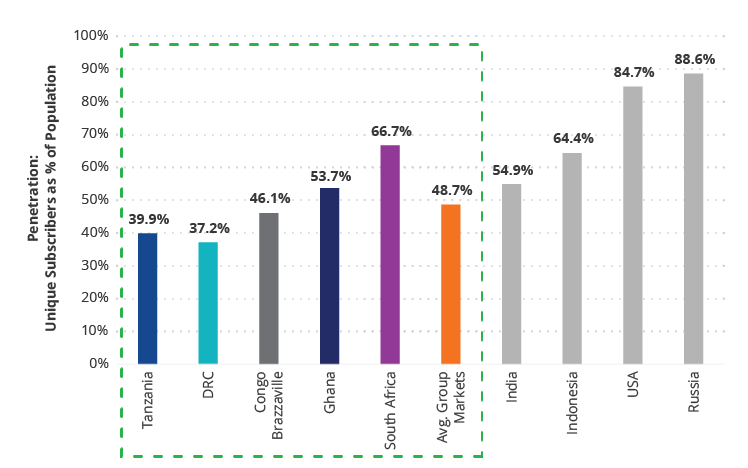

Africa is the world's second largest and second most populous continent (after Asia), with a massive opportunity for digitization of its economy. As displayed in the graph below, African countries remain grossly underpenetrated in comparison to other emerging markets, creating what we view as ample opportunity for alpha generation in the region.

Africa’s Lower Relative Digitization Penetration Creates Infinite Opportunity for Alpha Generation

Source: Helios Towers Company Data, GSMA Intelligence Database. Data as of June 2019.

Helios Towers: Connecting Africa by Bridging the Telecom Infrastructure Gap

Connectivity is key for socioeconomic development, and building out the telecom infrastructure is the foundation. Helios Towers (“HT”), an independent telecom tower infrastructure company with over 7,000 towers across Africa, is one of the leading players in Africa’s shifting telecom landscape.

HT is operating in some of the less accessible, underpenetrated and demographically attractive sub-Saharan African countries, with its largest exposures in Tanzania, The Democratic Republic of Congo (“DRC”) and Ghana. We saw an attractive structural growth opportunity in this company, as it directly addresses the growing need for telecom infrastructure due to the rising penetration of mobile phones, increased mobile data usage and evolving technology.

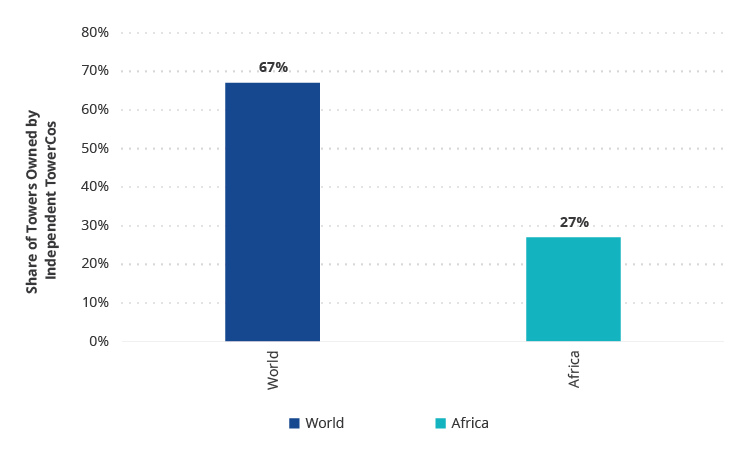

There is also a global trend of mobile network operators (“MNOs”) unbundling their telecom towers to independent companies to free up balance sheet capacity and better manage costs. This trend is welcomed by governments, as tower sharing by telecom operators through independent tower infrastructure companies both expands network coverage over time and is more environmentally friendly. Independent players like Helios Towers are set to benefit.

The company’s strong management, its solid execution track record and liquid balance sheet position HT particularly well to capitalize on M&A opportunities arising in this current market environment, along with “build to suit” organic growth opportunities. HT’s recently announced agreement to enter Senegal through the acquisition of 1,200 sites from Free Senegal1 is a good example. We like the company’s robust and visible revenue stream, driven by longer-term contracts with large telecom operators in Africa and its more defensive currency exposure with more than 60% of EBITDA in hard currency. The business model and performance have proven to be resilient in light of the current COVID-19 pandemic.

Africa vs. Global Tower Ownership: Majority of African Towers Are Still Owned by Telecom Operators

Source: BofA Global Research, Company Data. Data as of August 10, 2020.

Note: Ownership data refers to 2018.

We came across Helios Towers before the company went public. Senior Analyst Ola El-Shawarby met with management as it was still considering different strategic options for future growth. Ola was excited about the company and the unique exposure it provides. When HT announced its plans to go public, Ola continued the dialogue with the company’s management, led the due diligence effort on this name and presented it to the Emerging Markets Equity Investment Team. Helios Towers was added to our EME Focus List and we participated in the IPO that month. Since then, Ola has been in close communication with company management on a regular basis.

Safaricom: Bringing Financial Inclusion to Kenya as Its Mobile Money Space Pioneer

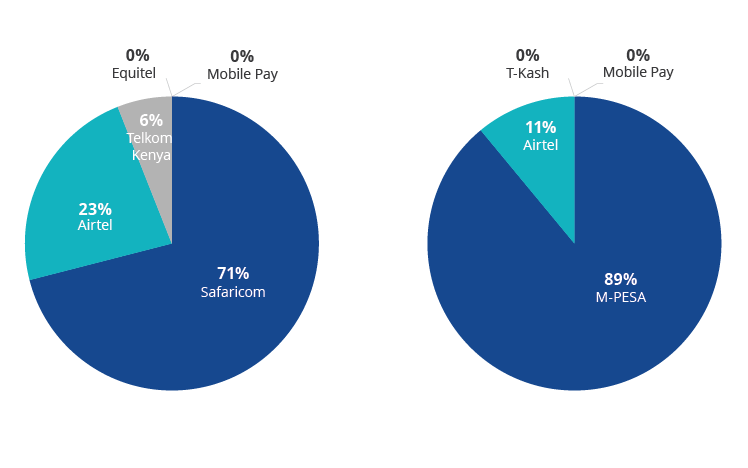

Safaricom is Kenya’s leading mobile operator by active subscriber market share (currently at 71%). We like Safaricom’s best-in-class service quality, which makes it the partner of choice across various sectors, especially for mobile data, as Kenya’s economy transitions towards digitization. In addition to the strong volume pickup of its mobile data segment in recent months, the other most exciting part of the business and the key driver of the structural growth story is Safaricom’s mobile money platform, M-PESA (approximately 34% of revenues).2

M-PESA has emerged as one of the most successful financial inclusion case studies globally. In a country where banking infrastructure is lacking and many people are considered “un-bankable,” M-PESA is changing the lives of millions of Kenyans in urban and rural areas. It utilizes a wide network of agents across Kenya to provide basic financial services such as P2P money transfer. It is also used for a wide variety of essential transactions, including the payment of household bills and salaries, distribution of pension payments and disbursement of agricultural subsidies and government grants. Customers can pay for goods and services both at retail stores and online.

Despite the strong growth of M-PESA over the years, company management indicates that cash transactions are still around 60% of all transactions in Kenya, which leaves ample room for future growth, in our view. Looking ahead and based on our regular discussions with management, we believe there is scope to expand the M-PESA product portfolio to also include lending, wealth and savings products. Management also believes the existing ecosystem can support small to medium-sized enterprises (“SMEs”) by making M-PESA the payment method of choice.3

Safaricom has also expressed interest in rolling out M-PESA in other African countries—like Ethiopia, which is taking steps towards opening up its telecom sector to foreign investments—in an attempt to replicate the success seen in Kenya.

Safaricom Leads Mobile Data Subscriber Market Share in Kenya and M-PESA Dominates Mobile Money Subscriber Market Share in Kenya

Source: EFGHermes, Company Data. Data as of June 23, 2020. Company Data is as of September 2019.

Safaricom is an old friend that we have held in the portfolio for about five years now, since August 2015. Members of the Investment Team have met with company management many times in New York and during overseas travels. Ola currently leads the effort on continuing to follow and analyze the performance of the company and remains in close contact with management.

Fawry: Digitizing Egypt’s Payments

Founded in 2008, Fawry is the first and largest e-payments4 company in Egypt, with 500 employees, annual revenues of over $50M (as of end of 2019) and a market cap of ~$1B. We saw a structural growth opportunity in the company’s positioning in the space and its advantageous scale compared to other players in digital payments. In Egypt, banking penetration remains low at only 32%, with consumers heavily cash reliant and digital payments penetration still nearly at half of the global average. A combination of recent regulatory incentives and widespread point of sale (“POS”) rollout could translate into a massive investment opportunity in Egypt’s economic digitization and we believe that Fawry is well positioned to capture it.

Fawry started out as an alternative digital payments provider, using proprietary technology and a wide network of small merchants equipped with Fawry POS machines all over Egypt to accept customer cash payments, predominantly to pay for telecom services and bills. The company’s bill payment services grew to include also utilities, becoming the main payment facilitator for government services through merchants and online. Over time, its merchants and customer network grew to 167K and 29M, respectively.

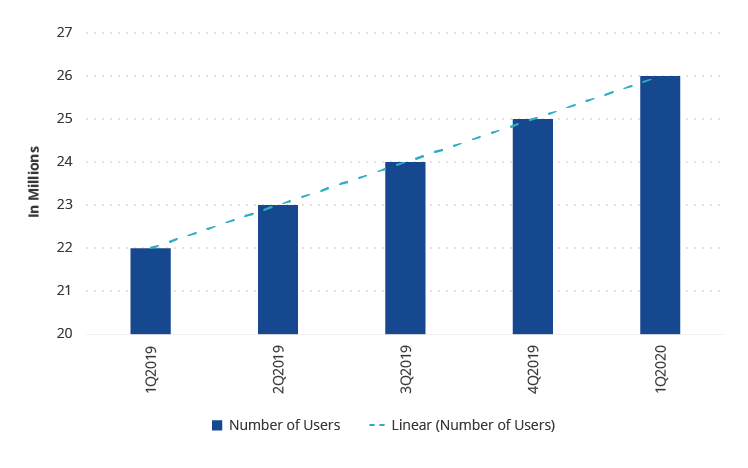

Fawry embarked on a diversification strategy to expand the ecosystem and capitalize on its growing network of merchants and customers to include merchant acquiring, facilitating cashless payments acceptance in-store and online, as well as digital wallets. The company also started providing supply chain management and micro-lending services, offering working capital financing mainly to its network of merchants at attractive yields and returns. While its core alternative digital payments segment continues to grow at a healthy rate of around 30%, the newer and higher margin segments are now growing at a faster pace (above 50% annually) and the company benefits from strong operating leverage. We are very encouraged by Fawry’s impressive, recently announced results, with recurring earnings in 2Q20 growing at above 140% and confirming our thesis that the current environment has further accelerated the digitization trend.

Fawry's User Base Has Been Growing and Continues to Grow in a Visible, Persistent Pattern

Source: Citi Research. Data as of July 21, 2020.

Ola has been a fan of Fawry as an occasional customer during her visits to Egypt and an observer of the fintech space in Egypt for many years now. She has followed the company’s performance even more closely and met with company management several times since they filed for an IPO in August 2019. While the stock’s lower liquidity levels did not support building a position during that time, Ola continued conducting due diligence on the name. We finally made our first investment in Fawry, taking advantage of a liquidity event in July 2020, when some private equity shareholders were reducing their stake.

Looking Forward

Trend acceleration has been quite positive for the VanEck Emerging Markets Equity Strategy. Our focus on many of these structural growth areas enabled us to uncover Helios Towers, Safaricom and Fawry. These companies are showing strong growth potential and Q2 earnings results further solidify our conviction in these names. As a result, our outlook is optimistic for the second half of the year, despite the current challenges.

Related Insights

April 19, 2024

April 19, 2024

April 18, 2024

February 29, 2024

DISCLOSURES

2 Company Data.

3 Company Data; based on information disclosed during the quarterly earnings call with management.

4 Consumer bill payments provider.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. Strategy holdings will vary.

Emerging Market securities are subject to greater risks than U.S. domestic investments. These additional risks may include exchange rate fluctuations and exchange controls; less publicly available information; more volatile or less liquid securities markets; and the possibility of arbitrary action by foreign governments, or political, economic or social instability.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURES

2 Company Data.

3 Company Data; based on information disclosed during the quarterly earnings call with management.

4 Consumer bill payments provider.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. Strategy holdings will vary.

Emerging Market securities are subject to greater risks than U.S. domestic investments. These additional risks may include exchange rate fluctuations and exchange controls; less publicly available information; more volatile or less liquid securities markets; and the possibility of arbitrary action by foreign governments, or political, economic or social instability.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.