Race for Cure Drives Biotech Stocks

May 26, 2020

Read Time 2 MIN

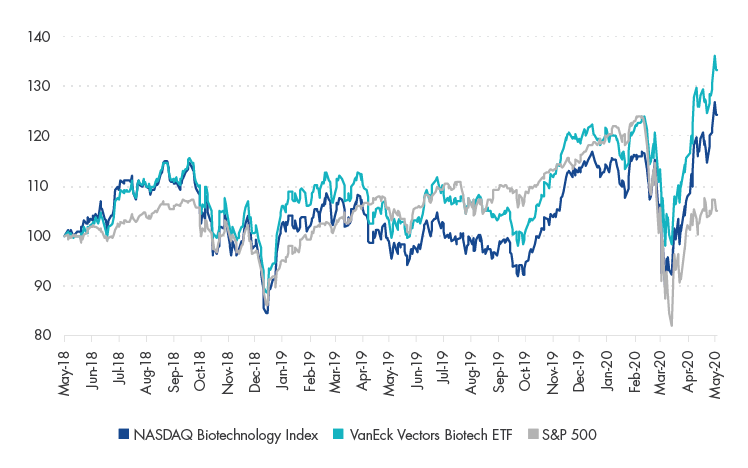

With the COVID-19 pandemic showing few signs of easing, biotech companies are racing to meet soaring demand for treatments, vaccines and testing kits. This is helping to drive renewed investor interest in the biotech sector.

Recent developments by some biotech firms have not only raised hope for investors eager for anything that will mitigate the epidemic, but the optimism has also helped lift the sector’s performance so far this year. ETFs that track companies in the biotech sector, such as the VanEck Vectors Biotech ETF (BBH), have also rallied.

Biotech Stocks Rise Amid Soaring Demand (Growth of $100)

Source: Factset. Data as of 13 May 2020. Past performance is no guarantee of future performance. ETF returns reflect temporary contractual fee waivers and/or expense reimbursements. Had the ETF incurred all expenses and fees, investment returns would have been reduced. Investment returns and ETF share values will fluctuate so that investors' shares, when redeemed, may be worth more or less than their original cost. ETF returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV.

Access the Biotech Opportunity

The sector’s growth potential seems encouraging, as forecasters expect demand for diagnostics and antibody tests to outstrip supply for the foreseeable future. At the time of writing, the coronavirus has already infected more than 4M globally, and the death toll has surpassed 290,000.1 Even governments that appeared to have tamed the disease have warned of resurgence.

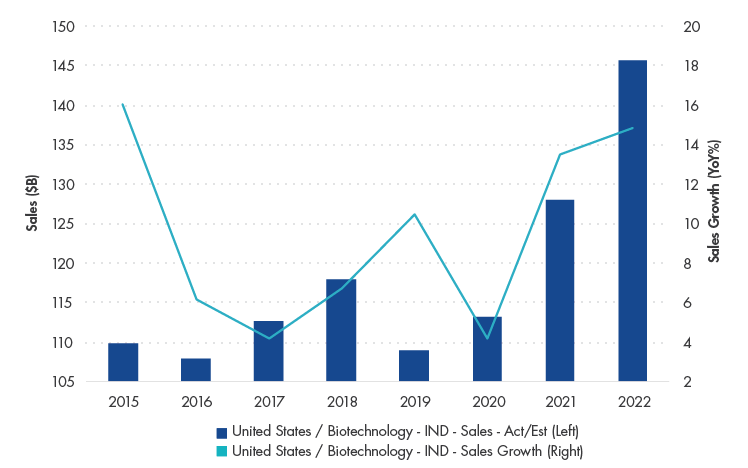

The chart below shows that industry sales and sales growth are projected to increase significantly this year and the next, after these dipped in 2019. Some companies at the forefront of the race to find a treatment look well positioned. These include Gilead Sciences (8.09% of net assets*) and Moderna (8.77% of net assets*), two of the top 10 holdings of BBH. Gilead recently indicated that the trial for coronavirus treatment Remdesivir has met its initial goal. In addition, the U.S. Food and Drug Administration (FDA) has granted emergency use of Remdesivir, enabling broader use of the antiviral drug in hospitalised patients with severe symptoms of COVID-19. Meanwhile, the FDA is also fast tracking Moderna’s experimental COVID-19 vaccine through the regulatory review process.

U.S. Biotech Sector Sales Outlook

Source: Factset. Data as of June 23, 2020.

COVID-19 and the urgency in finding a cure have opened up opportunities, making the biotech sector a prospective space for investments. Instead of trying to pick which are the most likely beneficiaries, one of the easiest ways to invest in biotech is via an ETF like BBH. The fund, with 25 holdings in the portfolio, focuses on the biotech segment of the U.S. market and provides exposure to some of the largest biotech companies that are at the forefront of the race to find a vaccine for the outbreak.

Related Insights

April 10, 2024

March 25, 2024

March 01, 2024

February 16, 2024

January 31, 2024

DISCLOSURES

*Fund net assets as of May 19, 2020.

1Source: Johns Hopkins University. Data as of May 11, 2020.

This material is for informational purposes only. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and are subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the companies mentioned herein. Fund holdings will vary. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/bbh/holdings/.

An investment in the VanEck Vectors® Biotech ETF (BBH) may be subject to risks which include, among others, investing in the biotechnology industry, equity securities, health care sector, depositary receipts, medium-capitalization companies, issuer-specific changes, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Related Funds

DISCLOSURES

*Fund net assets as of May 19, 2020.

1Source: Johns Hopkins University. Data as of May 11, 2020.

This material is for informational purposes only. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and are subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the companies mentioned herein. Fund holdings will vary. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/bbh/holdings/.

An investment in the VanEck Vectors® Biotech ETF (BBH) may be subject to risks which include, among others, investing in the biotechnology industry, equity securities, health care sector, depositary receipts, medium-capitalization companies, issuer-specific changes, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.