EM Growth Drivers – Clash of Titans

27 March 2023

Read Time 2 MIN

Recession Concerns

The market expectations for the U.S. Federal Reserve (Fed) remain stubbornly dovish, with the banking system’s turmoil emerging as the main culprit – especially as regards the impact of tighter lending conditions on the growth outlook. The Fed’s senior loan officer opinion survey shows that tightening was already underway going into the banking mini-crisis, but the share of “considerable tightening” was still small – so this space warrants close attention in the coming weeks. Most observers agree that spillovers from the developed markets (DM) banking turmoil into emerging markets (EM) should be limited – another supporting factor for the asset class in addition to lower debt ratios and much higher real rates. However, we might need to exercise caution when interpreting the latest EM activity gauges - which are just around the corner – given the timing of the mini-crisis.

China Rebound

Another factor to keep in mind when thinking about the EM growth outlook is that the credit impulse is now negative in about one-half of major EMs (in addition to being “barely there” in about 1/3, according to the sell-side estimates). This is, of course, a consequence of EM central banks’ early and aggressive policy tightening in response to the post-pandemic price pressures, but this raises the importance of China as a potential global growth “booster”. The recent sharp increase in China’s economic surprise index looks encouraging – the index is now the highest since 2006 – but the consensus prefers to be the cautious. Both the services and the manufacturing PMIs are expected to stay comfortably in expansion zone, but without further improvement.

China Reopening and EM Growth

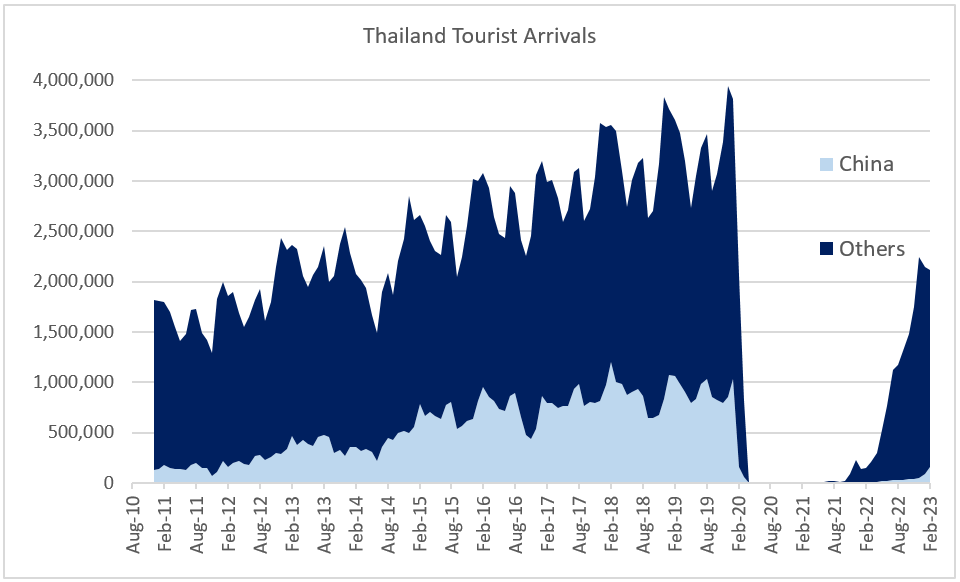

The latest signals in EM manufacturing suggest that China’s growth boost to EM growth is likely to materialize later this year – for now, numbers show mostly marginal improvements and signs of stabilization. Thailand’s tourism arrivals show that the impact of China’s reopening on services – especially in EM Asia – might also take time. While it is true that the number of Chinese tourists tripled since December, the improvement is from a near-zero base, and well below the pre-pandemic levels (see chart below). Stay tuned!

Chart at a Glance: China’s Growth Boost to EM – Patience, Please

Source: Bloomberg LP

Related Insights

07 April 2025

06 March 2025

20 February 2025

16 January 2025

07 April 2025

Trump’s tariffs spark trade war fears, fueling market volatility, inflation risk, and recession threats. With global retaliation likely, near-term growth is clearly at risk.

06 March 2025

Trump’s tariffs, AI’s next phase, and a potential U.S. gold revaluation could shake markets—investors who stay ahead of these transitions will be best positioned.

20 February 2025

China's AI breakthrough, persistent inflation, gold’s outperformance, and rising energy demand underscore a shifting investment landscape.

16 January 2025

In 2025, navigating turbulence means balancing tech innovation, inflation hedges, energy shifts, and risks from spending cuts and inflation.

05 December 2024

"Trump Trade 2.0" fueled U.S. equity and digital asset rallies, while real assets faltered under a strong dollar, with global markets reacting unevenly to pro-growth policies.