2020 Investment Outlook: The World’s Next Big Digital Platform

03 December 2019

Read Time 2 MIN

December 03, 2019

December 03, 2019

2020 Investment Outlook: The World’s Next Big Digital Platform

CEO Jan van Eck shares his 2020 investment outlook, with a focus on navigating central bank policy and what he views as the most interesting investable trend for 2020: the digitization of India.

Watch Video

Before we review financial market conditions, let’s focus on what we view as a big, investable trend.

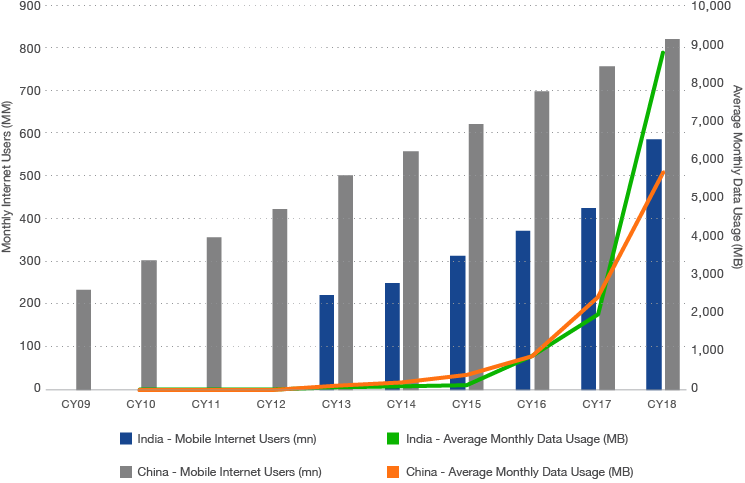

The supernovas of the last decade are the digital platforms and one more opportunity is quietly being seized. Amazon has approximately 40% of the ecommerce market in the U.S.1 Alibaba has approximately 60% of the market in China.2 We think the next supernova may be mobile phone vendor Reliance Jio in India. Reliance Jio has more than 355 million mobile phone clients as of the end of October, with a target of 450 million by 2021, out of India’s approximately 1.2 billion mobile users.3 Are you sufficiently investing in this trend?

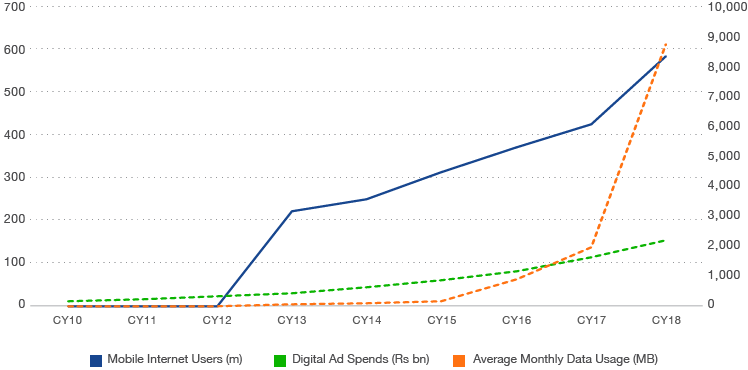

Digitizing India: Cellular Users and Data Consumption

Source: Bloomberg, Macquarie. Data as of 12/31/18.

Monthly data usage in India has actually surpassed China. In our view, there is disruptive potential that may create opportunities for investors as companies in India build out ecosystems to support India’s digitization. This may not be getting many news headlines, but I think it is very interesting from a growth perspective and an investable trend worth consideration.

Explosion of Digital Data Usage in India—What Are They Watching?!

Source: Bloomberg, Macquarie. Data as of 12/31/18.

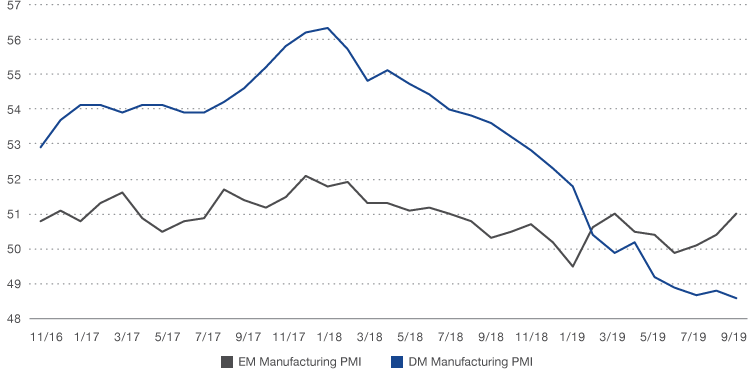

Central Banks Still Drive the Market

In developed markets, we expect continuing slow to moderate economic growth as central banks ease and support economies. Heading into 2019, one of our key messages was “Don’t fight the PBOC (People’s Bank of China).” China was addressing its debt bubble in a very balanced and attentive way, and as we predicted, this drip stimulus approach has been effective. China’s economy continues to move forward, even though its manufacturing sector may be having trouble. I believe Chinese policies will be adequate support for global growth. See our regular updates on China’s economic growth for more insights.

Manufacturing PMIs: Emerging Markets vs. Developed Markets

Source: Bloomberg. Data as of October 31, 2019. Past performance is no guarantee of future results. Chart is for illustrative purposes only.

Although unlikely while managing a debt bubble, if China experiences a growth surprise, I think we would see global financial markets and commodity markets jumping higher.

On the other hand, financial markets may turn negative if the U.S. Federal Reserve were to suddenly turn hawkish, though I think this is doubtful in an election year. I believe another potential downside depends on whether central banks in Europe are still considered a credible counterweight to slower growth. As discussed in my previous outlook, Time to Hedge Against Central Bank Uncertainty?, I think investors should consider a hedge in their portfolio, such as a gold position, in the event that central bank confidence weakens dramatically.

Managing Volatility in 2020

Given the upcoming U.S. presidential elections and high valuations in equities, investors may be concerned about volatility and become cautious. However, I think valuation can be a misleading indicator of how financial markets behave in the short term. In our view, smart beta ETFs offer one way to help manage volatility. For example, the VanEck Vectors Morningstar Wide Moat ETF (MOAT®) and VanEck Vectors Morningstar Durable Dividend ETF (DURA®) incorporate an assessment of the valuations of individual stocks, and overpriced components are removed from the respective underlying indices at their quarterly rebalancing. In dealing with volatility, our view is that, rather than being overly cautious at the portfolio construction level, investors should evaluate the individual strategies in their portfolio.

Asset Management Industry Outlook

Similar to what we have seen among custodian banks and online broker dealers, the asset management sector has become more concentrated, creating scale that is driving price competition. Our key takeaway from this is that each company has to have a unique selling proposition distinct from scale or price. Part of the core philosophy at VanEck is to come up with interesting investment strategies that are thoughtful and appropriate to the asset class and meet investor needs.

Looking at financial advisors, I think they have to think beyond portfolio construction. While portfolios are important, many financial advisors are looking at other value-added services—such as tax-related advice, estate planning, healthcare and other types of advice—in order to differentiate themselves.

Happy holidays and happy investing in 2020!

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.