China Rebound – V-Shape?

31 January 2023

Read Time 2 MIN

China Growth Outlook

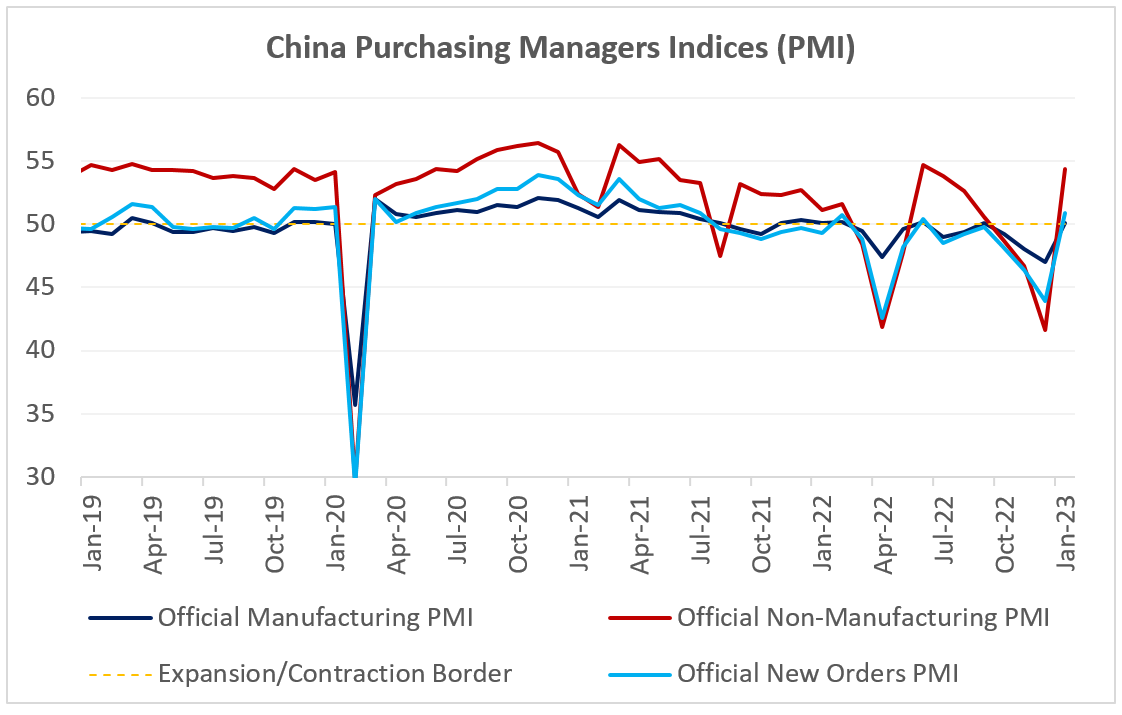

China’s rebound, which has boosted emerging markets (EM) asset prices, is real, and it is led by consumption – these are the main takeaways from the latest set of domestic activity gauges (Purchasing Managers Indices1). Both the manufacturing and the services PMIs moved back to expansion zone in January (respectively, 50.1 and 54.4 – see chart below), paving the way for further 2023 growth upgrades (currently 5.1%, according to the Bloomberg consensus forecast). Details show that China’s external environment remains challenging – the new export orders PMI is still contractionary (46.1) – and that small privately-owned companies are still struggling (47.2). These are good reasons to keep stimulus flowing for now. A sharp improvement in the services PMI (by nearly 13 points) is, however, an encouraging signal for those of us who have been complaining about China’s unbalanced growth since the onset of the pandemic. This is also a reason why the consensus sees higher inflation pressures in China down the road, expecting some policy tightening in the second half of the year.

China Rebound and EM

The market (both bonds and equities) has been anticipating improvements in China’s activity indicators for some time now – given the U-turn in the housing sector policies and the removal COVID restrictions. An important question now is what China’s growth rebound means for the rest of EM, which have been plagued by higher inflation and rising interest rates for most of 2022, but had a very good start to the year (so far). The TTC approach – China’s impact on trade (T), tourism (T) and commodity prices (C) – gives us a broad idea where to look for potential winners in 2023 (both in EM Asia and beyond). Thailand, South Korea and Indonesia are definitely on the list – as are commodity exporters (Chile).

Disinflation and Rate Cuts

It is not entirely clear, though, how China’s reopening will affect the pace of global disinflation and various central banks’ ability to cut rates in the coming months. Market expectations continue to price in H2 rate cuts across major EMs and in the U.S., setting a potentially positive stage for lower interest rates. But China-related growth tailwinds, as well as a new inflationary impulse, can potentially thwart these plans, leading to a longer pause rather than outright easing. If the U.S. Federal Reserve falls into this category, the market might become more discriminating in its assessment of the 2023 prospects for EM. Stay tuned!

Chart at a Glance: China Activity Gauges – A Nice Rebound

Source: Bloomberg LP.

1 We believe PMIs are a better indicator of the health of the Chinese economy than the gross domestic product (GDP) number, which is politicized and is a composite in any case. The manufacturing and non-manufacturing, or service, PMIs have been separated in order to understand the different sectors of the economy. These days, we believe the manufacturing PMI is the number to watch for cyclicality.

Related Insights

06 marzo 2025

20 febrero 2025

16 enero 2025

07 abril 2025

Los aranceles de Trump avivan los temores de una guerra comercial, impulsando la volatilidad del mercado, el riesgo inflacionario y la amenaza de una recesión. Ante posibles represalias globales, el crecimiento a corto plazo corre un riesgo evidente.

06 marzo 2025

Los aranceles de Trump, la próxima fase de la IA y una posible revalorización del oro estadounidense podrían sacudir los mercados; los inversores que se adelanten a estas transiciones estarán mejor posicionados.

20 febrero 2025

El avance de la IA en China, la persistente inflación, el rendimiento superior del oro y el aumento de la demanda energética ponen de relieve un panorama de inversión cambiante.

16 enero 2025

En 2025, superar los problemas significa equilibrar la innovación tecnológica, las coberturas contra la inflación, los cambios energéticos y los riesgos derivados de los recortes del gasto y la inflación.

05 diciembre 2024

"Trump Trade 2.0" impulsó los repuntes de las acciones estadounidenses y los activos digitales, mientras que los activos reales se tambalearon debido a un dólar fuerte, con los mercados mundiales reaccionando de forma desigual a las políticas favorables al crecimiento.