When Big Stories Collide

10 March 2023

Read Time 2 MIN

Fed Policy Response

Geopolitics is moving to the forefront again, “colliding” with concerns about a mini bank crisis/moral hazard in the U.S. – but against the backdrop of a strong payrolls number. The market responded to this new “twist” with another risk-off episode and some retracement of expectations for the U.S. Federal Reserve’s (Fed’s) peak rate. Some emerging markets (EM), however, are trying to ignore today’s “gloom and doom” – including several major currencies and sovereign bonds. And this, of course, invites comments about EMs’ stronger structural and institutional frameworks (many countries did their homework after the 2008 global financial crisis – especially “EM Graduates”), as well as EM central banks’ timely and aggressive response to the post-pandemic inflation episode.

EM Disinflation

The latest data releases confirmed the EM disinflation story. A pause in the hiking cycle looks increasingly justified in many countries, but the bar for rate hikes is quite high due to concerns about the pace of disinflation (the progress is bumpy), significant distances from official targets and stickier core inflation. The first point (bumpy progress) was on full display today in Brazil, where headline inflation surprised to the upside, and the price diffusion index inched higher. Czech headline inflation eased in February, but many analysts drew attention to the fact that it was narrow-based. The Peruvian central bank confirmed the “wait-and-see” approach yesterday, in part due to geopolitical risks and uncertainties.

China Rebound

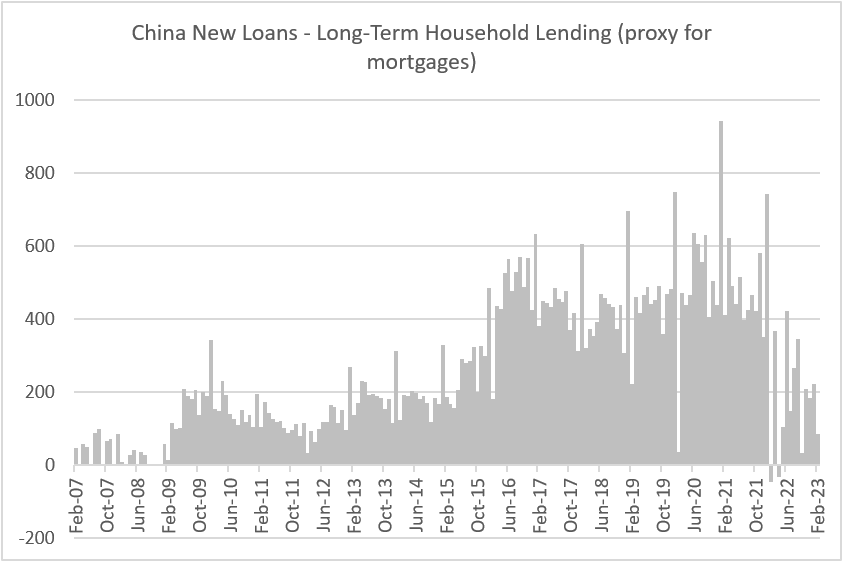

China featured prominently in the latest batch of global headlines, including renewed tensions with the U.S., the implications of President Xi Jinping’s third term and China’s reported role in rapprochement between two major energy players, Saudi Arabia and Iran. But today’s credit and monetary aggregates were just as important for the China rebound story. The headline numbers were stronger than expected – both total social financing and new yuan loans. However, details show that recovery is still in the initial stages and might take longer, especially as regards household consumption and housing sector/mortgages, which experienced a setback in February (see chart below). Stay tuned!

Chart at a Glance: China’s Mortgage Growth – Lower for Longer?

Source: Bloomberg LP

Related Insights

06 marzo 2025

20 febrero 2025

16 enero 2025

07 abril 2025

Los aranceles de Trump avivan los temores de una guerra comercial, impulsando la volatilidad del mercado, el riesgo inflacionario y la amenaza de una recesión. Ante posibles represalias globales, el crecimiento a corto plazo corre un riesgo evidente.

06 marzo 2025

Los aranceles de Trump, la próxima fase de la IA y una posible revalorización del oro estadounidense podrían sacudir los mercados; los inversores que se adelanten a estas transiciones estarán mejor posicionados.

20 febrero 2025

El avance de la IA en China, la persistente inflación, el rendimiento superior del oro y el aumento de la demanda energética ponen de relieve un panorama de inversión cambiante.

16 enero 2025

En 2025, superar los problemas significa equilibrar la innovación tecnológica, las coberturas contra la inflación, los cambios energéticos y los riesgos derivados de los recortes del gasto y la inflación.

05 diciembre 2024

"Trump Trade 2.0" impulsó los repuntes de las acciones estadounidenses y los activos digitales, mientras que los activos reales se tambalearon debido a un dólar fuerte, con los mercados mundiales reaccionando de forma desigual a las políticas favorables al crecimiento.