Addressing Contagion Fears

20 March 2023

Read Time 2 MIN

Global Banking Stresses

So, it looks like the Credit Suisse “fire” had been put out by Swiss authorities and the “confederation” of global banks (including the U.S. Federal Reserve’s swap lines), but these moves have not fully alleviated concerns associated with “dry wood” still left in the system. There is also a question about broader damage to the U.S. economy – due to tighter financial conditions and deposit outflows to larger banks – which resurrected the recession narrative. These concerns are behind the market expectations that the U.S. Federal Reserve (Fed) will affirm the “new normal” of lower rates on Wednesday. The implied probability of a 25bps rate hike is still around 70% and the Fed Funds Futures now price in a rate cut in June.

China Rebound and EM

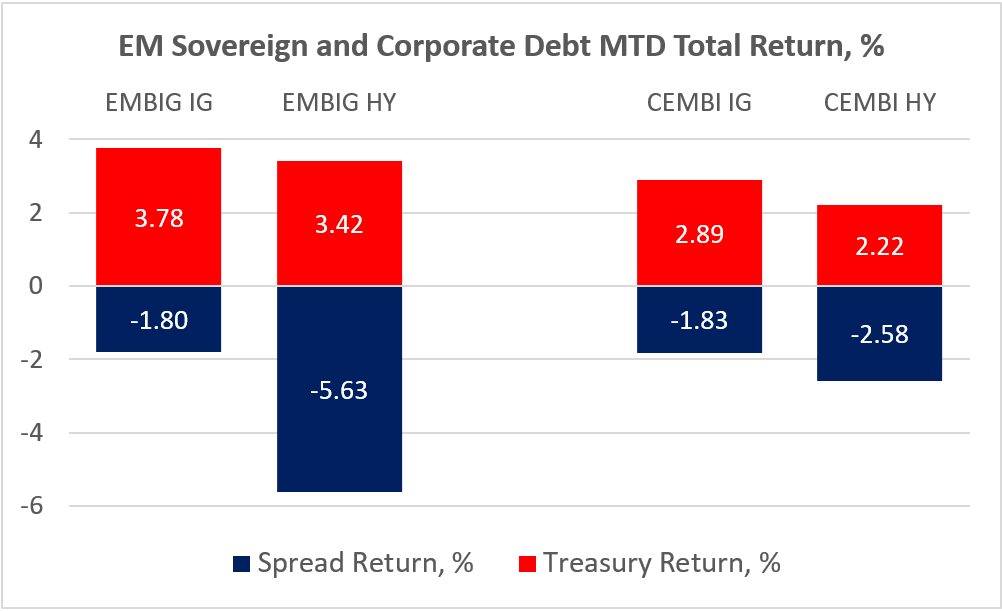

Emerging markets (EMs) are following the situation closely – especially the impact on EM banks – but there is no sense of panic. Investment grade EM bonds – both corporate and sovereign – show no stress (see chart below), with market spillovers (in the form of wider spreads) affecting mainly lower-rated sovereign bonds. Month-do-date total return on EM local debt (J.P. Morgan’s GBI-EM Index) is positive, and EMFX performance in March suggests that the China rebound narrative is alive and well as a global driver and that many EMs are arguably more correlated with China than with the Fed.

EM Policy Rates

Regarding EM policy response; it is telling that China decided to keep the 1-year and 5-year loan prime rates unchanged over the weekend – after bringing forward the cut in the reserve requirements for banks as a precautionary measure. The market increasingly treats EM policy outlooks as idiosyncratic stories, thinking that various EM central banks will be able to pause safely and even cut rates in 2023, irrespective of DM policy tribulations. This line of thinking might get tested in the next week or so. Several EM central banks will be holding their rate-setting meetings after the Fed, including Brazil (expected on hold), Mexico (the market sees +25bps), Colombia (+50bps more would be warranted given the inflation dynamics), the Philippines (+25bps more – also because of persistent inflation pressures), South Africa (many see a 25bps hike) and Thailand (a pause?). Central banks’ statements will also be scrutinized for comments about the global environment and how it affects their reaction functions. Stay tuned!

Chart at a Glance: EM Debt – Stress Is Localized

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.