Risk Control vs. Fundamentals

17 March 2023

Read Time 2 MIN

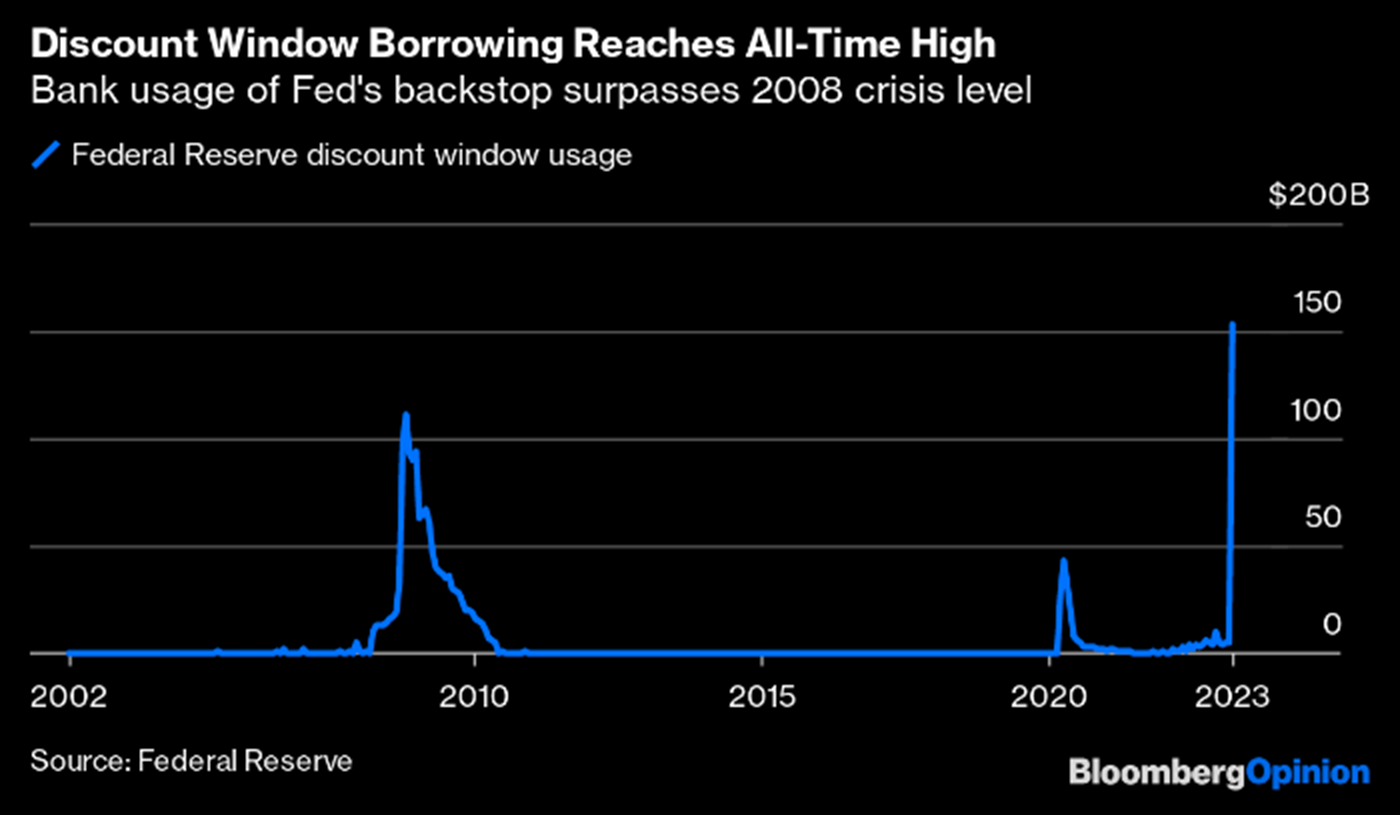

Fed Policy Rate

The market is still trying to evaluate the effectiveness of the U.S. Federal Reserve’s (Fed’s) liquidity reprieve for banks. A Bloomberg chart making rounds this morning shows a huge spike in banks’ discount window borrowing at the Fed (see below), but some bank credit default swaps (CDS) widened again. A big question is whether the Fed will reaffirm the “new normal” of lower interest rates at next week’s meeting, or follow the European Central Bank (ECB) hawks and prioritize inflation. The expectations are mixed. The implied probability of the full 25bps hike is still around 70%, and the implied peak rate remains below 5%. Today’s softer than expected University of Michigan survey – including short- and long-term inflation expectations – points to even more uncertainty in the next few days.

China Recovery

Most emerging markets (EM) are watching the current situation from the sidelines (policy-wise), but China decided to respond with a broad-based 25bps cut in its reserve requirement ratios1 (RRR) – in addition to liquidity injections through other facilities. The RRR cut was not entirely unexpected – short rates have been grinding higher for some time now, which is not an ideal backdrop for the nascent recovery – and the move does not contradict the State Council’s “supportive yet restrained” policy objectives. The timing, however, suggests that risk prevention played a big part.

EM Reaction to the Banking Crisis

China’s reaction is important because a number of EMs – especially in in Asia – are arguably more correlated with the reopening/rebound narrative than with the Fed. This reflects not only the “growth” links, but also the fact that inflation had peaked at lower levels than in EM peers, putting less tightening pressure on central banks. The EMFX price action in the past week illustrates the “anti-Fed correlation” point quite well – Asian currencies pretty much ignored the banking mini-crisis in developed markets (DM), rising against the U.S. dollar. Other important policy litmus tests in EM include rate-setting meetings in Brazil, Mexico, Colombia, Thailand and South Africa – all these will take place after the Fed reveals its policy objectives. Stay tuned!

Chart at a Glance: U.S. Fed’s Big Response to Banking Mayhem

Source: Federal Reserve

1The “reserve requirement ratio” (RRR) or cash reserve ratio (CRR) is the percentage of customer deposits and other liquid assets that commercial banks must store, within its own institution or with the central bank.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.