We’re Gonna Need a Bigger Boat?

15 March 2023

Read Time 2 MIN

Recession Fears and Fed Rates

Concerns that the Silicon Valley Bank and Credit Suisse “episodes” might not be isolated cases, but rather precursors to a fully-blown banking crisis and a global recession, are not going away, keeping the market expectations for the U.S. Federal Reserve (Fed) thoroughly depressed. The remaining Fed hikes are pretty much out the window this morning, and the Fed Funds Futures now price in 115-120bps of rate cuts (!) between now and December. The European Central Bank’s (ECB’s) rate-setting meeting is tomorrow – policy messaging has been quite hawkish until recently (given a series of upside inflation surprises), but the rate hike expectations are also dwindling as banking concerns jumped from the U.S. to Europe.

China Rebound

One counter-point to the global recession narrative is China’s reopening and growth rebound. The latest domestic activity indicators confirmed that even though the recovery is still moderate, it is gaining pace across the board (an encouraging sign for those concerned about China’s unbalanced growth). Importantly, property investments are finally started to show signs of stabilization – a signal that the easing of housing restrictions is bearing fruit. There was nothing to suggest that the economy needs another massive stimulus, but certain sectors and smaller privately-owned companies might require continuing targeted support.

EM Reaction to Market Turbulence

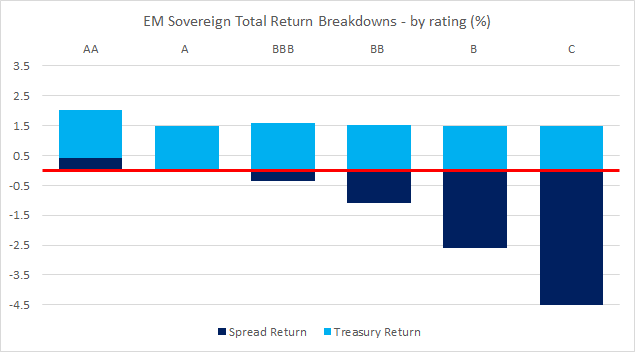

Many emerging markets (EM) are expected to benefit from China’s improving growth outlook – especially in Asia – but the market turbulence in developed markets (DM) is a major risk. So far, the reaction of EM sovereign bonds was quite logical (see chart below). Investment Grade bonds held on quite well (despite thinner spread “cushions”), while spread returns on lower-rated bonds were dragged down, in part, by higher U.S. rates’ volatility. EM FX is under more pressure today, but many local rates rallied in tandem with U.S. Treasuries. A sign of EM resilience so far is that the market continues to price in orderly (and cautious) rate cuts by those central banks that hiked early and aggressively in response to the rising post-pandemic price pressures – rather than “emergency” rate hikes to stem depreciation pressures, as was often the case in the past. Stay tuned!

Chart at a Glance: Market Turbulence and EM Sovereign Bonds – Logical Reaction

Source: Bloomberg LP. Data from 3/9/2023 to 3/14/2023.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.