Multi-Asset ETFs in Three Flavors

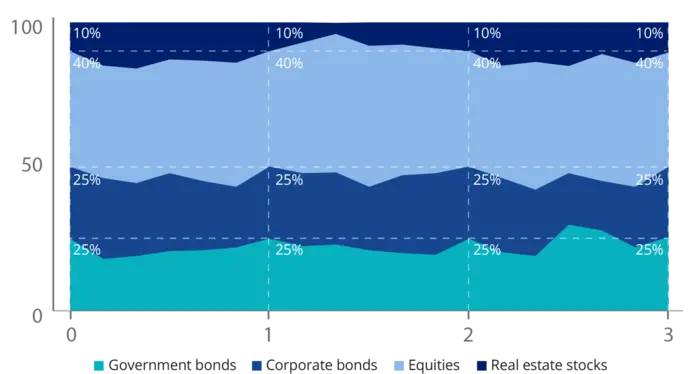

VanEck offers three Multi-Asset ETF variants, with investors having the chance to choose among different risk profiles. They represent a way to gain access, with one single purchase, to equities, corporate and government bonds as well as listed real estate.

VanEck Multi-Asset Conservative Allocation UCITS ETF

- 35% Government bonds

- 35% Corporate bonds

- 25% Global equities

- 5% Real estate stocks

DTM

ETF Details

ETF Details

Basis-Ticker:DTMISIN:NL0009272764

TER:0.28%

AUM:€20.7 M (as of 20-02-2026)

SFDR Classification:Article 8

Lower risk

Higher risk

Typically lower reward

Typically higher reward

1

2

3

4

5

6

7

VanEck Multi-Asset Balanced Allocation UCITS ETF

- 25% Government bonds

- 25% Corporate bonds

- 40% Global equities

- 10% Real estate stocks

NTM

ETF Details

ETF Details

Basis-Ticker:NTMISIN:NL0009272772

TER:0.30%

AUM:€39.3 M (as of 20-02-2026)

SFDR Classification:Article 8

Lower risk

Higher risk

Typically lower reward

Typically higher reward

1

2

3

4

5

6

7

VanEck Multi-Asset Growth Allocation UCITS ETF

- 15% Government bonds

- 15% Corporate bonds

- 60% Global equities

- 10% Real estate stocks

TOF

ETF Details

ETF Details

Basis-Ticker:TOFISIN:NL0009272780

TER:0.32%

AUM:€32.3 M (as of 20-02-2026)

SFDR Classification:Article 8

Lower risk

Higher risk

Typically lower reward

Typically higher reward

1

2

3

4

5

6

7

What is Multi-Asset Investing?

Multi-Asset investing is a strategy of an investment across stocks, government bonds, corporate bonds and real estate stocks. It makes investments more defensive, without necessarily eating into returns. It is practiced by the world’s most professional investors. The Multi-Asset ETF Suite by VanEck makes Multi-Asset investing easy, bringing it within everybody’s reach.

Multi-asset investing can be compared with communicating vessels. If one asset class goes down, another might go up and hence compensate.

Asset classes balancing each other

Source: VanEck.

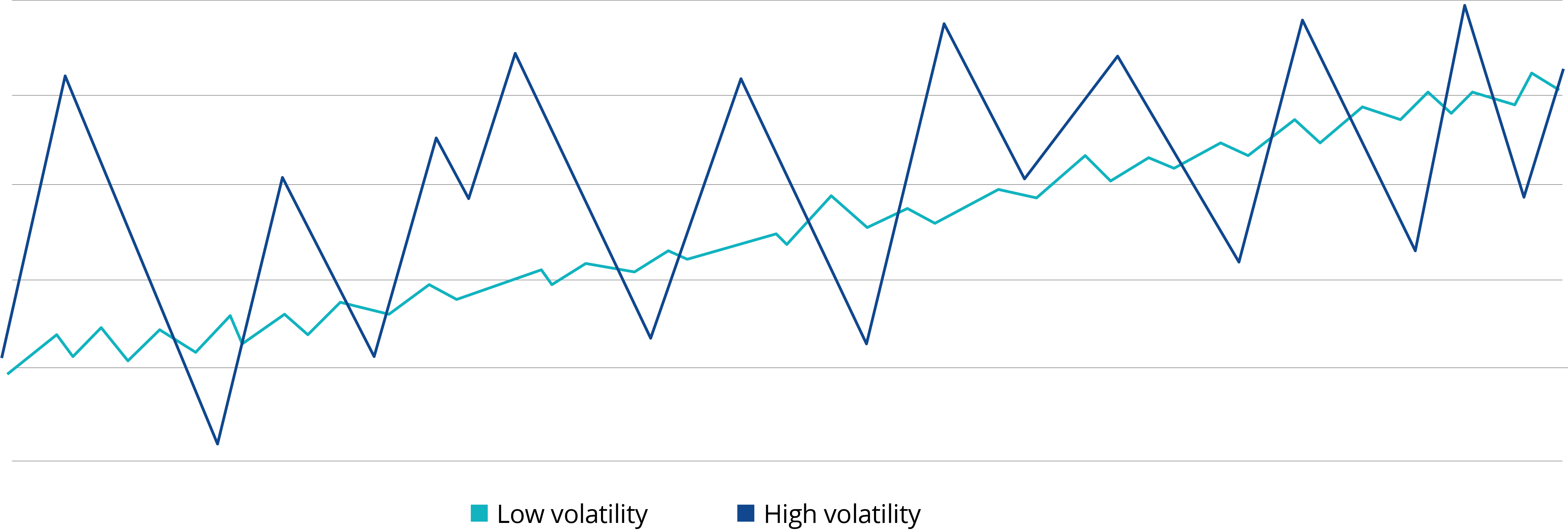

The expected results are returns that are usually less volatile compared to only investing in a single asset class.

Illustrative Example

Chance for reduced volatility with Multi-Asset ETF

Source: VanEck, for illustrative purposes only.

Most professionals use this knowledge and invest in multiple asset classes.

Example asset allocation from top 130 US public pension plans 2023

Source: publicplansdata.org, as of 2023.

Why VanEck's Multi-Asset ETF strategies?

You can invest in the Multi-Asset Allocation ETFs by VanEck and get exposure to different asset classes with one portfolio. The Multi-Asset ETF strategies rebalance asset classes once a year to maintain a predefined risk profile, and invest in stocks and bonds from roughly 200 companies and governments. Total all-in costs are currently no more than 0.32% per year, which compare so far favorably to other solutions, like actively managed multi-asset funds.

Low Costs

Annual Rebalancing

Award Winning

Covering Four Asset Classes

To make sure that our Multi-Asset ETF variants are widely diversified, we include four asset classes. Historically, they have tended not to move up and down in price together – what investment professionals call a low correlation. The asset classes are:

Bonds issued in Euro by Eurozone member states such as Germany, France, Italy and the Netherlands.

Bonds issued by large corporations with an investment-grade rating such as Anheuscher Busch, Daimler, JPMorgan and Siemens. All bonds are issued in euro in order to avoid currency risk.

Stocks from the world's 250 largest listed firms covered in the Multi-Asset ETF Suite.

Global stocks of firms from which invest in real estate, such as offices, warehouses and apartments.

You Choose How Defensive to Be

A Multi-Asset ETF lets you choose how much risk you want to take. They have three levels of risk and return: conservative, balanced and growth. The higher the risk, the higher the expected return and vice versa. The graph below shows you how each of the three options has performed over the last 13 years.

x

x

Source: VanEck. Past performance is not a reliable indicator for future performance. Please note that the performance includes income distributions gross of Dutch withholding tax because Dutch investors receive a refund of the 15% Dutch withholding tax levied. Different investor types and investors from other jurisdictions may not be able to achieve the same level of performance due to their tax status and local tax rules. Please see disclaimers at the end of the website.

Risk of a Multi-Asset ETF: Investors should consider risks before investing. See dedicated risk factors section on this website.

Main Risk Factors of a Multi-Asset ETF

While the diversification in a multi-asset strategy reduces risk, it is important to remember that all investments carry some risk. The Multi-Asset Funds by VanEck are subject to the four risks below:

The issuer or guarantor of a debt security may be unable and/or unwilling to make timely interest payments and/or repay the principal on its debt or to otherwise honour its obligations. Bonds are subject to varying degrees of credit risk which may be reflected in credit ratings. There is a possibility that the credit rating of a bond may be downgraded after purchase, which may adversely affect the value of the security.

The prices of the securities in the Fund are subject to the risks associated with investing in the securities market, including general economic conditions and sudden and unpredictable drops in value. An investment in the Fund may lose money.

Bond prices could rise or fall as the result of changes in the interest rates and the interest rate curve. Potential or actual downgrades in the credit rating can increase the assumed risk level.

Please contact us for more information:

- Phone: +31 (0)20 719 51 00

- Email: [email protected]