Marketing Communication

Discover VanEck’s Sustainable ETF Suite

Governments, companies and individuals have ambitious goals for cutting carbon emissions and heralding far-reaching change. Investors can take part in the transition to a more sustainable economy. They can finance it, by providing capital to virtuous companies, and potentially achieve positive financial returns.

At VanEck, we offer different sustainable ETFs to suit your investment views (classified as Article 9 according to the Sustainable Finance Disclosure Regulation - SFDR).

Future of Food ETF

- Access to the multi-decade transformation of the food sector

- Exposure to some of the pioneering sustainable food production ’s companies

- Trend driven by a growing global population and accelerating climate change

- Invest across alternative proteins, food flavoring and precision agriculture

Risk of capital loss

Lower risk

Higher risk

Typically lower reward

Typically higher reward

1

2

3

4

5

6

7

Circular Economy ETF

- Access to the current leading firms of this new economic concept

- An increasingly popular business model prioritizing reuse, repair and recycling

- EU aiming to a circular economy by 2050, with the Right to repair legislation as a crucial part

- Businesses could benefit through lower costs and greater efficiency

Risk of capital loss

Lower risk

Higher risk

Typically lower reward

Typically higher reward

1

2

3

4

5

6

7

Hydrogen ETF

- A key emerging renewable energy source

- Governments have placed hydrogen at the center of energy transition plans

- Potential applications ranging from cars to trains and airplanes

- Expected to comprise a significant share of the future global energy mix1

Risk of capital loss

Lower risk

Higher risk

Typically lower reward

Typically higher reward

1

2

3

4

5

6

7

How Regulation is Driving Sustainable ETFs

Growing numbers of investors are looking at investment ways that avoid harming the environment, promote social wellbeing and safeguard good corporate governance. Yet regulators and supranational entities are also acting to reinforce the trend for sustainable investing, for example through sustainable ETFs, introducing regulations and frameworks that make it easier for investors to back sustainable businesses. At the forefront of these are the UN Global Compact Principles (UNGC), the Sustainable Development Goals (SDGs) and the EU Taxonomy — all designed to help investors make informed sustainable investment decisions.

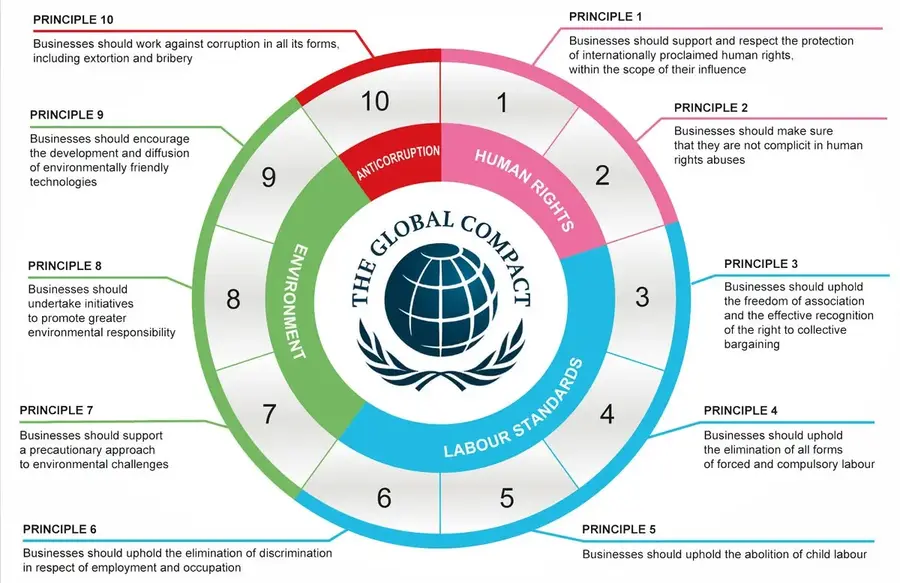

UNGC Principles

The UNGC principles are 10 pillars developed with the goal of guiding businesses to behave responsibly...

The UNGC principles are 10 pillars developed with the goal of guiding businesses to behave responsibly...

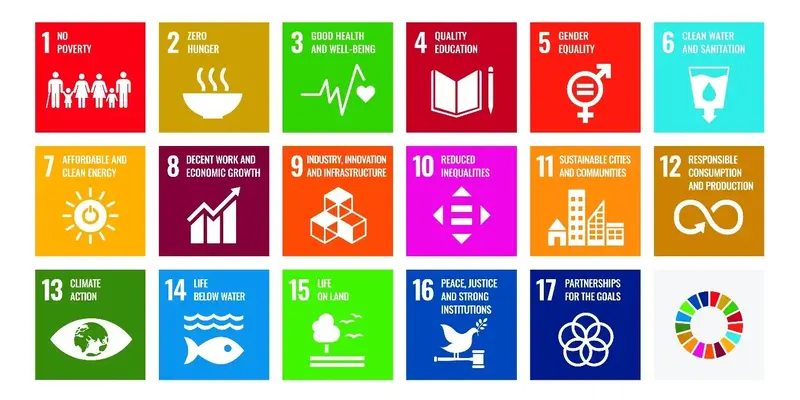

Sustainable Development Goals

The Sustainable Development Goals are 17 objectives that were adopted by 193 world leaders and...

The Sustainable Development Goals are 17 objectives that were adopted by 193 world leaders and...

EU Taxonomy

The EU Taxonomy is part of the European Green Deal which is leading the push for net zero carbon...

The EU Taxonomy is part of the European Green Deal which is leading the push for net zero carbon...

The goals of the EU Taxonomy regulation are:

By forcing issuers of financial products and companies to disclose the sustainability characteristics of investments, the EU Taxonomy aims to increase transparency. This leaves less scope for greenwashing.

The EU Taxonomy also aims to create a common language for defining what is green. This should improve communication between investors, issuers, project promoters and policy makers.

The EU Taxonomy aims to channel investments, for instance through sustainable ETFs, towards sustainable economic activities that can contribute to the EU’s six environmental objectives. These range from climate change mitigation to protection of biodiversity, as set out below:

EU Taxonomy Environmental Objectives

ESG Investing and Returns

Investing sustainably need not come, for the moment, at the cost of lower investment returns. While there is no conclusive evidence about the impact on returns, as sustainable investing grows in popularity, the most sustainable companies might be rewarded. For example, banks are cutting the cost of loans to companies cutting carbon emissions. It’s possible that this might lead to higher investment returns in years to come.

Sustainable Fund Assets Increase Worldwide, 2010-2022

Source: Statista.

Take the MSCI World index, both in its environmental, social and governance (ESG) and non-ESG versions. One of the best-known global stock market indices, it gives exposure to the largest stocks. Encouragingly, the ESG version has not only achieved higher annualized returns (for a five years period) but also scored better when incorporating volatility, as expressed by the Sharpe Ratio.

5Y Total Returns

5Y Annualized Returns

Sharpe Ratio

Source: Bloomberg, data as of 31/03/24.

Calling on Private Investors to Back the Green Transition

In order to reach the 2015 Paris Agreement’s goals for a net-zero world, public investments alone are not sufficient. Private investment has a key role to play. Sustainable ETFs can represent a way to channel these investments.

Preventing a climate disaster is estimated to require approximately USD2-2.8 trillion of funding annually by 2030 and far higher than around USD770 billion in 20222. Transforming energy infrastructure accounts for much of the cost.

2 Source: State of Green, IEA.

Governments and private investors will have to fund the necessary projects collaboratively. High upfront costs, technical challenges and long-time horizons often require a blend of public and private financing. Blending public and private financing can de-risk these investments and attract investors. This risk sharing is known as blended finance and it is an increasingly popular way to accelerate the green transition.

Investment/spending Needs for Climate Action Per Year by 2030

(Total investment needs per year by 2030: USD 2-2.8 trillion)

swipe

| Categories of investment | Needs by 2030 | ||

| Transforming the energy system | Power system | Zero carbon generation | $300-400bn |

| Transmission and distribution | $200-250bn | ||

| Storage and back-up capacity | $50-75bn | ||

| Early phase-out of coal | $40-50bn | ||

| Transport system | Low emission transport infrastructure | $400-500bn | |

| Fleet electrification/hydrogen | $100-150bn | ||

| Industry | Energy efficiency | $10-20bn | |

| Industrial processes | $10-20bn | ||

| Buildings | Electrification | $20-40bn | |

| Energy efficiency and GHG abatement | $70-80bn | ||

| Green hydrogen | Production | $20-30bn | |

| Transport and storage | $20-30bn | ||

| Just transition | Targeted programmes and safety nets | $50-100bn | |

| Coping with loss and damage | $200-400bn | ||

| Investing in adaptation and resilience | $200-250bn | ||

| Investing in natural capital | Sustainable agriculture | $100-150bn | |

| Afforestation and conservation | $100-150bn | ||

| Biodiversity | $75-100bn | ||

| Migrating methane emissions from fossil fuel and waste | $40-60bn | ||

Source: State of Green, “Finance for climate action – Scaling up investment for climate and development”.

Main Risk Factors

The securities of smaller companies may be more volatile and less liquid than the securities of large companies. Smaller companies, when compared with larger companies, may have a shorter history of operations, fewer financial resources, less competitive strength, may have a less diversified product line, may be more susceptible to market pressure and may have a smaller market for their securities.

Because all or a portion of the Fund are being invested in securities denominated in foreign currencies, the Fund’s exposure to foreign currencies and changes in the value of foreign currencies versus the base currency may result in reduced returns for the Fund, and the value of certain foreign currencies may be subject to a high degree of fluctuation.

The Fund’s assets may be concentrated in one or more particular sectors or industries. The Fund may be subject to the risk that economic, political or other conditions that have a negative effect on the relevant sectors or industries will negatively impact the Fund's performance to a greater extent than if the Fund’s assets were invested in a wider variety of sectors or industries.

The prices of the securities in the Fund are subject to the risks associated with investing in the securities market, including general economic conditions and sudden and unpredictable drops in value. An investment in the Fund may lose money.

Exists when a particular financial instrument is difficult to purchase or sell. If the relevant market is illiquid, it may not be possible to initiate a transaction or liquidate a position at an advantageous or reasonable price, or at all.

The Fund may invest a relatively high percentage of its assets in a smaller number of issuers or may invest a larger proportion of its assets in a single issuer. As a result, the gains and losses on a single investment may have a greater impact on the Fund's Net Asset Value and may make the Fund more volatile than more diversified funds.

Please contact us for more information:

- Phone: +31 (0)20 719 51 00

- Email: [email protected]