Welcome to VanEck

Select Investor Type

20 October 2025

It used to be that small government and the free market were considered a good thing. During the past 15 years, though, governments have been getting increasingly interventionist with implications for how we invest.

Think of a wave of industrial subsidies, soaring defense spending, expanding space programs and a broad nuclear revival. What’s more, government intervention is arguably underpinning the rising gold price, with central bank buying consistently high.

What does that mean for how we invest? Where big government has been spending its money in recent years, investors have been wise to follow. After all, governments have huge spending power that’s often multiplied by follow-on private sector capital expenditure. Their interventionist policies can transform a sector’s growth prospects – where government money goes, stock price rises may soon follow. There is no guarantee that government spending will result in higher stock prices or positive returns for investors. High returns may not be achieved, and your entire investment is at risk of loss.

This phenomenon is partly the result of a new era of intense geopolitical competition. Governments around the globe are shifting their investment priorities and controls to what they believe is needed for nation states to compete in the 21st century.

While past developments show that sectors supported by government spending have experienced notable growth, such outcomes are not guaranteed and may not necessarily recur. Government intervention can influence business activity and asset prices — as seen in areas such as defense, space, nuclear energy, and gold — but these markets remain subject to volatility and the risk of capital loss.

Turn first to defense. In 2024, global military spending rose for 10th consecutive year to reach $2.7 trillion, driven by the Russia-Ukraine war and other armed conflicts and geopolitical tensions, according to the respected Stockholm International Peace research Institute (SIPRI).1 This is the highest level SIPRI has ever recorded. How have equities reflected rocketing defense spending? Taking the VanEck Defense UCITS ETF as a proxy, it rose 60% p.a. in the 30 months between launch on 31 March 2023 and the end of September 2025, outperforming broad equity markets. Of course, past performance does not predict future returns and as a word of caution, much of this rise is in anticipation of orders for defense equipment to come rather than those already booked.

| 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR | 10 YR | ETF INCEPTION | |

| ETF | 12.50 | 15.46 | 80.68 | 88.45 | -- | -- | -- | 60.19 |

| MVDEFTR (Index) | 12.61 | 15.58 | 81.40 | 89.33 | -- | -- | -- | 61.00 |

| Performance differential (ETF – Index) | -0.11 | -0.12 | -0.72 | -0.88 | -- | -- | -- | -0.81 |

Data as of 30 Sep 2025. Past performance does not predict future returns. *Periods greater than one year are annualised. Investing is subject to risk, including the possible loss of principal. You must read the Prospectus and KID before investing, which are available at the Document section of the fund on www.vaneck.com.

Main Risk Factors: Equity Market Risk, Liquidity Risks, Industry or Sector Concentration Risk.

The accelerating arms race extends to space, where government spending surged by 10% in 2024 to a record $135 billion.2 Much of this was directed toward defense applications, ranging from secure communications and GPS to advanced surveillance systems and missile defense.

Note: The absence of data for the Soviet Union in 1991 means that no total can be calculated for that year. Source: SIPRI Military Expenditure Database, Apr. 2025

In this case, the VanEck Space Innovators UCITS ETF offers a guide to stock price performance. In the past 12 months, it has increased by 109.02%, again to 30 September.

| 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR | 10 YR | ETF INCEPTION | |

| ETF | 4.75 | 22.93 | 68.04 | 109.02 | 46.59 | -- | -- | 37.63 |

| MVSPCTR (Index) | 4.76 | 23.07 | 68.74 | 110.22 | 47.40 | -- | -- | 38.40 |

| Performance differential (ETF – Index) | -0.01 | -0.14 | -0.70 | -1.20 | -0.81 | -- | -- | -0.77 |

Data as of 30 Sep 2025. Past performance does not predict future returns. *Periods greater than one year are annualised. Investing is subject to risk, including the possible loss of principal. You must read the Prospectus and KID before investing, which are available at the Document section of the fund on www.vaneck.com.

Main Risk Factors: Foreign Currency Risk, Industry or Sector Concentration Risk, Risk of Investing in Emerging Markets Issuers.

Note than big government is not the only factor, as private companies are rapidly building out low earth satellite constellations. While historical data shows a possible relationship between government spending and market movements, any potential returns are uncertain and subject to market risk.

Nuclear is another industry benefiting from government policy. Countries as diverse as the US, Denmark, Germany, Belgium, the Netherlands and the UK are in a dash for atomic energy as they seek to solve three problems. They’re looking to build out nuclear energy capacity to fuel artificial intelligence, foster energy security and decarbonize power generation.

Governments’ actions to boost nuclear power generation are reflected in the performance of our VanEck Uranium and Nuclear Technologies UCITS ETF, which has risen 81% year-to-date at the end of September.

| 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR | 10 YR | ETF INCEPTION | |

| ETF | 15.86 | 27.16 | 80.69 | 84.20 | -- | -- | -- | 50.74 |

| MVNUCLTR (Index) | 15.92 | 27.34 | 81.51 | 85.36 | -- | -- | -- | 51.47 |

| Performance differential (ETF – Index) | -0.06 | -0.18 | -0.82 | -1.16 | -- | -- | -- | -0.73 |

Data as of 30 Sep 2025. Past performance does not predict future returns. *Periods greater than one year are annualised. Investing is subject to risk, including the possible loss of principal. You must read the Prospectus and KID before investing, which are available at the Document section of the fund on www.vaneck.com.

Main Risk Factors: Liquidity Risks, Investing in Natural Resources Companies, Industry or Sector Concentration Risk.

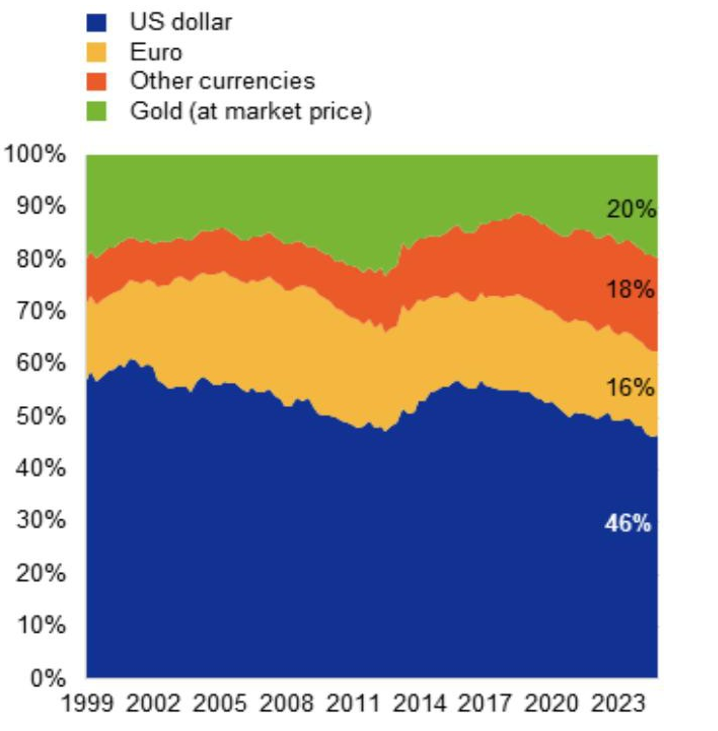

Lastly, government intervention is underpinning the gold price. In a time of intense geopolitical competition, and with questions over US Federal Reserve independence, central banks are buying more gold for their reserves. Data released earlier in 2025 by the European Central Bank showed that gold passed the euro to become the central banks’ second-largest reserve asset.3

Source: IMF, World Gold Council and ECB staff calculations (2025)

Against a backdrop of high demand and tight supply, the gold price has increased by more than 50% in 2025, exceeding $4,000 an ounce, as of September 30th 2025. As investors gain confidence that gold miners profit from the gold price development, the VanEck Gold Miners UCITS ETF has risen 125% in the same timeframe.

| 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR | 10 YR | ETF INCEPTION | |

| ETF | 21.49 | 46.89 | 124.92 | 93.56 | 48.98 | 15.67 | 19.76 | 14.84 |

| MVGDXTR (Index) | 21.56 | 47.11 | 125.87 | 94.56 | 49.74 | 16.19 | 20.31 | 15.36 |

| Performance differential (ETF – Index) | -0.07 | -0.22 | -0.95 | -1.00 | -0.76 | -0.52 | -0.55 | -0.52 |

Data as of 30 Sep 2025. Past performance does not predict future returns. *Periods greater than one year are annualised. Investing is subject to risk, including the possible loss of principal. You must read the Prospectus and KID before investing, which are available at the Document section of the fund on www.vaneck.com.

Main Risks Factors: Risk of Investing In Natural Resources Companies, Industry or Sector Concentration Risk, Risk of Investing in Smaller Companies.

What all of this suggests is that if government spending continues to shape markets so strongly, investors may find it more effective to capture such macro trends through broad asset allocation rather than traditional stock picking. Many seem to be doing so, as the VanEck Defense UCITS ETF, for example, has grown significantly to $7.7 billion as of September 2025.

That said, investors should remain mindful of valuation and policy risks. Periods of strong government support can lead to elevated valuations across certain sectors, while reduced policy backing may cause some companies to adjust from those levels. These dynamics can affect both ETF-based and single-stock investments, underscoring the importance of setting realistic expectations around performance and volatility.

It’s undoubtedly a new era, though, of far greater government intervention leading stock prices. In this environment, asset allocation via ETFs offers a practical way to participate in structural trends, while maintaining broad diversification and a long-term perspective.

1 Trends in world military expenditure 2024, SIPRI. April 2025.

2 Novaspace (2025, May 5). Defense spending drives government space budgets to historic high.

3 European Central Bank. (2025, June). Gold demand: the role of the official sector and geopolitics.

IMPORTANT INFORMATION

This is marketing communication. Please refer to the prospectus of the UCITS and to the KID/KIID before making any final investment decisions. These documents are available in English and the KIDs/KIIDs in local languages and can be obtained free of charge at www.vaneck.com, from VanEck Asset Management B.V. (the “Management Company”) or, where applicable, from the relevant appointed facility agent for your country.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Stadthausstrasse 14, CH-8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under MiFID under the Markets in Financial Instruments Directive (“MiFiD). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the Management Company. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

VanEck Defense UCITS ETF (the "ETF") is a sub-fund of VanEck UCITS ETFs plc, an open- ended variable capital umbrella investment company with limited liability between sub- funds. The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. The product described herein aligns to Article 6 Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Information on sustainability-related aspects pursuant to that regulation can be found on www.vaneck.com. Investors must consider all the fund's characteristics or objectives as detailed in the prospectus or related documents before making an investment decision.

VanEck Space Innovators UCITS ETF (the "ETF") is a sub-fund of VanEck UCITS ETFs plc, an open-ended variable capital umbrella investment company with limited liability between sub-funds. The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. The product described herein aligns to Article 8 Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Information on sustainability-related aspects pursuant to that regulation can be found on www.vaneck.com. Investors must consider all the fund's characteristics or objectives as detailed in the prospectus, in the sustainability-related disclosures or related documents before making an investment decision.

VanEck Uranium and Nuclear Technologies UCITS ETF (the "ETF") is a sub-fund of VanEck UCITS ETFs plc, an open-ended variable capital umbrella investment company with limited liability between sub-funds. The ETF is registered with the Central Bank, passively managed and tracks an equity index. The product described herein aligns to Article 6 Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Information on sustainability-related aspects pursuant to that regulation can be found on www.vaneck.com. Investors must consider all the fund's characteristics or objectives as detailed in the prospectus or related documents before making an investment decision.

VanEck Gold Miners UCITS ETF (the "ETF") is a sub-fund of VanEck UCITS ETFs plc, an open-ended variable capital umbrella investment company with limited liability between sub-funds. The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. The product described herein aligns to Article 6 Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Information on sustainability-related aspects pursuant to that regulation can be found on www.vaneck.com. Investors must consider all the fund's characteristics or objectives as detailed in the prospectus or related documents before making an investment decision.

The MarketVector™ Global Defense Industry Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. VanEck’s ETF is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the ETF. It is not possible to invest directly in an index.

MVIS® Global Space Industry ESG Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. VanEck’s ETF is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the ETF. It is not possible to invest directly in an index.

MarketVector™ Global Uranium and Nuclear Energy Infrastructure Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. VanEck’s ETF is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the ETF. It is not possible to invest directly in an index.

The MarketVector™ Global Gold Miners Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. VanEck’s ETF is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the ETF. Effective September 19, 2025 the NYSE Arca Gold Miners Index has been replaced with the MarketVector™ Global Gold Miners Index. It is not possible to invest directly in an index.

The indicative net asset value (iNAV) of the UCITS is available on Bloomberg. For details on the regulated markets where the ETF is listed, please refer to the Trading Information section on the ETF page at www.vaneck.com. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations. Investors must be aware that, due to market fluctuations and other factors, the performance of the ETFs may vary over time and should consider a medium/long- term perspective when evaluating the performance of ETFs.

Investing is subject to risk, including the possible loss of principal. Investors must buy and sell units of the UCITS on the secondary market via an intermediary (e.g. a broker) and cannot usually be sold directly back to the UCITS. Brokerage fees may incur. The buying price may exceed, or the selling price may be lower than the current net asset value. The Management Company may terminate the marketing of the UCITS in one or more jurisdictions. The summary of the investor rights is available in English at: summary-of-investor-rights_sept2025.pdf. For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

17 February 2026

17 February 2026

20 January 2026

15 January 2026

16 December 2025

15 December 2025