Chasing a Multibillion Dollar Opportunity From Your Barstool

October 13, 2020

Read Time 2 MIN

Despite the pandemic shutting down live sporting events for most of the second quarter in 2020, according to the American Gaming Association (AGA), revenue from legal sports betting through July remains up 19% year-over-year, partially due to legal sportsbooks going live in 12 states over the past year.1 Q1 2020 outperformed Q1 2019 by a whopping 49%, and it would not be unreasonable to once again reach this level of growth with the return of major sports leagues and events.2

You Bet Americans Like Their Sports

The illicit sports betting market in the U.S. is estimated to be worth upwards of $150 billion per year on the black market.3 The AGA’s national survey of expected sports betting activity for the 2020 NFL season shows that an estimated 33.2 million American adults, or approximately 13%, plan to bet on NFL games this year.4 On average, $58 billion is wagered each year on NFL and college football games – most of it through illegal channels.5

The Spread of Legal Sports Betting

In states where sports betting is legal and live, sports bettors are increasingly choosing legal sportsbooks over illegal operators when placing their wagers.6 Currently, eighteen states and the District of Columbia offer legal single-game, live sports betting to consumers through retail and/or online sportsbooks. Another four states have authorized sports betting, but have yet to launch and six states have active 2020 sports betting legislation.7 This may bode well for investors, gaming technology companies and traditional casinos.

Also helping to raise the profile of legal sports betting are recent deals in the industry, including:

- Daily fantasy and sports-betting company, DraftKings, is set to become the exclusive provider of daily fantasy sports and co-exclusive partner for gambling link-outs from ESPN.8

- Multi-State operator, Penn National Gaming, took a minority stake in Barstool Sports, a leading digital sports-media publisher, and successfully launched the Barstool Sportsbook app.9,10

- British bookmaker William Hill, founded in 1934, agreed to be acquired by Caesars Entertainment, giving the U.S. casino operator full control of a quickly expanding U.S. sports betting and online business.11

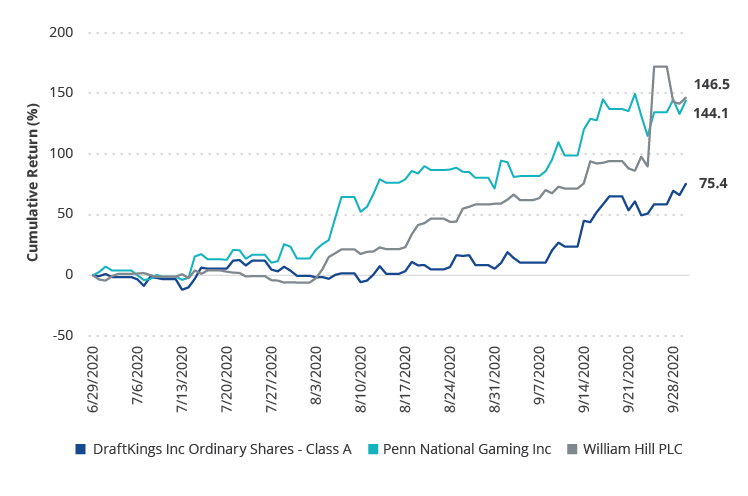

Lapping the Field: The Performance of Three Major Players

Source: Morningstar Direct. As of 9/30/2020. Past performance is not a guarantee of future results.

Investing in Sports Betting Stocks

In our view, sports betting is here to stay, and we believe it may reward companies with the ability to pivot and tap into online gambling.

VanEck Vectors® Gaming ETF (BJK®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Gaming Index (MVBJKTR), which is intended to track the overall performance of companies involved in casinos and casino hotels, sports betting, lottery services, gaming services, gaming technology and gaming equipment.

Related Insights

April 10, 2024

March 25, 2024

March 01, 2024

February 16, 2024

January 31, 2024

IMPORTANT DISCLOSURES

1 Source: Yahoo Finance, “The Biggest Storyline of the 2020 NFL Season Isn't the Pandemic—It's Gambling”.

2 Source: American Gaming Association, “Commercial Gaming Revenue Tracker, Q2 2020”.

3 Source: American Gaming Association, 97% of Expected $10 Billion Wagered on March Madness to be bet Illegally”.

4 Source: American Gaming Association, “Americans’ 2020 NFL Betting Plans”.

5 Source: American Gaming Association, “Embracing America’s Passion Through Effective Regulation”.

6 Source: American Gaming Association, “2020 Survey of American Sports Bettors”.

7 Source: American Gaming Association, “Map: Sports Betting in the United States”.

8 Source: Forbes, “DraftKings Stock Jumps Over 16% After Announcing ESPN Deal”.

9 Source: The Wall Street Journal, “Race Is On to Cash In on Sports Betting”.

10 Source: Play Pennsylvania, “Can Barstool Sportsbook Really Dominate FanDuel and DraftKings in PA?”.

11 Source: Fox Business, “William Hill Backs Caesars’ $3.7B Takeover Bid”.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the VanEck Vectors®Gaming ETF (BJK®) may be subject to risks which include, among others, investing in the gaming industry, equity securities, consumer discretionary sector, foreign securities, emerging market issuers, foreign currency, special risk considerations of investing in Asian and Chinese issuers, depositary receipts, small- and medium-capitalization companies, cash transactions, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Small- and medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Related Funds

IMPORTANT DISCLOSURES

1 Source: Yahoo Finance, “The Biggest Storyline of the 2020 NFL Season Isn't the Pandemic—It's Gambling”.

2 Source: American Gaming Association, “Commercial Gaming Revenue Tracker, Q2 2020”.

3 Source: American Gaming Association, 97% of Expected $10 Billion Wagered on March Madness to be bet Illegally”.

4 Source: American Gaming Association, “Americans’ 2020 NFL Betting Plans”.

5 Source: American Gaming Association, “Embracing America’s Passion Through Effective Regulation”.

6 Source: American Gaming Association, “2020 Survey of American Sports Bettors”.

7 Source: American Gaming Association, “Map: Sports Betting in the United States”.

8 Source: Forbes, “DraftKings Stock Jumps Over 16% After Announcing ESPN Deal”.

9 Source: The Wall Street Journal, “Race Is On to Cash In on Sports Betting”.

10 Source: Play Pennsylvania, “Can Barstool Sportsbook Really Dominate FanDuel and DraftKings in PA?”.

11 Source: Fox Business, “William Hill Backs Caesars’ $3.7B Takeover Bid”.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the VanEck Vectors®Gaming ETF (BJK®) may be subject to risks which include, among others, investing in the gaming industry, equity securities, consumer discretionary sector, foreign securities, emerging market issuers, foreign currency, special risk considerations of investing in Asian and Chinese issuers, depositary receipts, small- and medium-capitalization companies, cash transactions, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Small- and medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.