Marketing Communication

Possible Regime Change in Venezuela Sparks a Revival of Oil Services Stocks

17 February 2026

Following reports of political developments in Venezuela on January 3, U.S. officials announced a military operation and outlined potential plans relating to the country’s oil sector1. Since then, the stock prices of the U.S. oil services companies that would carry out the grunt work of rebooting the ailing oil fields have risen sharply. The future of the oil industry landscape in Venezuela remains unclear despite companies showing interest in becoming involved in the local market and U.S. aiming to invest in the local economy.

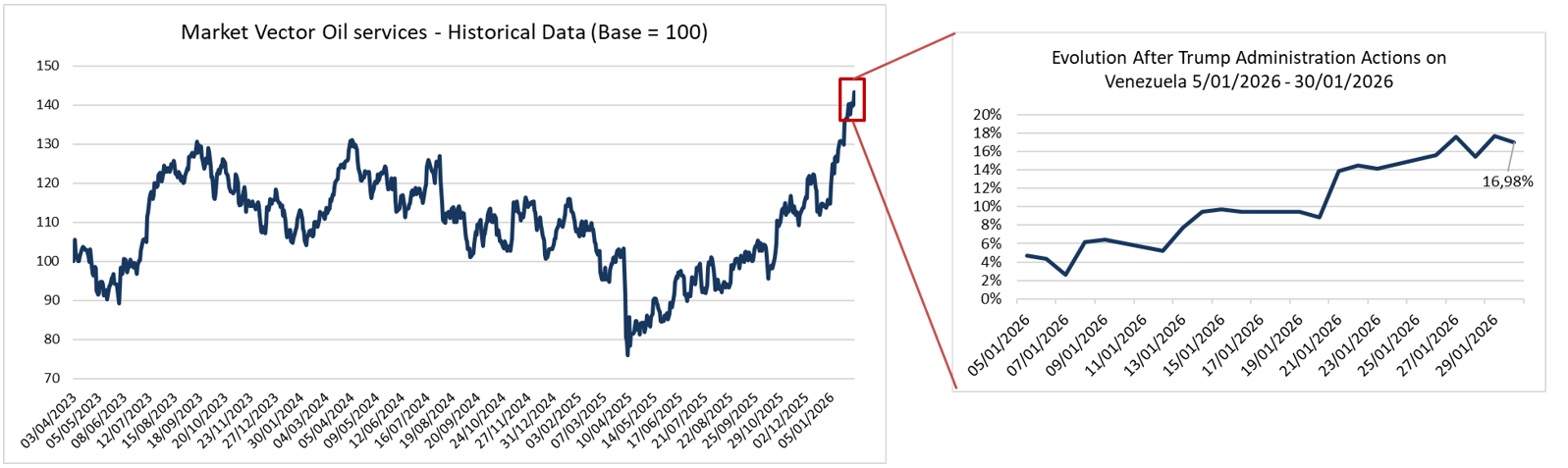

The price of the MarketVector™ U.S. Listed Oil Services 10% Capped Index (MVOICTR), which follows 25 leading sector share prices, is up 21.62%2 over the last month (Jan 2026).

U.S. oil services performance

MarketVector™ U.S. Listed Oil Services 03/04/2023-30/01/2026

Bloomberg. (2026, January 31). Performance of MarketVector™ U.S. Listed Oil Services 10% Capped Index — indexed to 100.

Past performance is not a reliable indicator of future results. Investment returns and principal value may fluctuate, so investors’ shares, when sold, may be worth more or less than their original cost.

These stock price moves suggest that investors may view oil services companies as well positioned to benefit from reported calls by President Trump for $100 billion in capital expenditure3 in Venezuela.

Several large oil services companies have operational experience in politically complex jurisdictions and have indicated interest in potential future projects. Notably, Olivier Le Peuch, CEO of the largest oil services company SLB, recently said he was confident of ramping up activities quickly in the right conditions4, while rival Halliburton’s CEO said he aims to swiftly enter the market5.

Geopolitical Turbulence and the Oil Industry

The oil and gas industry is frequently buffeted by geopolitics. Time and again, war and even minor military skirmishes have sparked spikes in oil and gas prices due to fears that vital supplies for the global economy might be interrupted.

Most recently, during the June 2025 Israel-Iran 12-day war the price of Brent crude oil spiked by 22% before subsiding6. More significantly, in the two weeks after Russia’s 2022 invasion of Ukraine, the prices of oil, coal and gas went up by around 40%, 130% and 180% respectively7.

Looking further back to the Gulf War in 1990, the Brent crude oil price more than doubled from about $15 a barrel ahead of Iraq’s invasion of Kuwait to $41 in 1991 before subsiding8.

But what’s different about the Venezuela raid is that oil prices have appeared relatively unmoved. Brent crude started the year priced at around $60 a barrel9, rising briefly to $62 in the following days10. It has since increased further to $6511 but this coincided with statements from the U.S. administration regarding potential intervention in Iran.

The reason why markets shrugged off the possibility of an interruption to Venezuela’s oil is it has dwindled to a small proportion of global supplies as infrastructure has fallen into disrepair. Despite having the largest proven oil reserves of any country, Venezuela produced about 900,000 barrels per day in 2025, down from 2 million 10 years ago and a peak of 3.5 million in the late 1990s12.

Essential Partners: From Upstream to Midstream

Oil services companies could be key to repairing existing oil facilities and drilling new wells. They play a vital role in an oil industry divided into three parts – upstream, midstream and downstream. The upstream segment covers exploration and production; midstream focuses on logistics and storage; downstream covers the processing and refining of crude oil to produce gasoline, diesel, jet fuel, heating oil and so on.

Oil services companies mainly operate in the upstream segment. They partner with major exploration and production companies, providing specialized equipment, technology and personnel for finding, drilling and producing oil and gas. Some also provide midstream activities, for example supporting pipeline construction and maintenance.

However, it’s far from certain whether the big U.S. oil companies needed to provide the capital for restoring Venezuela’s oil output are willing to do so. Venezuela has a history of seizing international oil companies’ assets, meaning they’re likely to seek legal and financial guarantees from the U.S. government13.

Driving Greater Efficiency

Even if the future of Venezuela’s oil sector remains unclear, oil services companies are at the heart of a drive towards greater efficiency worldwide in the extraction of oil and gas. They use specialized equipment and technology to improve operational efficiency.

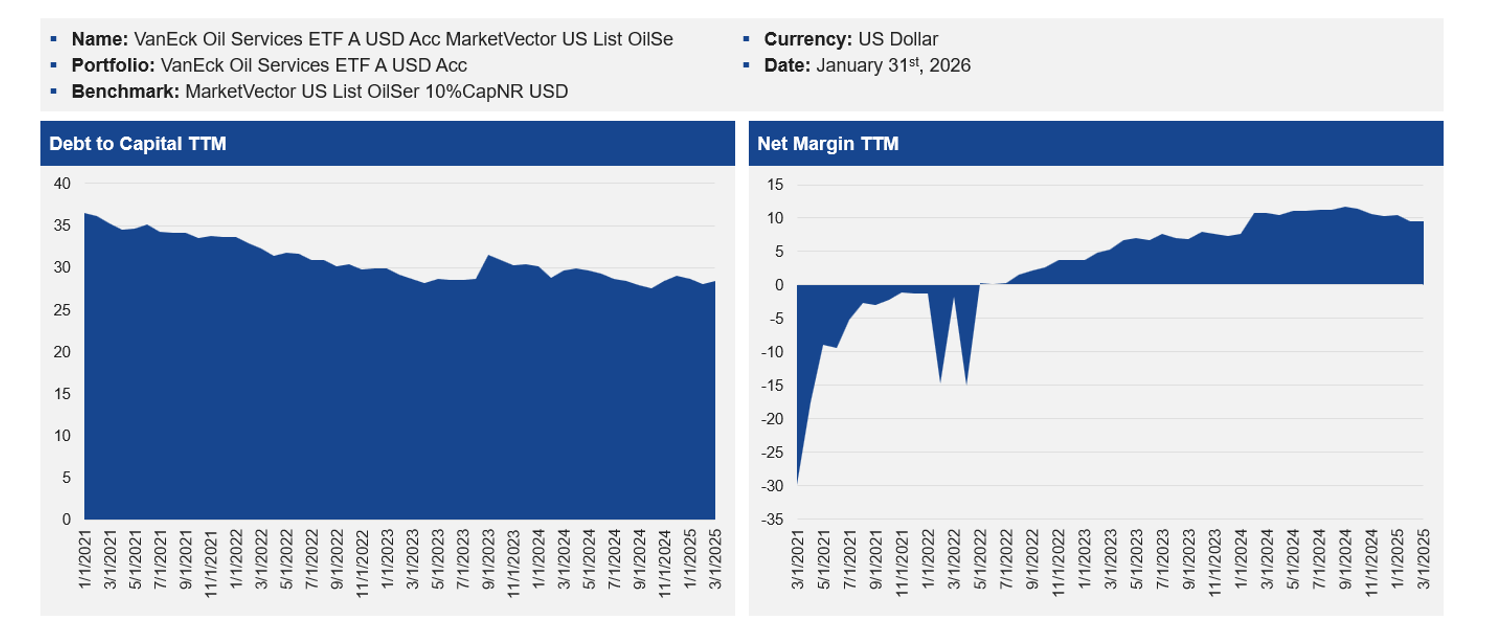

What’s more, they have been steadily improving their own financial efficiency and resilience. Over the past four years, they have reduced their financial leverage and improved profitability. In the charts below, the debt-to-capital ratio shows how leverage has declined since the beginning of this decade. Similarly, the net margin chart depicts higher profitability across the sector.

Improving Fundamentals

Morningstar. (2026, January 31). Financial metrics of VanEck Oil Services ETF A USD Acc

Trailing Twelve Months

Discussion around a potential return of U.S. oil companies to Venezuela has increased. If this were to occur, oil services companies could play a role in supporting their oil services partners to restore output levels. Recent share price performance may reflect investor expectations of increased activity, and an ETF such as VanEck Oil Services ETF (OIHV) offers exposure to companies within the oil services sector.

However, there may be additional reasons investors consider exposure to oil services companies: their track record of improving efficiency – both in oil and gas operations, and in their own financial performance.

The oil services industry is highly cyclical and sensitive to oil & gas prices, capex spending by exploration and production companies, and geopolitical/regulatory developments, which can drive significant volatility. The fund is concentrated in a single sector and may experience amplified gains or losses versus broader equity markets, and as an index-tracking ETF it may be exposed to market, liquidity and tracking error risks.

1Martin, E., Drozdiak, N., & McBride, C. (2026, January 3). Strike against Venezuela: How U.S. took Maduro. Bloomberg.

2Bloomberg L.P. (2026). MarketVector™ U.S. Listed Oil Services 10% Capped Index (MVOICTR).

3 Trump seeks $100bn for Venezuela oil, but Exxon boss says country ‘uninvestable’ (2026, January ?). BBC News.

4Somasekhar, A., & Dhumal, T. (2026, January 23). U.S. oilfield service company SLB says it can rapidly increase activities in Venezuela. Reuters.

5 Ft.com. Jan 15, 2026. Halliburton expects speedy return to Venezuela and plays down risks.

6 Portland Fuel. (2026, January). Energy Market Report: January 2026.

7 Adolfsen, J. F., Kuik, F., Lis, E. M., & Schuler, T. (2022). The impact of the war in Ukraine on euro area energy markets (ECB Economic Bulletin, Issue 4/2022). European Central Bank.

8 Ristanovic, A. (2020, June). Major oil market crashes in history. O&E Online.

9Agence France-Presse. (2026, January 5). Oil prices fall after U.S. ousts Venezuela’s Maduro. Gulf News.

10 Khan, S. (2025, December 22). Oil settles higher on risk of disruptions to Venezuela, Russia supply. Global Banking & Finance Review.

11 Khan, S. A. (2026, January 23). Brent crude price rebounds toward $65 on Trump Iran warning and Kazakhstan outage. TechStock².

12 McDermott, D., Rats, M., Laetsch, J., Kutz, D., Lin, H., Do, S., Latran, J. W., Kenny, J. M., & Warden, Z. C. (2026, January 5). Venezuela in transition – quantifying the impacts.

13Ft.com. Jan 9, 2026. U.S. oil giant Exxon/Mobil tells Donald Trump Venezuela is uninvestable.

IMPORTANT INFORMATION

This is marketing communication.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company VanEck Asset Management B.V. (“ManCo”). The representative in Switzerland is Zeidler Regulatory Services (Switzerland) AG, Stadthausstrasse 14, CH-8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under the Markets in Financial Instruments Directive (“MiFiD”). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the ManCo, which is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

This material is only intended for general and preliminary information and does not constitute an investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. All relevant documentation must be first consulted.

The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and has not been independently verified for accuracy or completeness and cannot be guaranteed.

Please refer to the Prospectus – in English language - and the KID/KIID - in local language - before making any final investment decisions and for full information on risks. These documents can be obtained free of charge at www.vaneck.com, from the ManCo or from the appointed facility agent.

VanEck Oil Services UCITS ETF ("ETF") is a sub-fund of VanEck UCITS ETFs plc, a UCITS umbrella investment company, registered with the Central Bank of Ireland, passively managed, index-tracking and tracking an equity index. The value of the ETF may fluctuate significantly as a result of the investment strategy. The ETF´s holdings are disclosed on each dealing day on www.vaneck.com under the ETF´s Holdings section and as per PCF under the Documents section and published via one or more market data suppliers. The indicative net asset value (iNAV: real-time estimate of the ETF’s intraday value) of the ETF is available on Bloomberg. For details on the regulated markets where the ETF is listed, please refer to the Trading Information section on the ETF page at www.vaneck.com. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets. Tax treatment depends on the personal circumstances of each investor and may vary over time. The ManCo may terminate the marketing of the ETF in one or more jurisdictions. The summary of the investor rights is available in English at: summary-of-investor-rights.pdf

The MarketVector™ U.S. Listed Oil Services 10% Capped Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. VanEck’s ETF is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the ETF. It is not possible to invest directly in an index.

Source: VanEck.

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations. Performance should be assessed over a medium- to long-term.

Investing is subject to risk, including the possible loss of principal. For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter