Introduction to an Investment Portfolio

An investment portfolio is a collection of assets (such as stocks, bonds, ETFs, and cash) selected to meet specific financial goals while managing risk. Investment portfolios vary widely, from conservative portfolios focused on preserving capital to aggressive ones aimed at maximizing growth. The composition of your Investment portfolio reflects your risk tolerance, time horizon, and financial needs.

By carefully balancing assets, diversifying across sectors, and periodically rebalancing, a well-constructed investment portfolio helps investors navigate market ups and downs, stay aligned with their financial objectives, and potentially grow their wealth over time.

- Know your risk tolerance: Age, financial situation, and income needs determine how much risk you can handle. Your risk tolerance should guide how you structure your investment portfolio.

- Three main risk profiles:

-

- Low risk: Prioritizes stability, mainly fixed-income assets.

- Medium risk: Balances growth and stability with a diverse mix.

- High risk: Focuses on growth, primarily equities.

- ETFs for easy diversification: Exchange-traded funds (ETFs) offer a straightforward way to achieve diversification across regions, sectors, and asset classes.

- Asset allocation affects performance and stability: More bonds enhance stability but lower returns, while more equities mean higher growth potential but greater volatility.

- Rebalance regularly to maintain strategy: Rebalancing keeps your investment portfolio aligned with your goals, avoiding excess risk from asset shifts over time.

Understanding Risk Profiles for Your Investment Portfolio

When constructing an investment portfolio, the starting point is understanding your risk tolerance. This is your comfort level with potential losses and your willingness to accept market fluctuations in pursuit of long-term gains. How would you feel if your investment portfolio lost 10% in a day? What if it dropped by 40%? Charlie Munger, an investment guru and Warren Buffett’s longtime partner at Berkshire Hathaway, once noted, “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder.” This statement captures the mindset required of investors, especially those in equities, who must be ready to weather market volatility to achieve long-term returns.

Before diving into the different risk profiles, let us briefly review how investments are typically categorized by risk.

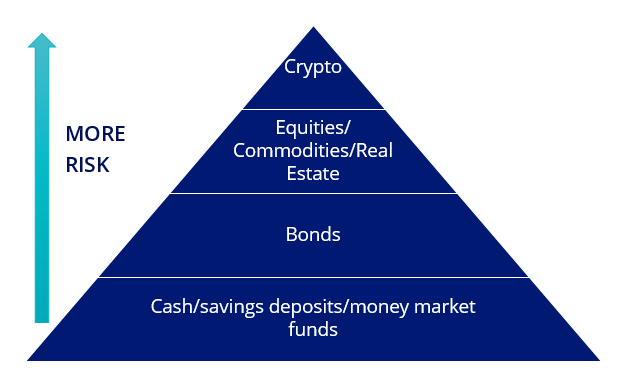

The Risk Pyramid: Organizing Your Investments by Risk

The risk pyramid categorizes investments based on their volatility and return potential, helping investors align their portfolios with their risk tolerance. Lower-risk assets provide stability but lower returns, while higher-risk assets offer greater growth potential but come with increased market fluctuations.

Risk Pyramid

Source: VanEck.

Investors typically structure their portfolios based on their investment horizon, financial goals, and risk appetite. Below are the three primary risk levels and their corresponding investment approaches:

Stability and Capital Preservation

Key focus: Preserving capital and minimizing volatility.

Common investments: Government bonds, cash equivalents, money market funds.

Investor profile: Suitable for those with shorter time horizons or a low risk tolerance, such as retirees or those needing regular access to funds.

Portfolio strategy: Prioritizes fixed-income assets to ensure stability, with minimal exposure to equities or volatile markets.

Balanced Growth and Stability

Key focus: Combining growth with controlled risk.

Common investments: A mix of equities, corporate bonds, balanced funds, and diversified ETFs.

Investor profile: Ideal for those with a moderate risk tolerance seeking long-term capital appreciation while managing fluctuations.

Portfolio strategy: Maintains a balanced allocation of growth assets and income-generating investments, reducing excessive exposure to market swings.

Maximizing Growth Potential

Key focus: High-return opportunities with significant market exposure.

Common investments: Equities, commodities, real estate, high-yield bonds, and cryptocurrencies.

Investor profile: Best suited for long-term investors willing to endure high volatility in pursuit of greater returns.

Portfolio strategy: Focuses on growth-oriented assets, accepting market fluctuations.

Crypto consideration: Cryptocurrencies are highly volatile and subject to regulatory uncertainties. As such, they should represent only a small portion of an otherwise diversified portfolio.

Understanding the Risk Factors that Shape Your Investment Decisions

When deciding on the right approach to risk, several key factors should be considered to align your investment portfolio with your financial goals and comfort level.

Younger investors typically have a longer time horizon, giving them the ability to withstand short-term volatility in exchange for higher long-term growth potential. In contrast, older investors, who may be closer to retirement, often prefer a more conservative approach to safeguard their capital and ensure stability.

Investors planning to withdraw funds regularly—such as retirees or those funding ongoing expenses—are better suited to a low-risk investment portfolio. This minimizes the chance of a significant loss during a market downturn and ensures liquidity when needed. Some investments are notoriously illiquid, such as physical real estate or closed ended funds.

Investors who are wealthier or have multiple income sources often have greater capacity to take on risk, as they can lose money without having to cut back on their lifestyle. Conversely, those with limited financial resources may prioritize stability to avoid the risk of losing essential funds.

These factors jointly affect how much risk you can afford to take, guiding you toward an investment strategy that meets both your financial needs and emotional comfort level.

Pitfalls in Creating an Investment Portfolio

Behavioral Biases That Affect Investment Decisions

Retail investors often face challenges in achieving proper diversification, which is essential for effective portfolio management. Behavioral biases, such as favoring familiar investments or concentrating too much in specific areas, can lead to imbalanced portfolios. These tendencies may increase exposure to certain risks and limit the potential for stable, long-term returns. Recognizing and addressing these biases is key to building a well-balanced investment strategy.

Sector Over-Concentration

Investors may be drawn to certain types of assets due to their perceived stability or past performance. While allocating capital to income-generating or high-growth assets can be beneficial, focusing too heavily on one type of investment increases vulnerability to specific risks. Market fluctuations, policy changes, and economic cycles can significantly impact concentrated portfolios.

A well-diversified portfolio distributes risk across multiple sectors and asset classes, reducing exposure to any single market development. Investors should periodically review their allocations and ensure a balanced approach that aligns with their long-term financial objectives.

Chasing Past Performance

A common tendency among investors is to favor assets that have recently performed well, assuming that past trends will continue. This approach can result in an unbalanced portfolio that lacks diversification and increases exposure to market volatility.

Rather than relying on recent performance as a guide, investors should consider broader market conditions, risk factors, and long-term growth potential. A well-structured investment strategy incorporates a mix of asset types, reducing reliance on any single category and improving overall portfolio resilience.

Loss Aversion

Investors often fear losses more than they value equivalent gains, leading to overly conservative strategies or reluctance to sell underperforming assets. This emotional decision-making can prevent investors from reallocating funds into more promising opportunities.

A disciplined investment approach focuses on long-term potential rather than short-term fluctuations, ensuring rational decisions aligned with financial goals.

Confirmation Bias

Investors sometimes seek out information that supports their existing beliefs while ignoring contradictory data. This can reinforce poor investment choices, deterring investors from adjusting their investment strategies to reflect objective market analysis.

Maintaining a diversified perspective, considering multiple viewpoints, and evaluating data critically can help investors make more balanced and informed decisions.

Home Bias

Many investors tend to favor domestic markets over international investments, often due to familiarity and perceived stability. However, this limits exposure to global opportunities and may result in missed diversification benefits.

A well-balanced portfolio includes a mix of domestic and international assets, helping to reduce dependency on local economic conditions and broaden investment potential.

Domestic Bias in Investment Portfolios

The Home Bias Report by Charles Schwab (2018)1 revealed that 74% of UK investors prefer to allocate the majority of their assets to domestic markets, due to familiarity with local companies and a desire to support their domestic economy. As shown in the graph below, the 2022 Home Bias Survey conducted by Whitebox reveals that German retail investors significantly overweight domestic equities, allocating 54% of their portfolios to local stocks. This strong preference for German equities limits their exposure to global opportunities, particularly in regions with faster-growing economies or innovative sectors. The survey found that this bias often results in sub-optimal portfolio diversification, leaving investors more vulnerable to local economic shocks and industry-specific risks. Furthermore, German investors forgo the potential stability and growth that comes with investing in a globally diversified portfolio, such as those incorporating international ETFs or emerging markets.

Stock Holdings by Region

Stock Holdings*, in € billion, Share in %

Source: BC Investment Data, Whitebox. Data as of March 2021.

Gender Differences in Risk Preferences

Research from J.P. Morgan surveying 500.000 retail investors suggests that gender plays a part in shaping investment behaviors and risk preferences. As the study shows, these differences are reflected in measurable portfolio risk metrics, including market risk (beta) and idiosyncratic risk.

- Market risk (beta): According to the research, male investors, on average, tend to build portfolios with higher market risk, which can lead to greater volatility.

- Idiosyncratic risk: The analysis suggests that female investors are more likely to favor diversified portfolios, reducing exposure to company-specific risks through broader asset allocation.

While these findings offer insights into general investment patterns, individual financial decisions are influenced by many factors, including experience, financial goals, and personal risk tolerance. Recognizing these differences can help investors refine their strategies and build portfolios aligned with their objectives.

Average Portfolio Risk Metrics by Gender

Idiosyncratic Risk (std. Dev. of Residuals)

Market Risk (Beta)

Source: J.P.MorganChase. Data as of 1/11/2024.

Generational Differences in Risk Preferences

Generational differences in investment behavior depend on life stages, financial priorities, and previous experience of market conditions. Research from J.P. Morgan suggests that investment risk preferences and portfolio composition tend to differ across age groups, as reflected in measurable portfolio risk metrics.

- Younger generations (Millennials and Gen Z): According to the research, these investors generally take higher levels of market risk (beta) and idiosyncratic risk. Their portfolios are often more volatile, which aligns with their longer investment horizons, allowing them to weather market downturns. This trend may also be influenced by a preference for high-growth sectors, including technology and digital assets.

- Generation X: As the analysis indicates, this group tends to take a moderate approach, balancing market exposure with diversification, leading to moderate levels of both market and idiosyncratic risk.

- Older generations (Baby Boomers and the Silent Generation): The study suggests that these investors often prioritize stability, generally adopting portfolios with lower market and idiosyncratic risk. They tend to allocate more toward fixed-income securities and dividend-paying stocks, reducing exposure to sector-specific or company-specific risks.

While these findings provide a broad perspective, the research highlights that individual investment strategies are shaped by factors beyond age, including personal financial goals, market knowledge, and risk tolerance. Recognizing these trends can help investors refine their approaches to align with their unique objectives.

Average Portfolio Risk Metrics by Investor Generation

Idiosyncratic Risk (std. Dev. of Residuals)

Market Risk (Beta)

Source: J.P.MorganChase. Data as of 1/11/2024.

How ETFs Deliver Diversification and Flexibility for Your Investment Portfolio

Exchange-traded funds (ETFs) are a powerful tool for building a balanced investment portfolio. Their inherent diversification allows investors to gain exposure to a wide range of assets, across companies, sectors, and geographical regions, without the need to select individual stocks or bonds. This built-in diversification makes ETFs particularly effective for creating an investment portfolio that can be adjusted to match various risk profiles, from conservative to aggressive. While ETFs offer many benefits, investors should also consider potential drawbacks, such as trading costs, market volatility, or limited liquidity in certain segments.

The graph below illustrates how different investment portfolio compositions perform over time, ranging from a 100% equity portfolio (light blue line) to a 100% bond portfolio (dark blue line). By comparing these, we can observe the impact of diversification and how portfolios respond to various market regimes.

For a more realistic assessment of returns, it is important to account for inflation. Adjusting for inflation shifts the performance lines downward, revealing real (inflation-adjusted) returns, which provide a clearer picture of the actual purchasing power of an investment portfolio's growth.

In this example:

- The 100% bond portfolio (dark blue line) shows greater resilience in a declining market, with less volatility and smaller losses. However, in the long term, it delivers lower returns compared to portfolios with a higher equity allocation.

- The 100% equity portfolio (light blue line) tends to offer higher returns, especially in bull markets, but experiences more significant fluctuations in value.

By mixing different asset classes, such as equities and bonds, you can adjust the risk-return trade-off to suit your own financial goals, risk tolerance, and time horizon.

x

x

Past performance is not a reliable indicator of future performance. Source: VanEck, Bloomberg.

Comparing Returns for Various Investment Portfolio Strategies

Below is the performance data for various investment portfolio strategies, measured over different time frames. This table reflects the returns for investment portfolios as of 30 April 2024, with data sourced from VanEck.

Return Comparison of Different Investment Portfolios

| Investment Portfolio | This Year | 1 Year | 3 Years (annualised) | 5 Years (annualised) | 10 Years (annualised) |

| 100% Equity Securities | 13.12% | 26.02% | 6.30% | 10.69% | 10.16% |

| Offensive Profile | 9.39% | 20.61% | 3.87% | 6.32% | 6.54% |

| Neutral Profile | 7.12% | 16.91% | 1.89% | 3.90% | 4.73% |

| Defensive Profile | 5.00% | 13.16% | 0.21% | 1.82% | 3.09% |

| 100% Bonds | 0.74% | 6.89% | -3.73% | -2.52% | 0.20% |

Source: VanEck, 30 April 2024. Data from: Equity securities under Solactive Sustainable World Equity Index GTR, Offensive profile under Multi-Asset Growth Allocation Index, Neutral profile under Multi-Asset Balanced Allocation Index, Defensive Profile under Multi-Asset Conservative Allocation Index and Bonds under Markit iBoxx EUR Liquid Sovereign Diversified 1-10 Index. “This is provided only for illustrative purposes and does not constitute an advice.”

Sample ETF Investment Portfolios with Different Risk Profiles

Below are some theoretical ETF investment portfolios with varying risk profiles, constructed using VanEck ETFs. Each portfolio includes a mix of global equity, real estate, government, and corporate bond ETFs, all denominated in euros.

Performance Chart of Different Strategies

| Defensive | 25% VanEck World Equal Weight Screened UCITS ETF | Cost of the profile: 0,17% per annum |

| 5% VanEck Global Real Estate UCITS ETF | ||

| 35% VanEck iBoxx EUR Sovereign Diversified 1-10 UCITS ETF | ||

| 35% VanEck iBoxx EUR Corporates UCITS ETF | ||

| Neutral | 40% VanEck World Equal Weight Screened UCITS ETF | Cost of the profile: 0,18% per annum |

| 10% VanEck Global Real Estate UCITS ETF | ||

| 25% VanEck iBoxx EUR Sovereign Diversified 1-10 UCITS ETF | ||

| 25% VanEck iBoxx EUR Corporates UCITS ETF | ||

| Offensive | 60% VanEck World Equal Weight Screened UCITS ETF | Cost of the profile: 0,19% per annum |

| 10% VanEck Global Real Estate UCITS ETF | ||

| 15% VanEck iBoxx EUR Sovereign Diversified 1-10 UCITS ETF | ||

| 15% VanEck iBoxx EUR Corporates UCITS ETF |

Source: VanEck, November 2024. “Investing is subject to risk including the loss of principal. The information provided above is only for illustrative purposes and does not constitute an advice.”

These diversified investment portfolios can, for example, be created through your bank or broker by buying the appropriate VanEck ETFs. By making a few simple transactions, you can align your investment portfolio with your financial goals, risk tolerance, and time horizon.

Investment Portfolio Rebalancing: Keeping Your Investment Portfolios Aligned

Rebalancing your investment portfolio periodically, such as once a year, is a crucial step to ensure that your investment portfolios stay aligned with your long-term financial goals and risk tolerance. Over time, market movements and the performance of different asset classes can cause your investment portfolio to become unbalanced. For example, if equity ETFs outperform other assets, they may make up a larger portion of your investment portfolio, increasing the overall risk exposure.

To maintain your desired asset allocation, you should rebalance by periodically selling some of your best-performing assets (like equities) and reallocating those funds into underperforming or more stable assets (like fixed-income ETFs or bonds). This process helps to restore the investment portfolio’s original balance, ensuring that it remains in line with your risk profile and Investment Portfolio strategy.

Why is Rebalancing Important?

- Maintaining desired risk levels: Without rebalancing, your investment portfolio could become too concentrated in certain asset classes, potentially increasing your risk exposure beyond your comfort level.

- Capitalizing on market changes: By selling assets that have appreciated significantly and buying those that have underperformed, you can capture gains while keeping your investment portfolio diversified.

- Avoiding emotional investing: Regular rebalancing reduces the temptation to react emotionally to market volatility, allowing you to stick to your long-term strategy.

How to rebalance your investment portfolio:

- Set a target asset allocation based on your risk profile, time horizon, and financial goals.

- Monitor your investment portfolio to check if any asset class has deviated significantly from your target allocation.

- Adjust your holdings by selling over-weighted assets (e.g., equities) and purchasing under-weighted assets (e.g., bonds, real estate) to bring the investment portfolio back to the desired balance.

By rebalancing regularly, you can maintain a consistent risk level and ensure that your investment portfolio remains aligned with your overall investment portfolio strategy.

Take a deeper dive into investment portfolio strategies and ETF fundamentals by exploring our courses in the Academy. Whether you are a beginner or experienced investor, these resources can help you fine-tune your approach to achieving financial goals.