FTX Snapshot

- Investors: FTX is backed by investors, such as Proof of Capital, Consensus Lab, FBG, Galois Capital, Binance, Temasek, SoftBank’s Vision Fund 2, Tiger Global & VanEck. Its latest valuation was $32 billion as of Jan. 2022.

- Regulations: FTX bases its operations from Hong Kong, but is owned by its Antigua and Barbuda-based parent-company FTX Trading Limited. FTX US is registered as a Money Services Business with FinCEN and compliant with the requirements of the Bank Secrecy Act (BSA). On the State level, the primary issues arise around consumer protection and money transmission laws.

- FIAT Services: The company also supports fiat services and has Australian partners for fiat onramp.

- Insurance: FTX also has an insurance fund to prevent user losses in the case of huge, sudden market movements. Traders who make use of the 50x-100x leverage pay higher fees, which are then added to this fund.

- Listing Process: Their standard listing is a futures listing. The listing committee prioritizes tokens based on trading interest and demand potential. FTX doesn’t charge a listing fee.

- Investments: FTX has executed around 15 investments since its lifetime in a bid to launch compelling new products that customers want, such as Blockfolio for $150 million and Sky Mavis for $152 million.

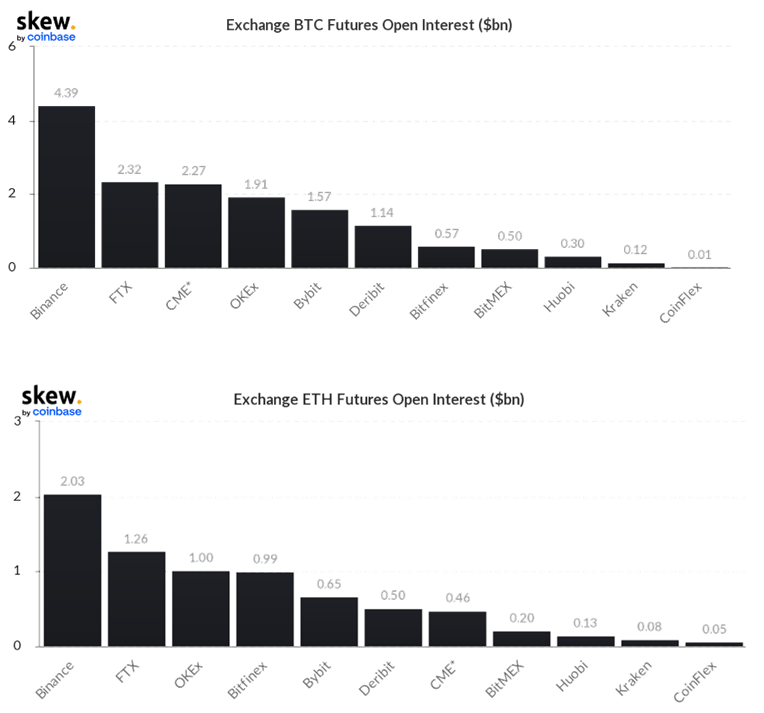

Source: Skew. Data for the period 1-12-2021 – 01-03-2022