More of the Same (Good) Thing in Moat Investing

17 December 2019

Share with a Friend

All fields required where indicated (*)The Morningstar® Wide Moat Focus IndexTM (“Moat Index”) has fortunately provided plenty of positive news to write about throughout 2019, particularly in the second half of the year, with impressive stock selection being a major story this year. November offered more of the same. This month gave the financials sector its turn to shine, extending the Moat Index’s year-to-date outperformance vs. the S&P 500 Index to more than five percent through November.

Outperformance Across the Board

Trailing Return (%) as of 30/11/2019

| 1 MO | YTD | 1 YR | 3 YR | 5 YR | |

|---|---|---|---|---|---|

| Moat Index | 4.27 | 32.85 | 20.70 | 17.94 | 13.39 |

| S&P 500 Index | 3.63 | 27.63 | 16.11 | 14.88 | 10.98 |

Source: Morningstar. Past performance is no guarantee of future results. Index performance is not illustrative of fund performance. For fund performance current to the most recent month-end, visit vaneck.com.

Moat Stocks Mega Merger

Charles Schwab Corp. (SCHW) was the Moat Index standout in November. The company’s stock price rallied 22% during the month on the heels of the announced acquisition of narrow moat TD Ameritrade (AMTD). The all-stock transaction was valued at an estimated $26 billion. Morningstar views Charles Schwab’s massive scale and industry-leading cost efficiency as wide moat worthy. Despite the company’s decision to cut commission pricing to $0 in early October, Morningstar believes the company can sustain returns on invested capital well above the cost of capital. A recent note from Morningstar cited a potential 10-15% upside to Charles Schwab’s fair value estimate based on the proposed deal terms.

Financials, Financials, Financials

Three other financials companies, all from different segments of the sector, were among the top performing Moat Index constituents in November. Custody bank State Street Corp. (STT) continued riding the momentum following the strong earnings results it reported in October to post gains in November. Asset manager BlackRock Inc. (BLK) saw a fair value estimate increase in mid-October in light of higher than expected assets under management figures. Lastly, Wells Fargo & Co. (WFC) posted solid performance in November, continuing the strong positive trend that began in mid-August.

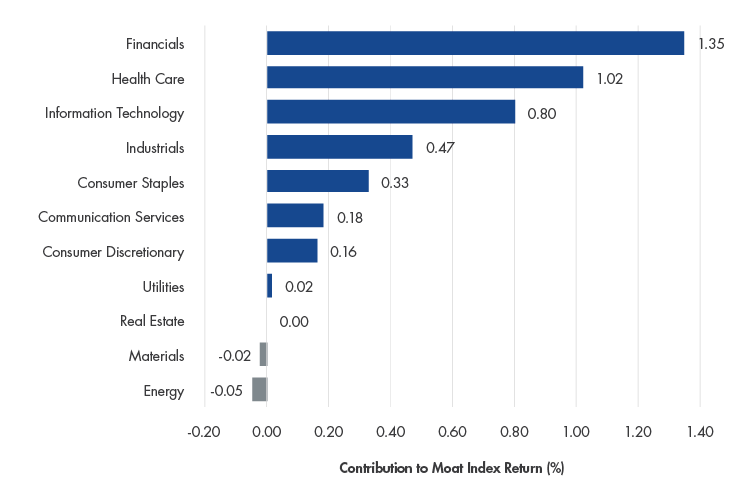

Most Sectors Contribute to Positive Returns for Moat Index

1 Month as of 30/11/2019

Source: Morningstar. Past performance is no guarantee of future results. Index performance is not illustrative of fund performance. For fund performance current to the most recent month-end, visit vaneck.com.

Down in the HOG Pit

41 of the Moat Index’s 51 constituents contributed positively in November. One standout on the downside was Harley Davidson Inc. (HOG), which has struggled in the face of nonexistent switching costs as consumers replace their bikes with cheaper alternatives. Morningstar notes HOG’s dominant position in the U.S. motorcycle market but also recognizes competitive pressures from lower cost providers and international competition in cyclical downturns or periods of exchange-rate differentials that allow foreign companies to discount their bikes domestically.

| Name | November Return (%) |

|---|---|

| Charles Schwab Corp | 22.07 |

| ServiceNow Inc | 14.47 |

| State Street Corporation | 13.67 |

| Altria Group Inc | 10.96 |

| Amgen Inc | 10.80 |

| Name | November Return (%) |

|---|---|

| Harley-Davidson Inc | -6.50 |

| KLA Corp | -2.60 |

| Cheniere Energy Inc | -1.64 |

| Comcast Corp Class A | -1.49 |

| Blackbaud Inc | -1.13 |

Source: Morningstar. Past performance is no guarantee of future results. These are not recommendations to buy or to sell any security.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Morningstar US Sustainable Wide Moat UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets. Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

UK - Facilities Agent: Computershare Investor Services PLC

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

Morningstar® US Sustainability Moat Focus Index is a trade mark of Morningstar Inc. and has been licensed for use for certain purposes by VanEck. VanEck Morningstar US Sustainable Wide Moat UCITS ETF is not sponsored, endorsed, sold or promoted by Morningstar and Morningstar makes no representation regarding the advisability in VanEck Morningstar US Sustainable Wide Moat UCITS ETF.

Effective December 17, 2021 the Morningstar® Wide Moat Focus IndexTM has been replaced with the Morningstar® US Sustainability Moat Focus Index.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

It is not possible to invest directly in an index.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter