China ETF

VanEck New China ESG UCITS ETF

China ETF

VanEck New China ESG UCITS ETF

Fund Description

The VanEck New China ESG UCITS ETF invests for growth in tomorrow’s China. Using an in-depth methodology, it invests in the Chinese economy’s sweet spot – the sustainable companies benefiting from consumer spending, healthcare demand and tech innovation.

-

NAV$12.96

as of 19 Apr 2024 -

YTD RETURNS-7.12%

as of 19 Apr 2024 -

Total Net Assets$5.5 million

as of 19 Apr 2024 -

Total Expense Ratio0.60%

-

Inception Date24 Sep 2021

-

SFDR ClassificationArticle 8

Overview

Fund Description

The VanEck New China ESG UCITS ETF invests for growth in tomorrow’s China. Using an in-depth methodology, it invests in the Chinese economy’s sweet spot – the sustainable companies benefiting from consumer spending, healthcare demand and tech innovation.

- Targeting tomorrow’s winners in China’s growth economy

- In-depth methodology identifies financially sound growth companies

- OWL Analytics environmental, social and governance methodology identifies sustainable businesses

Risk Factors:

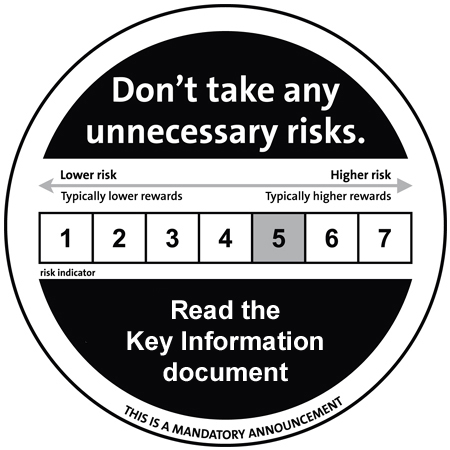

Risk of investing in Emerging Markets, Risk of investing in China, Risk of investing in smaller companies. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

MarketGrader New China ESG Index

Fund Highlights

- Targeting tomorrow’s winners in China’s growth economy

- In-depth methodology identifies financially sound growth companies

- OWL Analytics environmental, social and governance methodology identifies sustainable businesses

Risk Factors: Currency Risk, Risk of investing in Emerging Markets, Risk of investing in China, Risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MarketGrader New China ESG Index