AMX ETF

VanEck AMX UCITS ETF

AMX ETF

VanEck AMX UCITS ETF

Fund Description

The VanEck AMX UCITS ETF invests in Dutch securities that are traded on the Euronext Amsterdam and rank 26 – 50 based on their market capitalisation.

-

NAV€91.92

as of 16 Apr 2024 -

YTD RETURNS-0.41%

as of 16 Apr 2024 -

Total Net Assets€21.3 million

as of 16 Apr 2024 -

Total Expense Ratio0.35%

-

Inception Date14 Dec 2009

-

SFDR ClassificationArticle 6

Overview

Fund Description

The VanEck AMX UCITS ETF invests in Dutch securities that are traded on the Euronext Amsterdam and rank 26 – 50 based on their market capitalisation.

- Direct access to 25 listed medium-sized Dutch companies

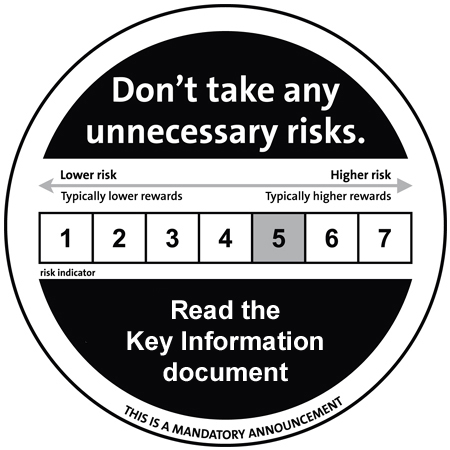

Risk Factors: Liquidity risk, equity market, limited diversification risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

AMX Index (RAMX)

Fund Highlights

- Direct access to 25 listed medium-sized Dutch companies

Risk Factors: Liquidity risk, equity market, limited diversification risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

AMX Index (RAMX)