Emerging Markets Local Currency Bond ETF

VanEck J.P. Morgan EM Local Currency Bond UCITS ETF

Emerging Markets Local Currency Bond ETF

VanEck J.P. Morgan EM Local Currency Bond UCITS ETF

Fund Description

VanEck J.P. Morgan EM Local Currency Bond UCITS ETF offers access to a diversified and liquid portfolio of Emerging Market bonds for investors that are looking for a yield pick-up versus other fixed income segments. It provides an attractive blend of risk and reward because emerging market countries tend to have less leveraged public finances, and their central banks have increasingly adopted conventional monetary policies.

-

NAV$57.01

as of 22 Apr 2024 -

YTD RETURNS-4.86%

as of 22 Apr 2024 -

Total Net Assets$90.3 million

as of 22 Apr 2024 -

Total Expense Ratio0.30%

-

Inception Date07 Apr 2017

-

SFDR ClassificationArticle 6

Overview

Fund Description

VanEck J.P. Morgan EM Local Currency Bond UCITS ETF offers access to a diversified and liquid portfolio of Emerging Market bonds for investors that are looking for a yield pick-up versus other fixed income segments. It provides an attractive blend of risk and reward because emerging market countries tend to have less leveraged public finances, and their central banks have increasingly adopted conventional monetary policies.

- Significantly higher yields than developed market bonds of the same quality

- Portfolio of bonds issued by emerging markets governments in their local currencies

- Diversified across 19 countries

- Restricted to countries whose debt can be freely traded by international investors

- Current lowest total expense ratio among all European ETFs in this category

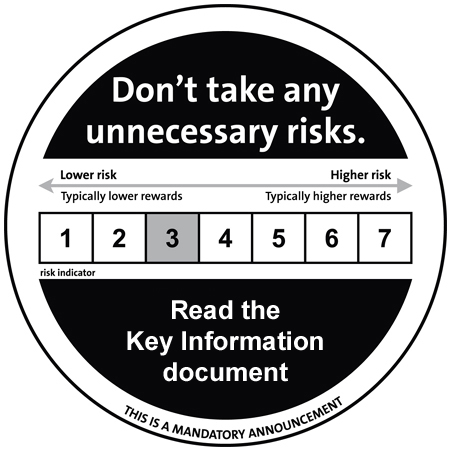

Risk factors: Foreign Currency Risk, Emerging Markets Risk, Credit Risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

J.P. Morgan GBI-EMG Core Index (GBIEMCOR)

Fund Highlights

- Significantly higher yields than developed market bonds of the same quality

- Portfolio of bonds issued by emerging markets governments in their local currencies

- Diversified across 19 countries

- Restricted to countries whose debt can be freely traded by international investors

- Current lowest total expense ratio among all European ETFs in this category

Risk factors: Foreign Currency Risk, Emerging Markets Risk, Credit Risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

J.P. Morgan GBI-EMG Core Index (GBIEMCOR)