Global Moat ETF

VanEck Morningstar Global Wide Moat UCITS ETF

Global Moat ETF

VanEck Morningstar Global Wide Moat UCITS ETF

Fund Description

The VanEck Morningstar Global Wide Moat UCITS ETF invests in global equities with powerful competitive advantages and attractive valuations. This concept has delivered successful long-term investment returns.

-

NAV$25.92

as of 18 Apr 2024 -

YTD RETURNS-1.35%

as of 18 Apr 2024 -

Total Net Assets$62.2 million

as of 18 Apr 2024 -

Total Expense Ratio0.52%

-

Inception Date07 Jul 2020

-

SFDR ClassificationArticle 6

Overview

Fund Description

The VanEck Morningstar Global Wide Moat UCITS ETF invests in global equities with powerful competitive advantages and attractive valuations. This concept has delivered successful long-term investment returns.

- Based on Warren Buffett´s “economic moats” concept

- Strategy with proven record of outperformance1

- Transparent indexing model from Morningstar, a renowned research partner

- Companies with long-term competitive advantages (switching costs, intangible assets, network effect, cost advantage, efficient scale)

- Targets companies trading at relatively attractive prices

- Could be the core of a global equity portfolio

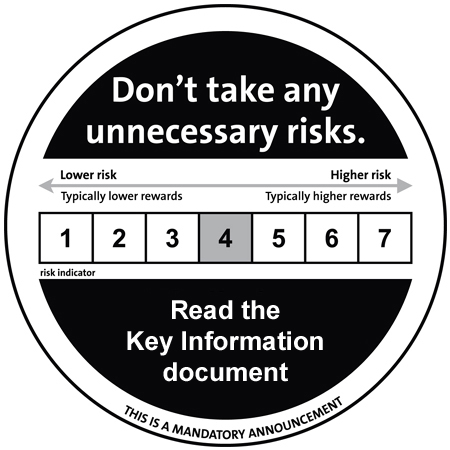

1Past performance is not a reliable indicator for future performance. Risk Factors: Equity market risk, limited diversification risk, foreign currency risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

Morningstar Global Wide Moat Focus Index

Fund Highlights

- Based on Warren Buffett´s “economic moats” concept

- Strategy with proven record of outperformance1

- Transparent indexing model from Morningstar, a renowned research partner

- Companies with long-term competitive advantages (switching costs, intangible assets, network effect, cost advantage, efficient scale)

- Targets companies trading at relatively attractive prices

- Could be the core of a global equity portfolio

1Past performance is not a reliable indicator for future performance. Risk Factors: Equity market risk, limited diversification risk, foreign currency risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

Morningstar Global Wide Moat Focus Index