E-sports, ESG and Cryptocurrencies are the ETF Trends in 2019

07 January 2019

Share with a Friend

All fields required where indicated (*)Investors can bet on future trends. The European ETF market in particular promises enormous growth potential as the market share of ETFs is still relatively small compared to total assets under management in Europe. Special areas such as e-sports, ESG and cryptocurrencies as well as smart beta offer investors interesting investment opportunities.

Pong, a video game released by Atari in the 1970s, is considered the pioneer of computer games. The game in a nutshell: A dot representing a ball is hit back and forth over a line with a vertical bar that can be moved up and down – similar to the game of tennis. If the ball gets past your racket, your opponent gets a point.

Pong was only the beginning of today's high-tech computer games. Nowadays, game producers are competing for millions of customers. In 2017, the market's revenues increased by 10.7 per cent, reaching sales of 116 billion US dollars. The e-sports entertainment category has been growing by an average of 40 per cent per year since 2015 and has 380 million users worldwide – and there is no end in sight for this growth.

Computer games – a billion-dollar industry

E-Sports is the term used to describe the competition that people all over the world participate in via computer games. The games are mainly based on motor skills such as hand-eye coordination and reaction speed, but also require strategic thinking. E-sports is even recognised as a sport in some countries by the established sports associations. Some German Bundesliga clubs operate their own e-sports teams, mainly for the FIFA football simulation developed by EA Sports. Players can win prize money in various competitions. The “cyberathletes” are respected celebrities, in particular in South Korea, but also in other Asian countries. In terms of earnings, however, the German Dota 2 player Kuro Takhasomi (26) from the e-sports powerhouse “Team Liquid” is the most successful player in the world with total winnings of more than four million dollars so far. The popularity of the games has also been gigantic: The League of Legends World Championship in 2017 attracted more spectators globally than the final games of the World Series (Baseball USA), the NBA finals (Basketball USA) and the NHL finals (Hockey USA) in the same year. Tournaments for video games such as FIFA, StarCraft 2, League of Legends and Dota 2 regularly fill stadiums around the globe. Given the rapidly growing global population, a large part of which is young, affluent and loyal, the computer game industry is likely to be an exciting topic for investors.

Further return-driving trends

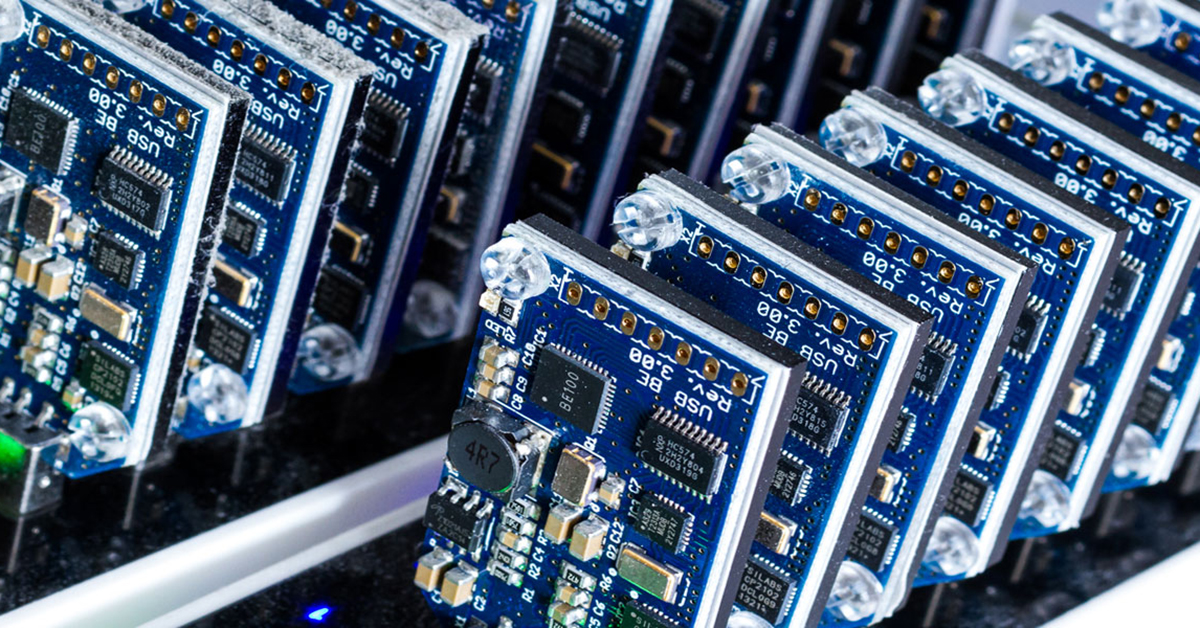

Technologically speaking and from an investor's point of view, “digital assets” have enormous potential. While this market has mainly been driven by retail investors in recent years, an increasingly greater institutionalisation is ensuring broader acceptance of the technology itself and is drawing institutional investors to this new asset class. The invention of blockchain technology, which functions like a public ledger, could make international payment transactions completely digital and thus simpler, less expensive and more secure. But it is not only banks or financial intermediaries who prone for disruption. Great potential lies in the elimination of intermediaries of all kinds in an increasing sharing economy.

Another investment topic with a promising future are companies in which ESG (“Environment, Social & Governance”) plays an important role. More and more investors are focusing on ecological and social aspects as well as the way companies are governed. In May 2018, for example, the insurer Allianz announced that it would withdraw from the insurance business for coal power plants and facilities using other fossil fuels by 2040. Acting sustainably is “en vogue” and is anchored in a wide range of global regulations and agreements. ESG investors can benefit from these developments.

Those who recognise global trends early on can position themselves and potentially profit from the markets. However, investors should not rely on this alone. Irrespective of which trends and phases set the tone in the markets, the golden rule of investing still applies: “Time in the market, not timing the market.” A long-term investment horizon is required to make money in capital markets. History shows that the longer you are invested in the market, the less likely you are to lose money. Since 1950, there has not been one rolling 20-year period in which one would not have made a profit with stocks, bonds or an equally weighted portfolio.

ETFs as ideal investment vehicles

Exchange-traded funds (ETFs) are particularly suitable for long-term investments. For them, the old wisdom applies: The profit is in the purchase. ETFs reflect the performance of the markets – less fees. Passively managed funds are significantly more cost-efficient than their actively managed counterparts. The approach of active fund management is theoretically compelling: Investors attempt to achieve a higher return than the market by adjusting the asset allocation dynamically. In practice, however, there are very few active managers who can justify their long-term outperformance with the additional costs.

Basically, one can say that in more efficient markets, such as the US equity market, there are hardly any fund managers who beat the S&P 500 in the long term. This also applies to other key indices such as the DAX or the EURO STOXX 50. Warren Buffett's wager provides a superb example of this. In 2007, the American investment legend wagered one million US dollars that an index fund would outperform a basket of hedge funds over a ten year period. Buffett won the bet and donated the winnings to a local foundation. An interesting marginal aspect: The index fund gained 7.1 per cent p.a., while the fund basket gained 2.2 per cent p.a.

Portfolio diversification

Of course, there are no guarantees that investors working with index funds will generate profits year after year. After the bull market of recent years, 2018 has so far shown that equities are exposed to risks in the short and medium term that can lead to falling prices. The end of the extremely loose monetary policies, the trade conflict between the US and China and a possible slowdown in global growth pose major challenges for investors. However, the fact remains: In established, efficient markets such as the US and Europe, outperformance is difficult to achieve. This makes it difficult for active fund managers to outperform the market. To reduce the overall risk of a portfolio, investors can add assets to their portfolio that are considered “safe havens” – gold, German and Swiss government bonds have been the most notable examples in the past. In the index funds segment, smart beta strategies can reduce risk and diversify portfolios. These ETFs use alternative weighting rules and filter for components such as high dividends, value or volatility.

Conclusion: Trends such as e-sports, cryptocurrencies or ESG may well serve as return drivers in the coming year and beyond. Otherwise the following holds true: Anyone who invests long-term and uses passive and cost-effective investment vehicles has a good chance of being successful in the markets.

IMPORTANT DISCLOSURE

This commentary originates from VanEck Investments Limited (“VanEck”) and does not constitute an offer to sell or solicitation to buy any security. It was published as a guest article at "DasInvestment" (December 20, 2018): https://www.dasinvestment.com/e-sport-nachhaltigkeit-und-kryptowaehrungen-das-sind-die-3-zukunftstrends-bei-passiven-fonds.

Belangrijke kennisgeving

Uitsluitend voor informatie- en advertentiedoeleinden.

Deze informatie is afkomstig van VanEck (Europe) GmbH. VanEck (Europe) GmbH is aangesteld als distributeur van VanEck-producten in Europa door VanEck Asset Management B.V., een beheermaatschappij onder Nederlands recht en geregistreerd bij de Nederlandse Autoriteit Financiële Markten (AFM). VanEck (Europe) GmbH, met als vestigingsadres Kreuznacher Str. 30, 60486 Frankfurt, Duitsland, is een financiële dienstverlener die onder toezicht staat van BaFin, de Duitse toezichthouder voor de financiële markten. De informatie is uitsluitend bedoeld om beleggers te voorzien van algemene en voorlopige informatie en mag niet worden opgevat als beleggings-, juridisch of fiscaal advies. VanEck (Europe) GmbH en de aan VanEck (Europe) GmbH verbonden en gelieerde bedrijven (samen "VanEck") wijzen elke aansprakelijkheid van de hand met betrekking tot beslissingen die de belegger op basis van deze informatie neemt ten aanzien van het kopen, verkopen of aanhouden van beleggingen. De visies en meningen die hier worden gegeven, zijn die van de auteur(s) en komen niet noodzakelijkerwijs overeen met die van VanEck. De meningen zijn actueel op de datum van publicatie en kunnen worden aangepast op basis van veranderende marktomstandigheden. Bepaalde verklaringen in deze bijdrage kunnen ramingen, voorspellingen en andere op de toekomst gerichte verklaringen zijn die niet overeenkomen met de werkelijkheid. Wij achten de informatie die afkomstig is van derden, betrouwbaar. Deze informatie is echter niet onafhankelijk gecontroleerd. De nauwkeurigheid en volledigheid ervan kunnen daarom niet worden gegarandeerd. Alle indices die worden vermeld, zijn maatstaven voor het vergelijken van algemene marktsectoren en rendementen. Het is niet mogelijk om rechtstreeks in een index te beleggen.

Alle rendementsgegevens hebben betrekking op het verleden en bieden geen garantie voor toekomstige resultaten. Beleggen brengt risico's met zich mee, waaronder mogelijk verlies van de hoofdsom. Lees het prospectus en de essentiële beleggersinformatie voordat u gaat beleggen.

Niets in dit materiaal mag in welke vorm dan ook worden verveelvoudigd en er mag ook niet naar worden verwezen in andere publicaties zonder de uitdrukkelijke schriftelijke toestemming van VanEck.

© VanEck (Europe) GmbH

Gerelateerde inzichten

Related Insights

14 maart 2024

18 maart 2024

15 maart 2024

14 maart 2024

11 maart 2024