Hawks vs. Growth Headwinds

28 July 2022

Read Time 2 MIN

Fed Hikes, U.S. Recession

The below-consensus Q2 GDP print in the U.S. (0.9% sequential contraction) came on the heels of yesterday’s 75bps rate hike by the U.S. Federal Reserve (Fed) and Chairman Jerome Powell’s hawkish press-conference, at which he mentioned a possibility of another “unusually large” move in September. This is a reminder that the Fed is willing to tolerate a recession in order to bring inflation down. Incidentally, the U.S. is among the countries with the sharpest cuts in the 2022 and 2023 growth forecasts in the just-updated World Economic Outlook (IMF).

Global Growth Headwinds

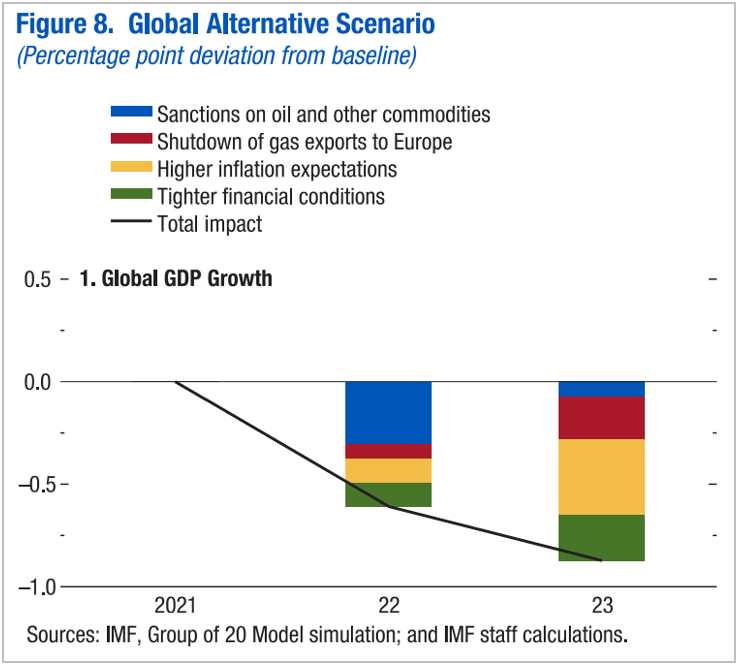

The IMF believes that the global balance of risks is squarely to the downside due to a combination of the Russia/Ukraine war’s impact on gas prices, higher inflation and higher costs of disinflation and tighter financial conditions. The new 2022 world GDP forecast is 0.4% lower than April’s projection, and the 2023 forecast was cut by 0.7%. An adverse scenario sees even deeper cuts in global growth projections (see chart below). What was a bit surprising is that the downward revision of the growth forecasts for emerging markets (EM) as a whole was relatively small. In part, this might be due to the fact that parts of EM are expected to benefit from higher commodity prices – these are some Middle Eastern economies and LATAM.

China Growth Slowdown

China, however, is not that lucky. The IMF thinks that the Chinese economy will expand only by 3.3% in real terms this year, which is 1.1% lower than the April estimate. China’s 2023 forecast was cut by 0.5%, to 4.6%. Both numbers are significantly lower than the official growth target of about 5.5%. This is why the market keeps a very close eye on new policy initiatives that could potentially reverse the negative impact of the past – growth-negative – policy initiatives (this sounds like circular reasoning, but…). The central bank’s intention to create a bailout fund (up to CNY1T) to give low-interest loans to real estate developers so that they can complete unfinished apartments (“diffusing” the mortgage payers’ strike in the process) looks promising. But we also learned today that the Politburo was not too keen on aggressive stimulus. Near-term, our focus is on the July batch of China’s activity surveys (out this weekend), which will show whether the economy (especially consumption) enters Q3 in a meaningfully better shape or whether the improvement is still marginal. Stay tuned!

Chart at a Glance: What’s Behind Adverse Growth Scenarios

Source: International Monetary Fund, World Economic Outlook Update, July 2022

Related Insights

07 April 2025

06 March 2025

20 February 2025

10 February 2026

Debasement is back in focus. Here’s what’s driving it, what could reverse it and how we’re positioning portfolios for both scenarios.

07 April 2025

Trump’s tariffs spark trade war fears, fueling market volatility, inflation risk, and recession threats. With global retaliation likely, near-term growth is clearly at risk.

06 March 2025

Trump’s tariffs, AI’s next phase, and a potential U.S. gold revaluation could shake markets—investors who stay ahead of these transitions will be best positioned.

20 February 2025

China's AI breakthrough, persistent inflation, gold’s outperformance, and rising energy demand underscore a shifting investment landscape.

16 January 2025

In 2025, navigating turbulence means balancing tech innovation, inflation hedges, energy shifts, and risks from spending cuts and inflation.