“Too High For Too Long” – Inflation? Rates? Both?

16 March 2023

Read Time 2 MIN

DM Rate Hikes

The market tried to bounce on the news that Credit Suisse was allowed to borrow from the Swiss National Bank, but concerns about the debacle’s impact on bank lending standards – and, hence, the growth outlook both in Europe and the U.S. – led to some back and forth. The European Central Bank’s (ECB’s) decision to go for a larger 50bps rate hike refocused the market’s attention on economic fundamentals – specifically, persistent price pressures in developed markets (DM), which, according to the ECB, were “projected to remain too high for too long”. The consensus expects headline inflation in Europe and the U.S. to remain outside the target until 2025. The question is whether the U.S Federal Reserve (Fed) will follow suit with a hawkish message next week, or will the banking sector anxieties take precedence? As of this morning, the Fed Funds Futures showed around 70% probability of a 25bps rate increase in March, and implied around 90bps of rate cuts in the rest of the year.

EM Rate Cuts

The policy landscape in emerging markets (EM) is less dramatic these days – aggressive post-pandemic policy tightening means that the real rates are high (=a safety cushion for EMFX), and disinflation is underway in most places. As a result, more and more EM central banks can pause safely (and enjoy the DM show). The Indonesian central bank did just that earlier today – keeping the policy rate on hold and main economic forecasts broadly unchanged. And the Brazilian central bank is expected to do the same next week – with a calmer messaging if the government’s new fiscal framework proposals (expected any day now) look orthodox enough.

EM Disinflation

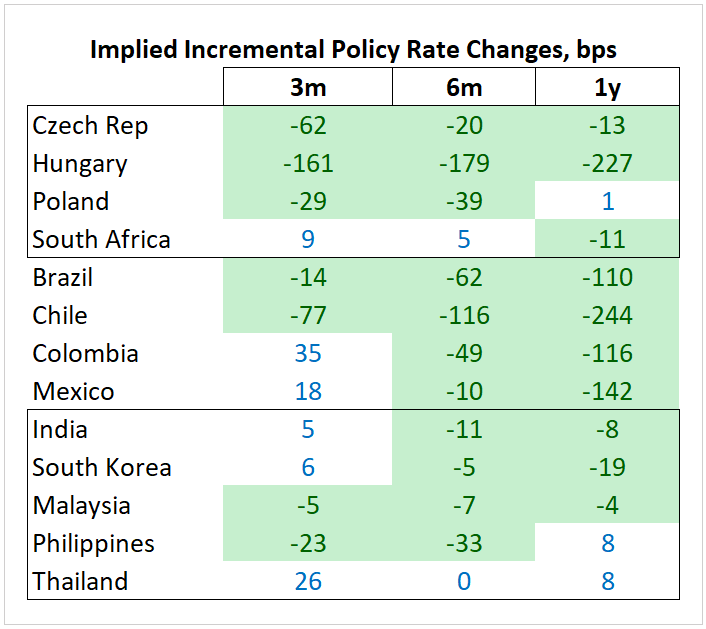

We consider it a sign of EM resilience that the market continues to price in rate cuts in the next 12 months, despite recent turbulence in DM (see chart below). But we have to admit that the bar for policy easing can be (should be?) high – in part, because the disinflation progress is uneven, core inflation is often sticky and inflation is still far away from the target in many countries. We’ve got some reminders today, as Poland’s core inflation surprised to the upside in February (accelerating to 12% year-on-year), and South Africa’s inflation expectations moved higher in Q1. Actually, several EM central banks might need to tighten a bit more before contemplating a pause – Mexico, and potentially South Africa. Stay tuned!

Chart at a Glance: Implied Rate Cuts in EM – Market Turbulence Notwithstanding

Source: Bloomberg LP.

Related Insights

07 April 2025

06 March 2025

20 February 2025

16 January 2025

07 April 2025

Trump’s tariffs spark trade war fears, fueling market volatility, inflation risk, and recession threats. With global retaliation likely, near-term growth is clearly at risk.

06 March 2025

Trump’s tariffs, AI’s next phase, and a potential U.S. gold revaluation could shake markets—investors who stay ahead of these transitions will be best positioned.

20 February 2025

China's AI breakthrough, persistent inflation, gold’s outperformance, and rising energy demand underscore a shifting investment landscape.

16 January 2025

In 2025, navigating turbulence means balancing tech innovation, inflation hedges, energy shifts, and risks from spending cuts and inflation.

05 December 2024

"Trump Trade 2.0" fueled U.S. equity and digital asset rallies, while real assets faltered under a strong dollar, with global markets reacting unevenly to pro-growth policies.