All Quiet on the Growth Front?

27 February 2023

Read Time 2 MIN

China’s Rebound

The next wave of emerging markets (EM) activity gauges is about to hit the shore, starting with China’s official PMIs (Purchasing Managers Indices) tomorrow evening. China’s 2023 growth outlook is bottoming out - the consensus forecast has been raised from 4.8% to 5.2% on the back of reopening news. However, the market now has additional questions regarding the recovery’s timeline, whether it will be more unbalanced than previously thought, and how much of “excess” savings will be used to boost consumption (rather than precautionary savings). The housing sector is still sluggish, which can also weigh on consumer sentiment – China watchers hope the forthcoming National People’s Congress meeting will provide more color regarding additional policy support.

Global Growth Outlook

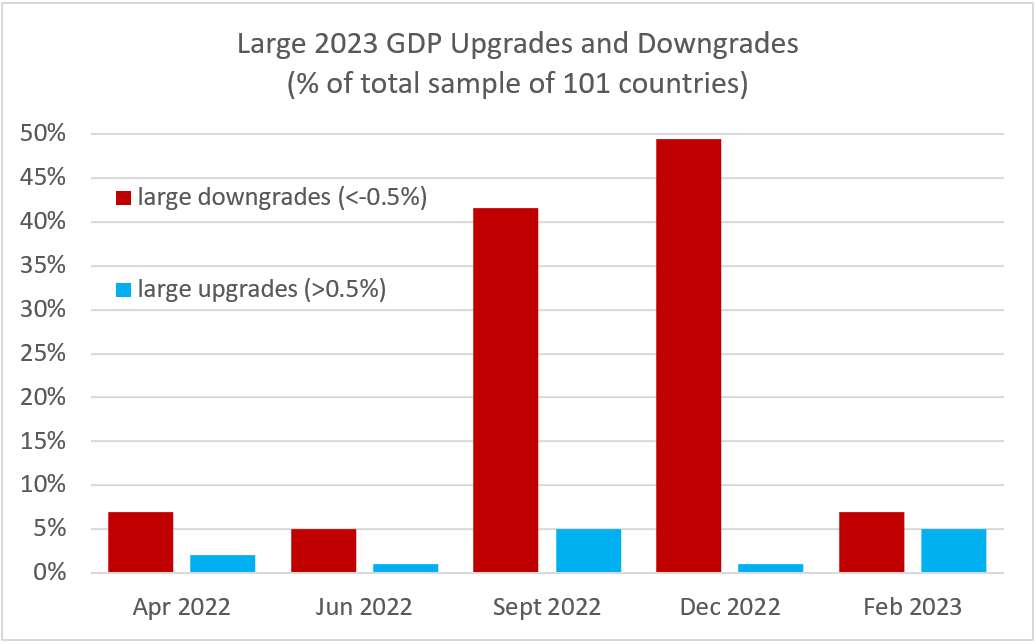

The global growth backdrop for EMs does not look as desperate as in September. The Bloomberg consensus survey (101 countries) shows that the share of large growth downgrades (-0.5% and more) dropped to 6-7% from about 50% at the end of last year (see chart below). At the same time, the share of large growth upgrades is still very low (5%). The last batch of EM PMIs was also mixed/inconclusive. The ratio of expansion-to-contraction was still below 50% in January, and the ratio of improvements-to-deteriorations looked about the same. As regards market implications, the growth outlook is important not only for EM carry trades (a better outlook can offset the impact of higher Fed rates) but for sovereign spreads as well (helping to cope with “risk-free” rates’ volatility – especially for High Yielding bonds).

DM GDP Forecasts

The developing markets (DM) “portion” of global growth looks more promising, according to high-frequency data. Downside risks for Europe appear to be contained, with the recession no longer part of the consensus story. The economic surprise index for the U.S. continues to grind higher, supporting the market expectations of the higher peak rate (5.4% or so) and less need for “emergency” rate cuts in H2 (Fed Funds Futures now imply only 12-13bps). Some EM central banks might feel the need to match the Fed’s higher policy rate trajectory (Mexico comes to mind here), but this does not apply to all EMs, many of which hiked early and aggressively and now have very high real policy rates. Stay tuned!

Chart at a Glance: 2023 Growth Upgrades – Wait-n-See Mode (For Now)

Source: VanEck Research; Bloomberg LP

Related Insights

07 April 2025

06 March 2025

20 February 2025

10 February 2026

Debasement is back in focus. Here’s what’s driving it, what could reverse it and how we’re positioning portfolios for both scenarios.

07 April 2025

Trump’s tariffs spark trade war fears, fueling market volatility, inflation risk, and recession threats. With global retaliation likely, near-term growth is clearly at risk.

06 March 2025

Trump’s tariffs, AI’s next phase, and a potential U.S. gold revaluation could shake markets—investors who stay ahead of these transitions will be best positioned.

20 February 2025

China's AI breakthrough, persistent inflation, gold’s outperformance, and rising energy demand underscore a shifting investment landscape.

16 January 2025

In 2025, navigating turbulence means balancing tech innovation, inflation hedges, energy shifts, and risks from spending cuts and inflation.