China’s Dismal Q2 GDP – Nothing to See Here?

15 July 2022

Read Time 2 MIN

China Growth Slowdown

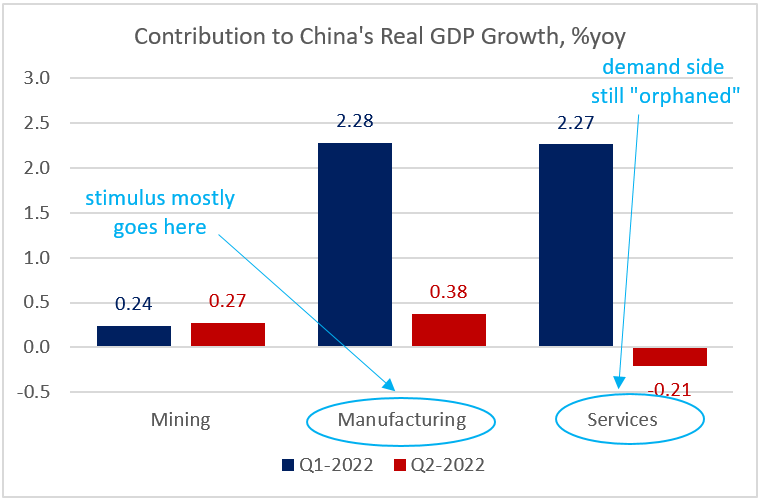

Chinese stocks reacted negatively to China’s dismal Q2 GDP print, even though June’s activity data showed signs of a rebound. The Q2 real GDP growth dropped by 2.6% in sequential terms and was barely positive on a year-on-year basis (0.4%). The services sector was hit the hardest – posting a negative year-on-year growth for the first time since the pandemic (Q3 2020). But manufacturing also showed a comparable drop in the contribution to quarterly growth (see chart below). China’s zero-COVID policy was the main culprit, and the removal of some restrictions was already visible in June’s industrial production, retail sales and investments. (Much) stronger than expected credit aggregates for June suggest that domestic activity should show even better results in July and August – naturally, provided there are no new lockdowns.

China Policy Stimulus

The question is whether the prospective Q3 rebound (fingers crossed) would significantly narrow (or close) the widening gap between the 2022 growth forecast and the official growth target. As we said, easier movement restrictions are a huge plus – but given that China’s zero-COVID policy will not go anywhere any time soon, there is an ever-present risk that lockdowns will be back. We also keep an eye on the new growth headwind, which some commentators call the “mortgage payment crisis”. And this brings us back to the additional stimulus. Today’s reports that the central bank decided to keep the 1-year medium-term lending facility rate unchanged at 2.85% tells us that this is pretty much business as usual as regards the fiscal-monetary breakdown (emphasis on fiscal support). Finally, authorities continue to target supply side (especially infrastructure) to prop up growth, while demand side remains an afterthought. The next stop on the growth front is the release of July’s activity gauges at the end of the month.

China Growth – Global Implications

China’s growth trials and tribulations can have a significant impact on some global commodity prices – with major implications for some emerging markets (EM) currencies, like the Chilean peso. Granted, concerns about the policy direction after the presidential elections helped to drive the peso down this year, but this happened against the backdrop of falling copper prices. The central bank tried to stay away from the FX market, but finally gave up yesterday, announcing a USD25B FX intervention program, making the Chilean peso the happiest EMFX on the block (up by 438bps against the U.S. dollar, according to Bloomberg LP, as of 9:40am ET). Every little bit helps, when dealing with persistent inflation pressures – including a stronger/stable currency. Stay tuned!

Chart at a Glance: China – Universal Slowdown, Lopsided Stimulus

Source: VanEck Research; Bloomberg LP

Related Insights

07 April 2025

06 March 2025

20 February 2025

16 January 2025

07 April 2025

Trump’s tariffs spark trade war fears, fueling market volatility, inflation risk, and recession threats. With global retaliation likely, near-term growth is clearly at risk.

06 March 2025

Trump’s tariffs, AI’s next phase, and a potential U.S. gold revaluation could shake markets—investors who stay ahead of these transitions will be best positioned.

20 February 2025

China's AI breakthrough, persistent inflation, gold’s outperformance, and rising energy demand underscore a shifting investment landscape.

16 January 2025

In 2025, navigating turbulence means balancing tech innovation, inflation hedges, energy shifts, and risks from spending cuts and inflation.

05 December 2024

"Trump Trade 2.0" fueled U.S. equity and digital asset rallies, while real assets faltered under a strong dollar, with global markets reacting unevenly to pro-growth policies.