U.S. Fed Boxed In… EMs Finally Free?

13 March 2023

Read Time 2 MIN

Fed Policy Rate Outlook

Bold moves from regulators might have saved the Silicon Valley Bank depositors, but the debacle caused some wild market moves, including expectations for the U.S. Federal Reserve’s (Fed’s) policy rate. Rate hikes have been almost completely priced out this morning, and the implied peak rate dropped well below 5%. The 2-year U.S. Treasury yield recorded one of the largest daily declines since 1983 – actually, the second largest at the time of the note – with many market participants questioning whether the current situation is in the same ballpark as the previous crises. On top of everything else, we have the next inflation print in the U.S. tomorrow. So, the outlook for the Fed’s next rate-setting meeting is interesting to say the least.

EMFX Performance

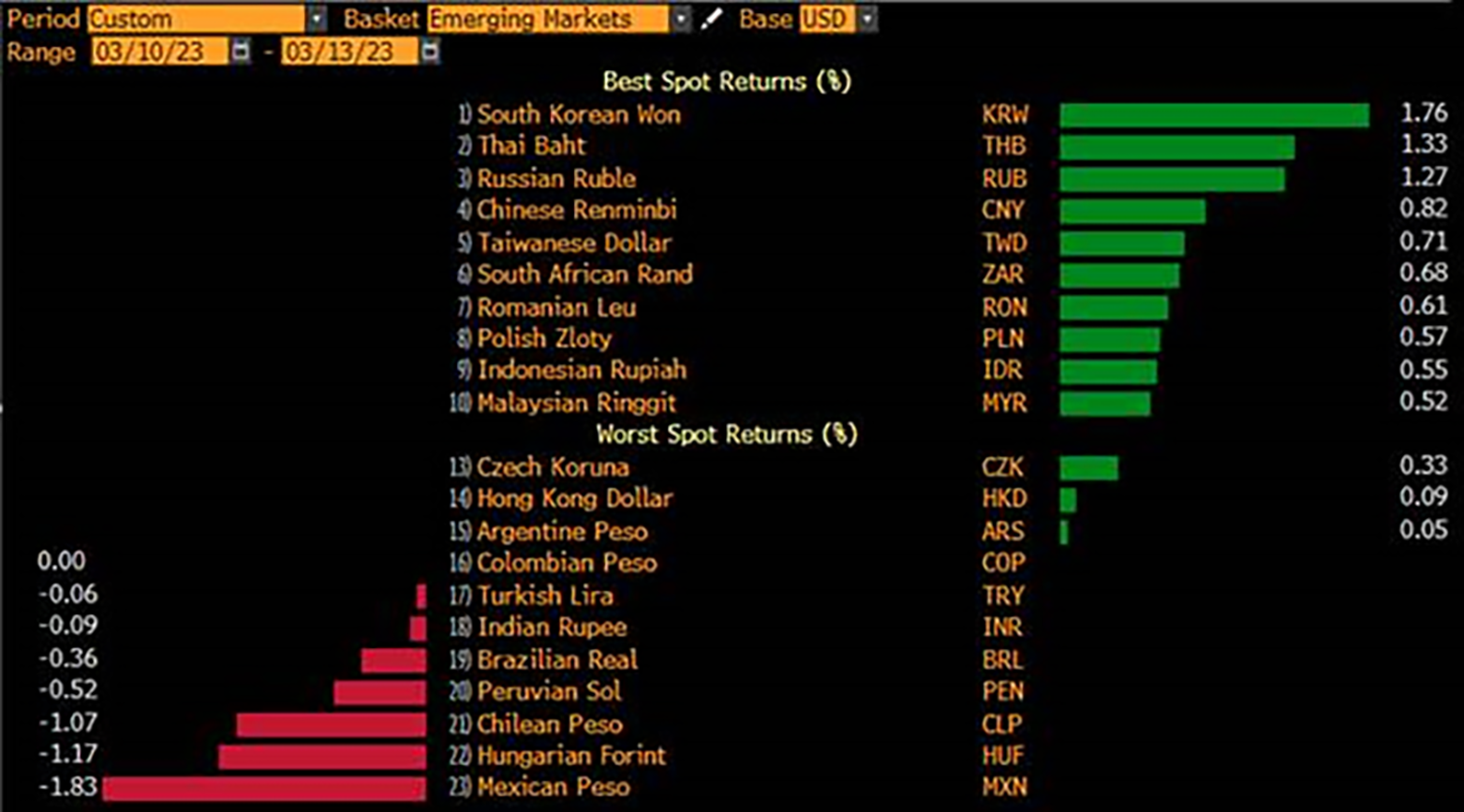

How are EMs doing in this environment? We are seeing a lot of red in various equity markets, but rates are rallying across the board. Many EM currencies are in the black as well (see chart below) – the Mexican peso being among few EM FX casualties so far this morning, most likely due to “nearshoring” concerns. We also noted that local swap curves continue to price in orderly and cautious rate cuts in several EMs – just as they did last week – showing no signs of panic. There are plenty of uncertainties going forward – including contagion fears – but EMs’ resilience (so far) has attracted attention.

EM Fundamental Strengths

Our long-standing arguments in favor of EM bonds are: (1) independent central banks (EM central banks moved much faster with aggressive rate hikes in the current cycle and now have very high real policy rates); (2) lower debt (hence, fewer concerns about fiscal dominance); and (3) benefits from China’s reopening (arguably, many EMs are now more correlated with China than the Fed). Many EMs learned the lessons of the past crises and strengthened their policy frameworks – both fiscal and monetary (the fact that the market would regularly punish them for policy transgressions definitely helped). It is easy to ignore these factors during “everything rallies” – but will this be the moment when EMs will finally come of age? Stay tuned!

Chart at a Glance: EM FX – Holding on Well, Despite Market Turbulence

Source: Bloomberg LP

Related Insights

07 April 2025

06 March 2025

20 February 2025

16 January 2025

07 April 2025

Trump’s tariffs spark trade war fears, fueling market volatility, inflation risk, and recession threats. With global retaliation likely, near-term growth is clearly at risk.

06 March 2025

Trump’s tariffs, AI’s next phase, and a potential U.S. gold revaluation could shake markets—investors who stay ahead of these transitions will be best positioned.

20 February 2025

China's AI breakthrough, persistent inflation, gold’s outperformance, and rising energy demand underscore a shifting investment landscape.

16 January 2025

In 2025, navigating turbulence means balancing tech innovation, inflation hedges, energy shifts, and risks from spending cuts and inflation.

05 December 2024

"Trump Trade 2.0" fueled U.S. equity and digital asset rallies, while real assets faltered under a strong dollar, with global markets reacting unevenly to pro-growth policies.