Central Banks vs. Noise

03 February 2023

Read Time 2 MIN

U.S. Federal Reserve Outlook

High-frequency economic indicators are usually quite noisy, but today’s surprisingly strong U.S. labor market report is also a reminder that tail risks exist and that they should not be underestimated (especially if the market is in the status quo mode). The asset price knee-jerk reaction notwithstanding, Fed Funds Futures looked through the upside surprise – the last time we checked, the implied Fed peak rate was still expected to be under 5%, with about 40bps of rate cuts priced in for the second half of the year.

Global Disinflation

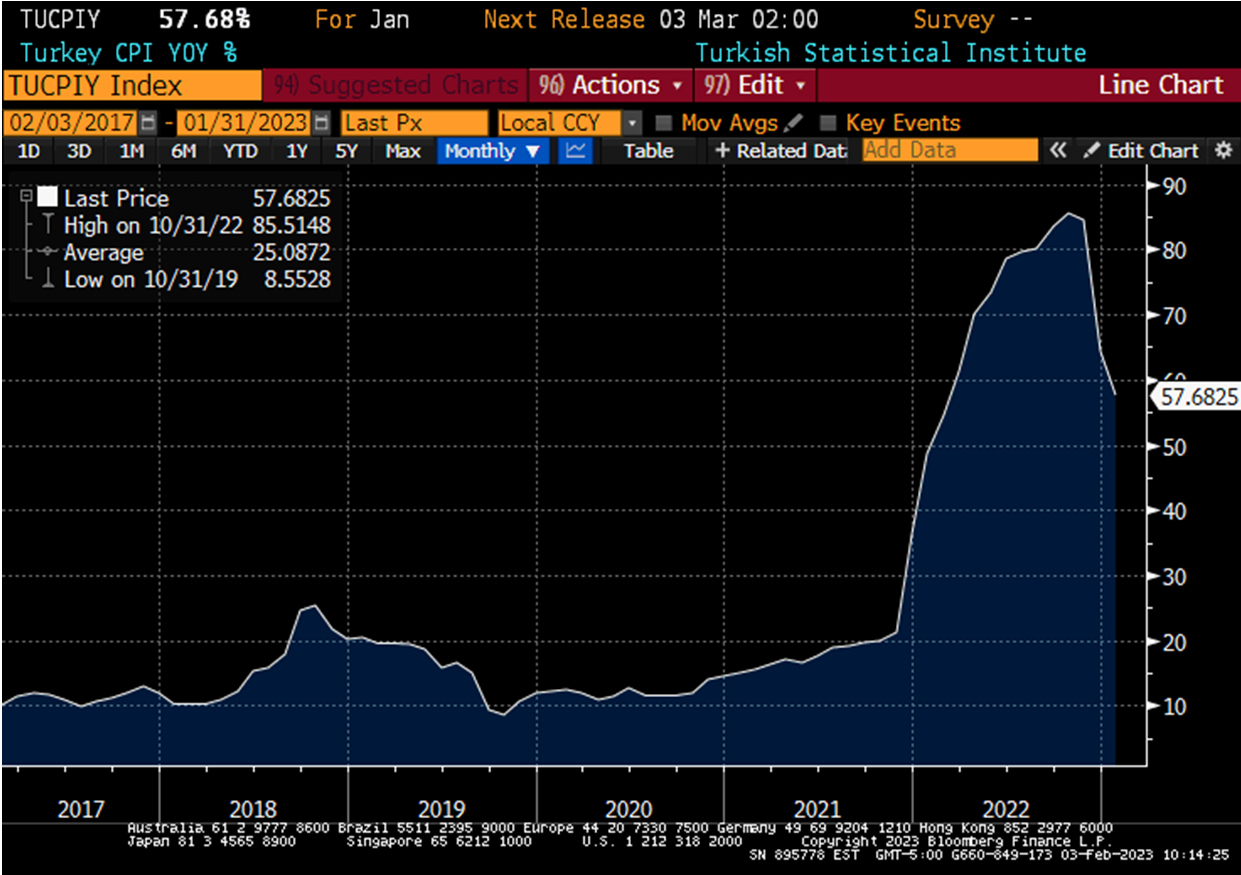

Emerging markets (EM) economic landscape is also full of noise, but some elements are less “frothy” – like China’s reopening or “the mother of all base effects” in global inflation. The latter will be a major driver behind this year’s disinflation, and Turkey is a great example that shows that effect in action. Turkey’s monthly sequential inflation jumped by 6.65% in January (it was an upside surprise, but annual inflation went down another leg (see chart below). We think that the high base effect will become more pronounced in Central Europe, helping to return headline inflation back to single digits later this year. The question is whether this would be enough to entice the regional central banks to cut rates. The latest policy signals were more hawkish than we expected – even in the Czech Republic, where the dovish overhaul of the national bank’s board raised concerns in the summer.

Brazil Rate Cuts

Another trend that – unfortunately – might last for a long time is Brazilian President Luiz Inácio Lula da Silva’s (Lula’s) obsession with the central bank’s independence (Mr. President elaborated on the topic once again in his interview yesterday). As far as the market is concerned, 90s band No Doubt may offer the best advice in their song "Don’t Speak" (“Don't speak; I know what you're thinkin'; I don't need your reasons; Don't tell me 'cause it hurts”). But a singalong is not a policy option for the Brazilian central bank. Such statements alter the available policy space, forcing the board to remain hawkish for longer, despite successful disinflation, sky-high real interest rates and the deteriorating growth outlook. Higher rates translate into larger fiscal outlays for debt service, slowing the fiscal adjustment, pushing the debt/GDP ratio up and scaring investors away. Stay tuned!

Chart at a Glance: Turkey Inflation – High Base Effect in Action

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.