Gold Takes Hold Amid Uncertainty

09 September 2019

Share with a Friend

All fields required where indicated (*)Uncertainties Abound as Gold Reaches Fresh Highs

Trade tensions have become trade wars and trade wars are threatening to become currency wars. Gold moved to a fresh six-year high of $1,555 per ounce on August 26 as markets reacted to retaliatory threats and actions between the U.S. and China. It looks as if the established superpower and the emerging superpower have begun an economic war for global supremacy. The uncertainty is creating a drag on commerce at a time in the cycle when it might do the most damage to the global economy. At the same time, central banks across the globe are cutting rates in an attempt to offset recessionary forces.

As a result, gold has been rising across all currencies as a hedge against economic uncertainty and fiat currency debasement. It has made record local currency highs in Australia, India, Europe (Euro), Japan and many other countries. Gold ended the month with a $106.40 (7.5%) gain at $1,520.30. Silver’s performance was stellar, with a $2.12 (13.0%) gain at $18.38. Gold stocks rose with the metals, as the NYSE Arca Gold Miners Index[1] advanced 11.7%, while the MVIS Global Junior Gold Miners Index[2] gained 8.4%.

Higher gold prices have not deterred central banks, as they continued buying in July. They are currently on a pace to exceed the 2018 volumes, which were the second strongest on record. Top buyers in 2019 are Russia, Poland, China, Turkey and India. Trade wars and sanctions are giving emerging countries added incentive to add more gold to their foreign exchange reserves.

Don’t Ignore the Warning Signs

The gold price is now consolidating above the $1,500 per ounce level in a similar fashion to the consolidation above $1,400 in July. Futures positioning and strong bullion ETF inflows suggest the market may be due for a pullback. However, given the strong price moves through technical levels since June and the evolving risks of Brexit, trade and economic weakness, the inevitable correction might not happen until gold is trading at substantially higher levels.

Chairman Powell’s comments from the Jackson Hole conference on 31 July characterized the U.S. Federal Reserve’s (“Fed”) July rate cut as precautionary, insurance against risks and a mid-cycle adjustment. These reassuring comments remind us of a prior Fed Chairman’s comments ahead of the global financial crisis when we were told that problems in subprime mortgages would stay contained. Market watchers should be concerned by the fact that:

- Since 1921 there have been 11 three-month/10-year treasury yield curve inversions that were followed by 11 recessions. And the 12th such inversion began in August.

- With the August U.S. ISM Purchasing Managers’ Index[3] falling to 49.1, the world is officially in a manufacturing recession.

- Not since the 1930s has the Fed ended a rate hiking cycle when the funds rate was just 2.5%.[4]

- In a typical easing cycle, the Fed cuts rates by 5% to 6%, suggesting the U.S. will eventually join Europe and Japan in setting rates below zero.

- Since the 2007 credit bubble high, global debt has increased by $128 trillion to $244 trillion, while global debt/GDP has increased from 98% to 187%. Cutting rates has little efficacy in a world that is already drowning in debt.[5]

- Globally, $17 trillion of bonds now trade at negative yields.[6]

We believe many aspects of the financial system are far from normal, and now that the record economic expansion looks to be on its last legs, these abnormalities may create extraordinary and unpredictable risks. Recent performance indicates that gold and gold stocks may help hedge a portfolio against these risks.

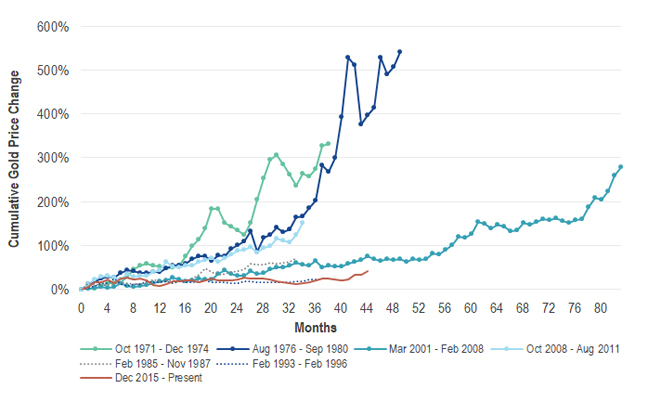

Tracing Historical Trends of Gold and Gold Stocks

A comparison with prior multi-year periods of rising gold prices (or “bull markets”, loosely defined) might lend some insights as to where this market is heading. The chart below compares several gold bull markets from the past half century, classified as either “secular” (long term) or “cyclical” (short term and occurring within an multi-year period of overall declining gold prices or a “bear market”). The gold price performance since 2015 had been tracking the same pattern as the 1993 – 1996 cyclical bull market. However, the price trend since June puts the current market on a trend that is becoming more like the secular bull market from 2001 to 2008 in our view.

Gold Performance in Historical Gold Bull Markets

Source: VanEck, Bloomberg. Data as of August 2019. “Gold” represented by Gold Spot ($/oz). Past performance is not indicative of future results.

One of the key drivers of the current gold market is falling real interest rates. With more Fed cuts expected this year, the duration of the current bull market is becoming similar to past secular bull markets. It remains to be seen whether performance will match the 2001 – 2008 market, when the key driver was U.S. dollar weakness.

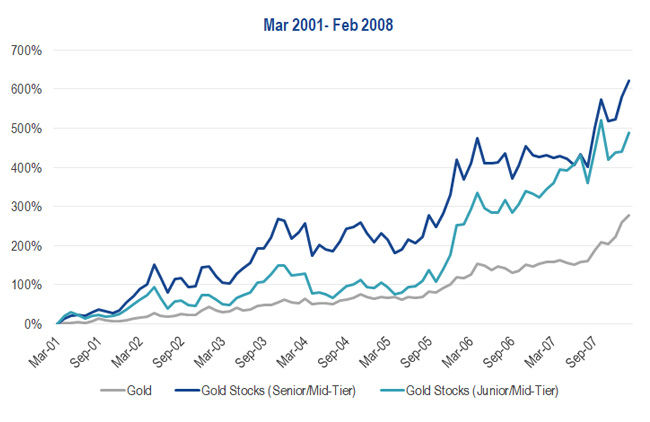

This chart plots the spectacular performance of gold stocks during the 2001 – 2008 bull market:

Gold vs. Gold Stocks in March 2001 to February 2008 Gold Bull Market

Source: VanEck, Bloomberg. Data as of August 2019. “Gold” represented by Gold Spot ($/oz). “Gold Stocks (Senior/Mid-Tier)” represented by NYSE Arca Gold Miners Index (GDMNTR). “Gold Stocks (Junior/Mid-Tier)” represented by MVIS Global Junior Gold Mining Index (MVGDXJTR). “Senior” miners are defined by production levels of approximately 1.5-6.0 million ounces of gold per year (“Mid-Tier” miners approximately 0.3-1.5 million ounces per year; “Junior” miners approximately <0.3 million ounces per year). Past performance is not indicative of future results. Indices are not securities in which an investment can be made. Index descriptions provided in disclosures below.

How This Gold Bull Market May be Different

There are many similarities between the gold industry today and that of 2001. 2001 marked the end of a secular bear market in which gold prices fell to $253 per ounce and investor sentiment towards the sector was extremely low. Likewise, 2019 marks the end of several years of stagnant range-bound trading that was preceded by one of the worse peak-to-trough bear markets on record. Sentiment and valuations are again extremely low, in our view.

In both cases, gold miners had endured many years of low gold prices. As a result, they became more efficient, reduced debt and streamlined management. We believe the companies are well managed and profitable. Cost pressure is minimal; therefore, there is no cost inflation to eat away at margins.

One significant difference between today’s companies and those in 2001 is a lack of hedging. The mark to market of many hedge books became hugely negative as the gold price rose in the 2000s. This cost companies billions. Today’s gold industry is essentially unhedged, which may give the current miners more leverage to rising gold prices than their earlier counterparts.

Regardless of whether gold equities reach the heights of past cycles, we believe there are now enough risks to financial well-being to be supportive of gold and gold stocks for a considerable period of time.

All company, sector, and sub-industry weightings as of 31 August 2019 unless otherwise noted.

[1] NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold.

[2] MVIS Global Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver.

[3] The ISM Manufacturing Index is an index based on surveys of more than 300 manufacturing firms by the Institute of Supply Management. The ISM Manufacturing Index monitors employment, production inventories, new orders and supplier deliveries.

[4] Gluskin Sheff, “Breakfast With Dave” (9 August 2019). Gluskin Sheff + Associates Inc., a Canadian independent wealth management firm, manages investment portfolios for high net worth investors, including entrepreneurs, professionals, family trusts, private charitable foundations, and estates.

[5] Gluskin Sheff, “Breakfast With Dave” (9 August 2019).

[6] VanEck, Bloomberg.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter