Mining ETF

VanEck Global Mining UCITS ETF

Mining ETF

VanEck Global Mining UCITS ETF

Fund Description

Invest in the transition to a zero-carbon economy through the VanEck Global Mining UCITS ETF. Demand from developing economies is rising just as the need from sustainable technologies such as wind turbines and solar cells is accelerating. Yet after years of restructuring supply appears tight. This ETF is a simple and effective way to invest in this powerful theme through a broad portfolio of mining companies.

-

NAV$32.36

as of 23 Apr 2024 -

YTD RETURNS-0.34%

as of 23 Apr 2024 -

Total Net Assets$733.8 million

as of 23 Apr 2024 -

Total Expense Ratio0.50%

-

Inception Date18 Apr 2018

-

SFDR ClassificationArticle 6

Overview

Fund Description

Invest in the transition to a zero-carbon economy through the VanEck Global Mining UCITS ETF. Demand from developing economies is rising just as the need from sustainable technologies such as wind turbines and solar cells is accelerating. Yet after years of restructuring supply appears tight. This ETF is a simple and effective way to invest in this powerful theme through a broad portfolio of mining companies.

- First and only European ETF currently to give global access to metals and mining stocks from developed and emerging markets

- Benefit from rising demand post-Covid-19 in developing economies

- Broadly diversified portfolio includes the most important raw material miners (incl. gold, silver, copper, nickel, zinc, lithium, iron ore)

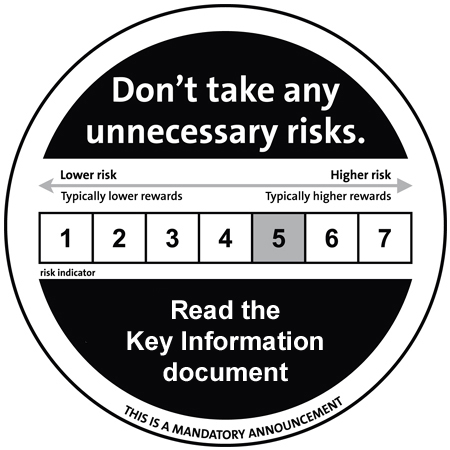

Risk Factors: Risk of investing in natural resources companies, emerging markets risk, risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

S&P Global Mining Reduced Coal Index

Fund Highlights

- First and only European ETF currently to give global access to metals and mining stocks from developed and emerging markets

- Benefit from rising demand post-Covid-19 in developing economies

- Broadly diversified portfolio includes the most important raw material miners (incl. gold, silver, copper, nickel, zinc, lithium, iron ore)

Risk Factors: Risk of investing in natural resources companies, emerging markets risk, risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

S&P Global Mining Reduced Coal Index