Real Estate ETF

VanEck Global Real Estate UCITS ETF

Real Estate ETF

VanEck Global Real Estate UCITS ETF

Fund Description

The VanEck Global Real Estate UCITS ETF invests in assets that stand the test of time – the world’s oldest store of value. Real estate is the cornerstone of many professional investment portfolios.

-

NAV€35.51

as of 24 Apr 2024 -

YTD RETURNS-3.12%

as of 24 Apr 2024 -

Total Net Assets€258.7 million

as of 24 Apr 2024 -

Total Expense Ratio0.25%

-

Inception Date14 Apr 2011

-

SFDR ClassificationArticle 8

Overview

Fund Description

The VanEck Global Real Estate UCITS ETF invests in assets that stand the test of time – the world’s oldest store of value. Real estate is the cornerstone of many professional investment portfolios.

- A single trade buys a real estate portfolio consisting of the global top 100 real estate stocks

- Diversified across multiple real estate sectors:

- Residentials

- Offices

- Industrials

- Hotels

- Healthcare

- Retail

- Regular income1

- Currently one of the lowest total expense ratios in real estate ETFs (0.25% p.a.)

- Excludes companies with poor ESG performance (as defined by the Global Real Estate Sustainability Benchmark)

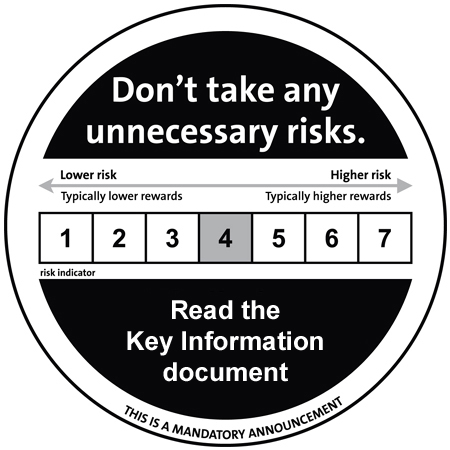

1Not guaranteed. Risk Factors: Foreign currency risk, equity market risk, industry or sector concentration risk, interest rate risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

GPR Global 100 Index (GPR100GI)

Fund Highlights

- A single trade buys a real estate portfolio consisting of the global top 100 real estate stocks

- Diversified across multiple real estate sectors:

- Residentials

- Offices

- Industrials

- Hotels

- Healthcare

- Retail

- Regular income1

- Currently one of the lowest total expense ratios in real estate ETFs (0.25% p.a.)

- Excludes companies with poor ESG performance (as defined by the Global Real Estate Sustainability Benchmark)

1Not guaranteed. Risk Factors: Foreign currency risk, equity market risk, industry or sector concentration risk, interest rate risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

GPR Global 100 Index (GPR100GI)