Emerging Markets vs. Developed: Where to Invest Now?

June 22, 2020

Read Time 4 MIN

Which offers more compelling opportunities for investors now: emerging markets or developed markets? As investors consider reallocating their portfolios heading into the second half of 2020, we share our views on this subject to help them navigate across asset classes and make informed investment decisions for the remainder of the year and beyond:

- Firstly, we expect growth to be the main driver of emerging markets equity returns in the near future. We believe quality growth companies with strong fundamentals and solid growth estimates will be at the front and center of a new decade of economic transformation. We are optimistic that continued fiscal and monetary support in emerging markets countries should help counter the overall economic impact of the unfortunate pandemic.

- Secondly, developed markets have become overcrowded and overvalued, whereas emerging markets have evolved and become much more exciting to follow and invest in today—for example, healthcare in China and digitization in India. Emerging markets companies are currently trading at a discount and are rather attractive from an investor’s total portfolio diversification perspective.

Emerging Markets Growth Is Leading the Future of Global Economies

Despite the uncertainty surrounding COVID-19, we believe emerging markets growth prospects are increasingly relevant to the global economy. As illustrated in the graph below, the emerging markets growth trend should pick up and outpace developed markets growth. According to the International Monetary Fund estimates dated April 2020, for the Emerging Markets and Developing Economies group, growth (as measured by real GDP) is expected to decrease to -1.0% in 2020 and increase to +6.6% in 2021. Advanced Economies growth is projected to plummet to -6.1% levels in 2020 and bounce back to +4.5% in 2021. To summarize, Global Economic growth is estimated to be negative -3.0% in 2020, primarily driven by Advanced Economies’ underperformance; and increase to +5.8% in 2021, as a result of Emerging Markets & Developing Economies driving that global growth effort forward. The estimated emerging markets growth trajectory, coupled with low inflation targets1 set by countries’ independent central banks, make emerging markets a compelling investment opportunity for global investors.

World Economic Outlook: Growth Projections

Source: IMF Staff Calculations. As of April 2020.

Herd Alert: Developed Markets Are Overcrowded and Overvalued

Over the last 10 years, global investors have been chasing the same assets: the safest government bonds, investment-grade corporate bonds, technology stocks and dollar-denominated assets.2 This trend in allocations has led developed markets, like the U.S., to become overvalued and overcrowded. A thoughtful allocation to emerging markets may help protect against such massive herding risk.

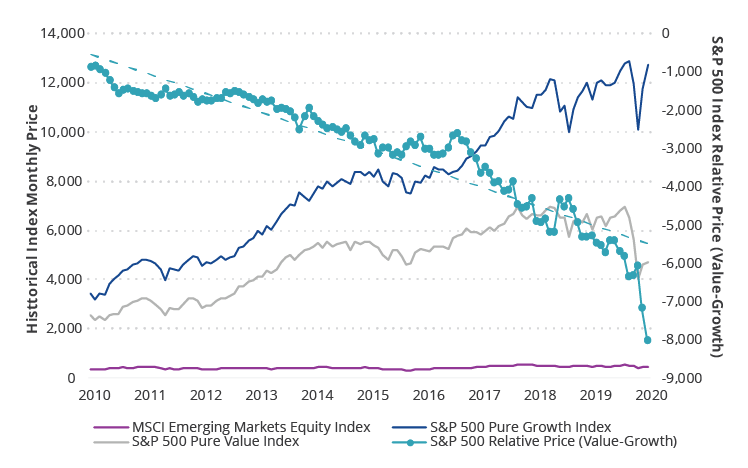

S&P 500 Index has been overvalued and overcrowded, with relative DM Value trending negatively over the last 10 years

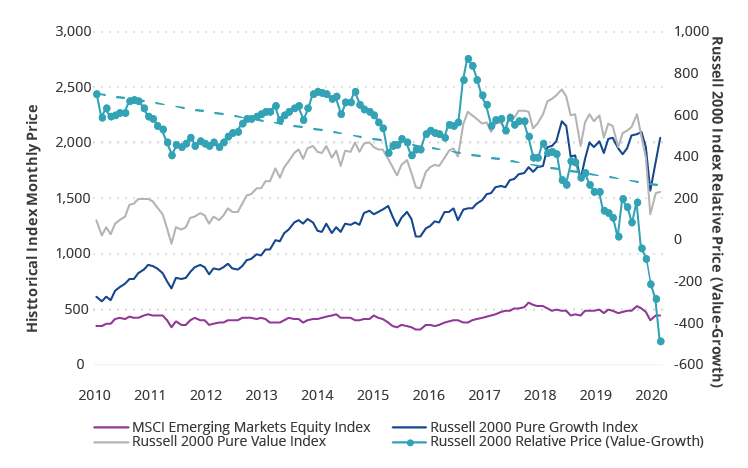

Russell 2000 Index has been overvalued and overcrowded as well, with DM Value trending downwards over the last 10 years

Source: Bloomberg. As of 5/31/2020.

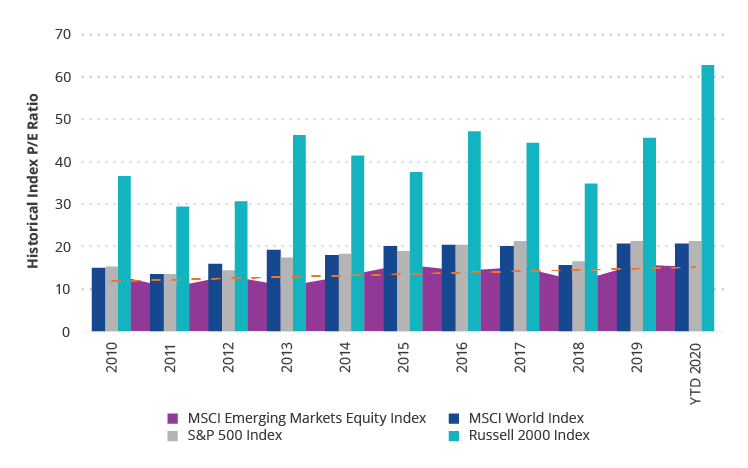

Attractive Emerging Markets Valuations vs. Developed Markets

Currently, emerging markets stocks are trading at a discount vs. developed markets, as outlined in the graph below. We are optimistic that our emerging markets portfolio company valuations will increase over time, as emerging markets are catching up with the developed world. Companies on the VanEck Emerging Markets Equity Strategy’s Focus List, for example, are reporting solid numbers and are relatively cheap versus historical estimates or current DM valuations for our estimated operating profitability growth. Their balance sheets are in good shape, generating strong cash flows over a three- to five-year time horizon.

Emerging Markets have been trading at a discount vs. Developed Markets

Source: Bloomberg. As of 5/31/2020.

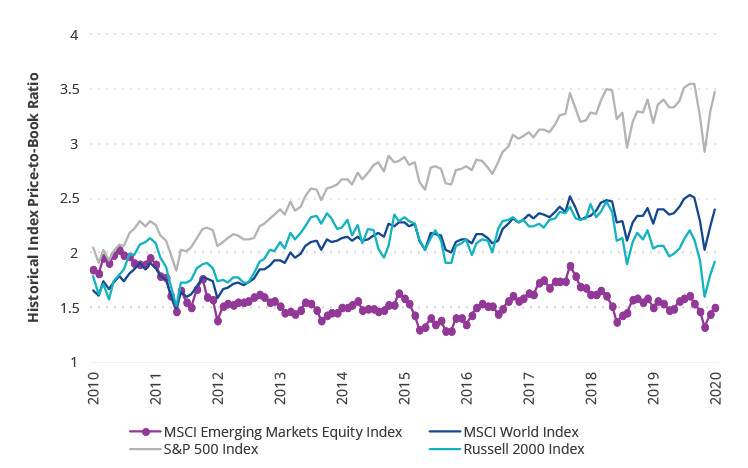

In terms of the price-to-book value, stocks in the MSCI Emerging Markets Equity Index have been trading at a major discount in comparison to those of developed markets, as highlighted in the graph below.

Emerging Markets have compelling valuations vs. Developed Markets

Source: Bloomberg. As of 5/31/2020.

Emerging Markets Equity: Growth vs. Value Investing

Within emerging markets, we believe that growth will continue to outpace value. This is partly driven by much of the value in emerging markets being represented by companies with highly cyclical (and economically dependent) earnings streams, combined with larger state ownership. We call this “value-for-a reason.” In addition, as many value strategies are predicated on some form of mean regression in their valuation methodologies, the accelerating disruption that we see across industries can make value investing quite challenging.

Avoid Herding: Take the Emerging Markets Equity Route

With the emphasis on growth as the driver of future emerging markets and global economies, coupled with attractive valuations and a compelling case for investors’ total portfolio diversification, the VanEck Emerging Markets Equity Strategy is well positioned to identify and invest in exceptional, structural growth companies that are front and center, and the potential future, of emerging markets and global economies!

Related Insights

April 19, 2024

April 19, 2024

April 18, 2024

February 29, 2024

DISCLOSURES

1 Based on the Economist article “Away from the Crowd” published on October 26, 2019, most of the 25 emerging market economies listed on the indicators page of the publication have inflation below 4%.

2 As cited in the Economist article “Away from the Crowd,” published on October 26, 2019.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Emerging Market securities are subject to greater risks than U.S. domestic investments. These additional risks may include exchange rate fluctuations and exchange controls; less publicly available information; more volatile or less liquid securities markets; and the possibility of arbitrary action by foreign governments, or political, economic or social instability.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets countries. The MSCI Emerging Markets Investable Market Index (IMI) is a free float adjusted market capitalization index that is designed to capture large-, mid- and small-cap representation across emerging markets countries.

The MSCI All Country World Index (ACWI) is a free float‐adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets (DM) and emerging markets.

The Standard & Poor's 500, often abbreviated as the S&P 500, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 index components and their weightings are determined by S&P Dow Jones Indices.

The S&P 500 Pure Growth Index includes only those components of the parent index that exhibit strong growth characteristics, and weights them by growth score.

The S&P 500 Pure Value Index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme.

The Russell 2000 Index is an index which measures the performance of the smallest 2,000 companies within the Russell 3000 Index.

The Russell 2000 Pure Growth Index includes only those components of the parent index that exhibit strong growth characteristics, and weights them by growth score.

The Russell 2000 Pure Value Index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURES

1 Based on the Economist article “Away from the Crowd” published on October 26, 2019, most of the 25 emerging market economies listed on the indicators page of the publication have inflation below 4%.

2 As cited in the Economist article “Away from the Crowd,” published on October 26, 2019.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Emerging Market securities are subject to greater risks than U.S. domestic investments. These additional risks may include exchange rate fluctuations and exchange controls; less publicly available information; more volatile or less liquid securities markets; and the possibility of arbitrary action by foreign governments, or political, economic or social instability.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets countries. The MSCI Emerging Markets Investable Market Index (IMI) is a free float adjusted market capitalization index that is designed to capture large-, mid- and small-cap representation across emerging markets countries.

The MSCI All Country World Index (ACWI) is a free float‐adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets (DM) and emerging markets.

The Standard & Poor's 500, often abbreviated as the S&P 500, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 index components and their weightings are determined by S&P Dow Jones Indices.

The S&P 500 Pure Growth Index includes only those components of the parent index that exhibit strong growth characteristics, and weights them by growth score.

The S&P 500 Pure Value Index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme.

The Russell 2000 Index is an index which measures the performance of the smallest 2,000 companies within the Russell 3000 Index.

The Russell 2000 Pure Growth Index includes only those components of the parent index that exhibit strong growth characteristics, and weights them by growth score.

The Russell 2000 Pure Value Index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.