Defense Against Complacency

June 16, 2020

Read Time 5 MIN

The VanEck Vectors® Real Asset Allocation ETF (RAAX®) uses a data-driven, rules-based process that leverages over 50 indicators (technical, macroeconomic and fundamental, commodity price, and sentiment) to allocate across 12 individual real asset segments in five broad real asset sectors. These objective indicators identify the segments with positive expected returns. Then, using correlation and volatility, an optimization process determines the weight to these segments with the goal of creating a portfolio with maximum diversification while reducing risk. The expanded PDF version of this commentary can be downloaded here.

Overview

The VanEck Vectors Real Asset Allocation ETF (RAAX) returned +0.61% versus +4.34% for the Bloomberg Commodity Index and +3.42% for its custom blended benchmark. The reason for RAAX’s recent underperformance is that the model remains convinced that we are in the midst of a bear market. RAAX, therefore, continues to seek shelter in an ultra-conservative portfolio of U.S. Treasury bills and gold bullion.

Historically, getting defensive based on falling asset prices, deteriorating economic activity and extreme near-term investor sentiment has been a successful recipe during bear markets. We do not think that has changed. So far, the remarkable Fed fueled market recovery has challenged conventional market thinking. Like always, we look to the past for information about the future. In previous bear markets, asset prices have not fallen in a linear fashion. Roads to market bottoms are typically bumpy. The biggest bumps come in the form of bear market rallies. And, so far, this has been one heck of a rally. The S&P 500 Index is now up over 35% since the low achieved on March 23!

| Average Annual Total Returns (%) as of May 31, 2020 | ||||

| 1 Mo† | YTD† | 1 Year | Life | |

| (04/09/18) | ||||

| RAAX (NAV) | 0.61 | -24.80 | -17.90 | -10.38 |

| RAAX (Share Price) | 0.73 | -24.80 | -18.00 | -10.40 |

| Bloomberg Commodity Index* | 4.34 | -21.20 | -17.06 | -12.84 |

| Blended Real Asset Index* | 3.42 | -19.88 | -12.11 | -6.86 |

| Average Annual Total Returns (%) as of March 31, 2020 | ||||

| 1 Mo† | YTD† | 1 Year | Life | |

| (04/09/18) | ||||

| RAAX (NAV) | -17.83 | -25.77 | -22.48 | -11.78 |

| RAAX (Share Price) | -17.54 | -25.58 | -22.37 | -11.67 |

| Bloomberg Commodity Index* | -12.81 | -23.29 | -22.31 | -14.66 |

| Blended Real Asset Index* | -17.20 | -27.74 | -24.01 | -12.10 |

The table presents past performance which is no guarantee of future results and which may be lower or higher than current performance. Returns reflect temporary contractual fee waivers and/or expense reimbursements. Had the ETF incurred all expenses and fees, investment returns would have been reduced. Investment returns and ETF share values will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. ETF returns assume that distributions have been reinvested in the Fund at “Net Asset Value” (NAV). NAV is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. VanEck Vectors ETF investors should not expect to buy or sell shares at NAV.

†Returns less than a year are not annualized.

Expenses: Gross 1.13%; Net 0.75%. Expenses are capped contractually at 0.55% through February 1, 2021. Expenses are based on estimated amounts for the current fiscal year. Cap exclude certain expenses, such as interest, acquired fund fees and expenses, and trading expenses.

The model is cautioning against complacency. Yes, we are experiencing a monster of a rally. But we also just experienced a monster of a crash. Without trying to be an alarmist, the other crash that resembles what we experienced in March is the Great Depression. At the beginning of the Great Depression, the S&P 500 Index lost 44.34% in two-months and then rebounded by 45.83% in the following five-months. Investors then, just like now, experienced a huge boost in confidence. As we all know, the worst was yet to come and the maximum drawdown during the Great Depression exceeded 85% from peak-to-trough.

We are not suggesting that prices will fall nearly as much as they did during the Great Depression. That event taught hard lessons on the risks of failing to adequately support the markets and economy when it is needed most. The “Fed put” has given investors much needed confidence. But government support does not mean that prices cannot correct and, with all of the damage that has been done, our model anticipates near-term challenges.

A Deeper Dive

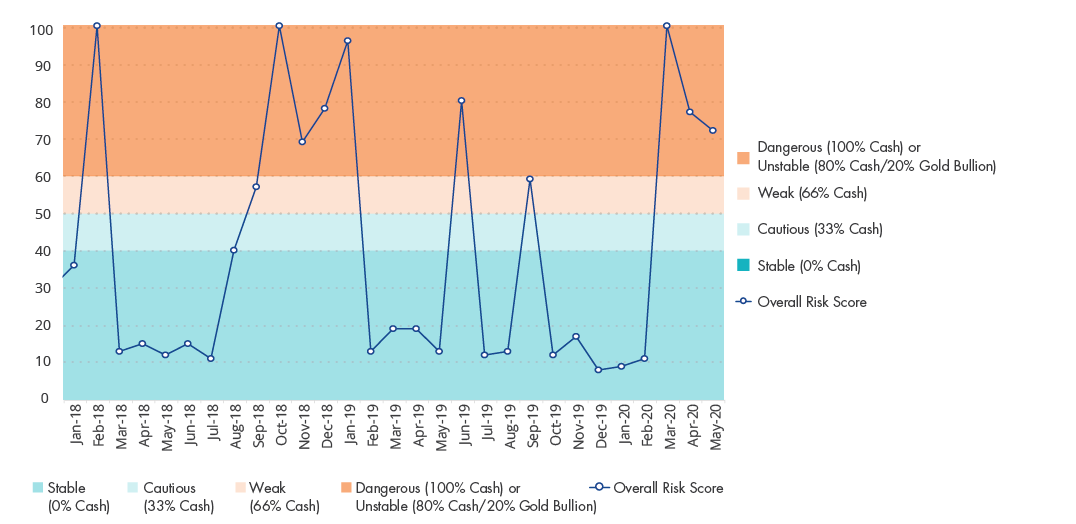

Below is the overall real asset composite. A score of 0 represents the lowest risk level and a score of 100 represents the highest risk level. A score of 60 or higher will result in our most defensive posture. The current score of 72 indicates an unstable risk regime for real assets.

Overall Risk Score

The risk score can be decomposed into key factors that drive real asset prices. These include price trends, economic activity, realized volatility and investor sentiment.

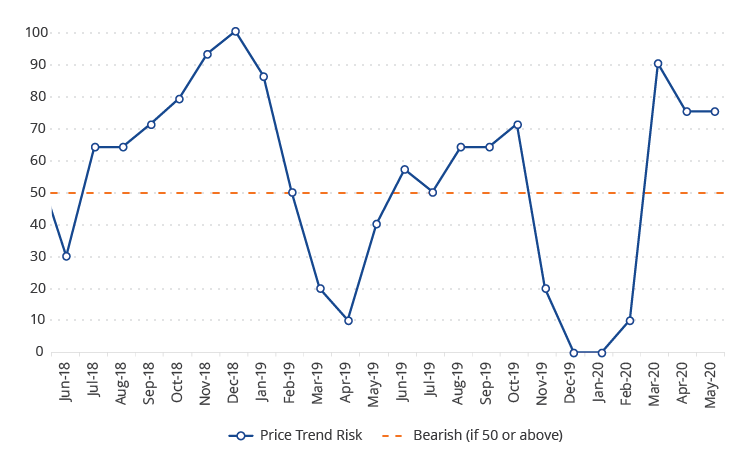

Price trends are bearish on each real asset with the exception of gold bullion, gold equities and low carbon energy.

Price Trend Risk Score

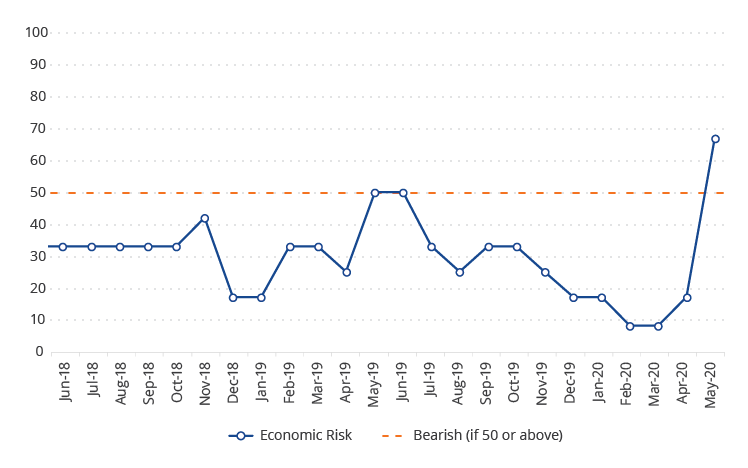

The economic composite turned bearish as the supply and demand dynamics for real assets have been disrupted by the COVID-19 pandemic.

Economic Risk Score

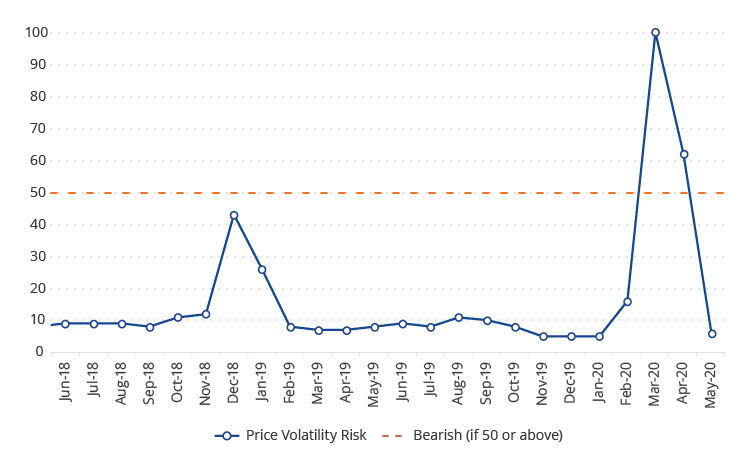

Volatility has declined significantly as the U.S. Federal Reserve acted swiftly and decisively to calm markets.

Price Volatility Risk Score

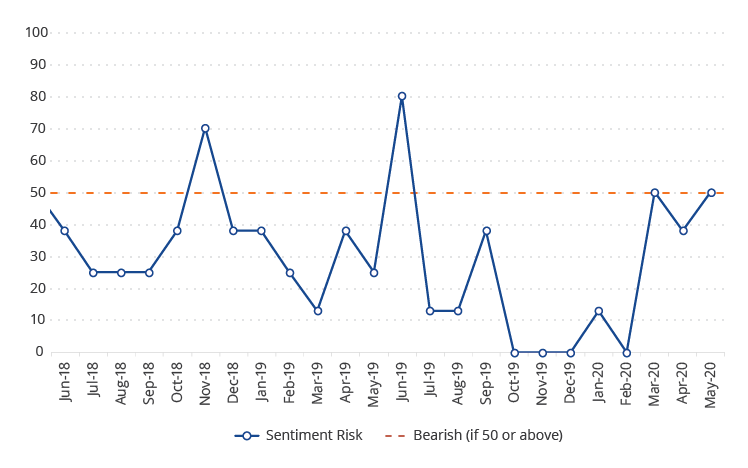

Investor sentiment within commodities is at a near-term extreme, indicating that prices are more vulnerable to a correction.

Investor Sentiment Risk Score

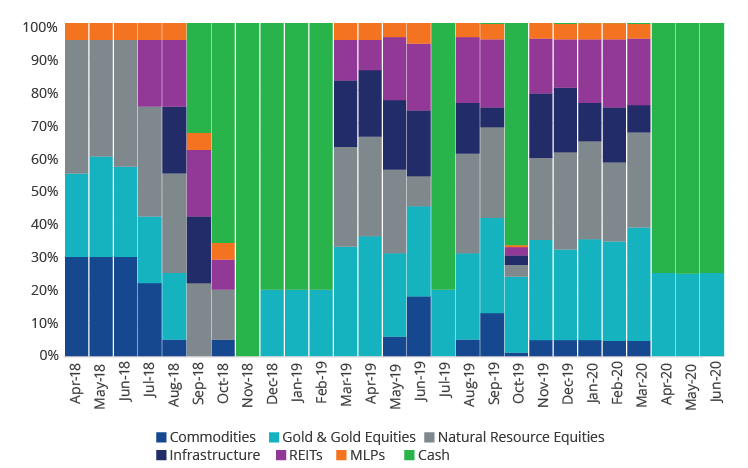

June will mark the third month that RAAX has remained defensively positioned. It will continue to measure the risks within the real asset markets and, if conditions materially improve, look for an opportunity to re-invest. Alternatively, if the risk remains high, it will remain defensive.

Real Asset Sector Allocations Since Inception

Real Asset Class Allocations

| Jun-20 | May-20 | Change from Previous Month |

||

| Cash | 74.7% | 75.2% | -0.5% | Decrease |

| Gold Bullion | 25.3% | 24.8% | 0.5% | Increase |

| Global Metals & Mining Equities | 0.0% | 0.0% | 0.0% | No Change |

| Unconventional Oil & Gas Equities | 0.0% | 0.0% | 0.0% | No Change |

| Steel Equities | 0.0% | 0.0% | 0.0% | No Change |

| Oil Services Equities | 0.0% | 0.0% | 0.0% | No Change |

| Energy Equities | 0.0% | 0.0% | 0.0% | No Change |

| Agribusiness Equities | 0.0% | 0.0% | 0.0% | No Change |

| Coal Equities | 0.0% | 0.0% | 0.0% | No Change |

| Low Carbon Energy Equities | 0.0% | 0.0% | 0.0% | No Change |

| MLPs | 0.0% | 0.0% | 0.0% | No Change |

| Diversified Commodities | 0.0% | 0.0% | 0.0% | No Change |

| Global Infrastructure | 0.0% | 0.0% | 0.0% | No Change |

| Gold Equities | 0.0% | 0.0% | 0.0% | No Change |

| REITs | 0.0% | 0.0% | 0.0% | No Change |

Related Insights

February 28, 2024

February 22, 2024

December 19, 2023

DISCLOSURES

Please note that the information herein represents the opinion of the author, but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

*The Blended Real Assets Index consists of an equally weighted blend of the returns of Bloomberg Commodity Index, S&P Real Assets Equity Index, and VanEck® Natural Resources Index. Equal weightings are reset monthly. The S&P Real Assets Equity Index measures the performance of equity real return strategies that invest in listed global property, infrastructure, natural resources, and timber and forestry companies. The VanEck Natural Resources Index is a rules-based index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the production and distribution of commodities and commodity-related products and services. Sector weights are set annually based on estimates of global natural resources consumption, and stock weights within sectors are based on market capitalization, float-adjusted and modified to conform to various asset diversification requirements. The S&P 500® Index (S&P 500) consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial and transportation).

The S&P Real Assets Equity Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The Solactive MLP & Energy Infrastructure Index tracks the performance of MLPs and energy infrastructure corporations. The MVIS U.S. Listed Oil Services 25 Index is intended to track the overall performance of U.S.-listed companies involved in oil services to the upstream oil sector, which include oil equipment, oil services, or oil drilling. The Dow Jones Equity All REIT Index, designed to measure all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index composed of publicly traded companies involved primarily in the mining for gold. The Index is calculated and maintained by the New York Stock Exchange. The S&P® North American Natural Resources Sector Index: a modified capitalization-weighted index which includes companies involved in the following categories: extractive industries, energy companies, owners and operators of timber tracts, forestry services, producers of pulp and paper, and owners of plantations. The S&P® GSCI Total Return Index is a world production-weighted commodity index comprised of liquid, exchange-traded futures contracts and is often used as a benchmark for world commodity prices.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

An investment in the Fund may be subject to risks which include, among others, in fund of funds risk which may subject the Fund to investing in commodities, gold, natural resources companies, MLPs, real estate sector, infrastructure, equities securities, small- and medium-capitalization companies, foreign securities, emerging market issuers, foreign currency, credit, high yield securities, interest rate, call and concentration risks, all of which may adversely affect the Fund. The Fund may also be subject to affiliated fund, U.S. Treasury Bills, subsidiary investment, commodity regulatory (with respect to investments in the Subsidiary), tax (with respect to investments in the Subsidiary), liquidity, gap, cash transactions, high portfolio turnover, model and data, management, operational, authorized participant concentration, no guarantee of active trading market, trading issues, market, fund shares trading, premium/discount and liquidity of fund shares, non-diversified and ETPs risks. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. Small- and medium-capitalization companies may be subject to elevated risks.

Diversification does not assure a profit or protect against a loss.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

©2020 VanEck.

Related Funds

DISCLOSURES

Please note that the information herein represents the opinion of the author, but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

*The Blended Real Assets Index consists of an equally weighted blend of the returns of Bloomberg Commodity Index, S&P Real Assets Equity Index, and VanEck® Natural Resources Index. Equal weightings are reset monthly. The S&P Real Assets Equity Index measures the performance of equity real return strategies that invest in listed global property, infrastructure, natural resources, and timber and forestry companies. The VanEck Natural Resources Index is a rules-based index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the production and distribution of commodities and commodity-related products and services. Sector weights are set annually based on estimates of global natural resources consumption, and stock weights within sectors are based on market capitalization, float-adjusted and modified to conform to various asset diversification requirements. The S&P 500® Index (S&P 500) consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial and transportation).

The S&P Real Assets Equity Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The Solactive MLP & Energy Infrastructure Index tracks the performance of MLPs and energy infrastructure corporations. The MVIS U.S. Listed Oil Services 25 Index is intended to track the overall performance of U.S.-listed companies involved in oil services to the upstream oil sector, which include oil equipment, oil services, or oil drilling. The Dow Jones Equity All REIT Index, designed to measure all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index composed of publicly traded companies involved primarily in the mining for gold. The Index is calculated and maintained by the New York Stock Exchange. The S&P® North American Natural Resources Sector Index: a modified capitalization-weighted index which includes companies involved in the following categories: extractive industries, energy companies, owners and operators of timber tracts, forestry services, producers of pulp and paper, and owners of plantations. The S&P® GSCI Total Return Index is a world production-weighted commodity index comprised of liquid, exchange-traded futures contracts and is often used as a benchmark for world commodity prices.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

An investment in the Fund may be subject to risks which include, among others, in fund of funds risk which may subject the Fund to investing in commodities, gold, natural resources companies, MLPs, real estate sector, infrastructure, equities securities, small- and medium-capitalization companies, foreign securities, emerging market issuers, foreign currency, credit, high yield securities, interest rate, call and concentration risks, all of which may adversely affect the Fund. The Fund may also be subject to affiliated fund, U.S. Treasury Bills, subsidiary investment, commodity regulatory (with respect to investments in the Subsidiary), tax (with respect to investments in the Subsidiary), liquidity, gap, cash transactions, high portfolio turnover, model and data, management, operational, authorized participant concentration, no guarantee of active trading market, trading issues, market, fund shares trading, premium/discount and liquidity of fund shares, non-diversified and ETPs risks. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. Small- and medium-capitalization companies may be subject to elevated risks.

Diversification does not assure a profit or protect against a loss.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

©2020 VanEck.