Opportunities in Retail Stocks as Consumers Stock Up?

April 16, 2020

Read Time 2 MIN

Many retail stores have closed amid the current COVID-19 induced economic shutdown. As analysts raise concerns about bankruptcies and supply shocks, the thought of gaining an exposure to retail in a portfolio may seem counter-intuitive. However, some segments of this market are seeing soaring demand.

According to Moody’s research, their analysts expect that "consumers will continue to front-load purchases of food and other consumables for weeks to come as they ride out the pandemic. This will increase sales volume and also boost profits because consumers are less price sensitive when the need for essentials is so strong."1

Some large retailers that are focused on e-commerce, groceries or other essential products have been experiencing unprecedented sales volumes as the rush to stock up on household essentials continues. In the two weeks ending March 22, 2020, U.S. grocery sales are up 83% from the same period last year.2 At a time when many other industries are seeing large-scale layoffs, these retailers are on a hiring spree to help address the rise in demand. Amazon has hired 80,000 workers over the course of a few weeks as part of its plan to add 100,000 to its workforce3, while Walmart plans to expand its employee base by 10%.4

Accessing the Investment Opportunity

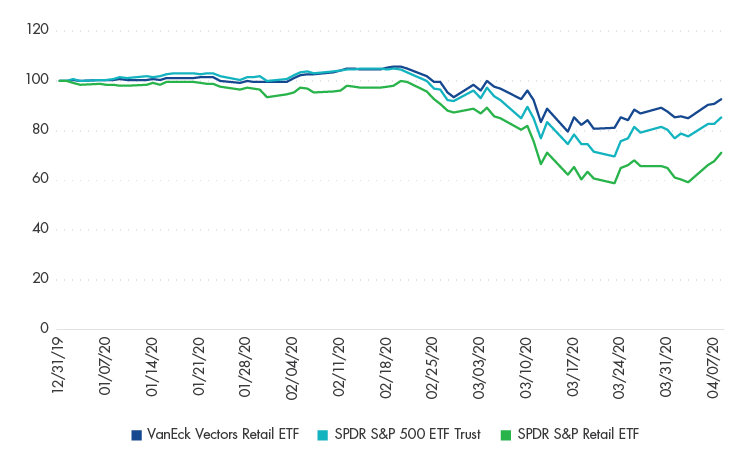

The VanEck Vectors® Retail ETF (RTH®) offers exposure to companies involved in retail, including distribution, wholesalers, online retailers and retailers of food and other staples. Amazon, Costco, Walmart and CVS are among its largest holdings. Year-to-date as of April 6, 2020, RTH was significantly outperforming the S&P 500, at -9.4% vs -17.2%, respectively.

YTD Total Return (Indexed to 100)

Source: FactSet. Data as of 4/8/2020. Past performance is not a guarantee of future results.

| Average Annual Total Returns (%): Month end as of March 31, 2020† | ||||

| 1 Mo† | YTD† | 1 Yr | Life | |

| (12/20/11) | ||||

| RTH (NAV) | -6.17 | -12.29 | 1.50 | 14.87 |

| RTH (Share Price) | -6.43 | -12.34 | 1.40 | 15.00 |

| MVRTHTR (Index) | -6.23 | -12.35 | 1.35 | 14.69 |

| Average Annual Total Returns (%): Quarter end as of March 31, 2020† | ||||

| 1 Mo† | YTD† | 1 Yr | Life | |

| (12/20/11) | ||||

| RTH (NAV) | -6.17 | -12.29 | 1.50 | 14.87 |

| RTH (Share Price) | -6.43 | -12.34 | 1.40 | 15.00 |

| MVRTHTR (Index) | -6.23 | -12.35 | 1.35 | 14.69 |

The table presents past performance which is no guarantee of future results and which may be lower or higher than current performance. Returns reflect temporary contractual fee waivers and/or expense reim¬bursements. Had the ETF incurred all expenses and fees, investment re¬turns would have been reduced. Investment returns and ETF share values will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. ETF returns assume that distributions have been reinvested in the Fund at “Net Asset Value” (NAV). NAV is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. VanEck Vectors ETF investors should not expect to buy or sell shares at NAV.

†Returns less than a year are not annualized.

Expenses: Gross 0.47%; Net 0.35%. Expenses for RTH are capped contractually at 0.35% until February 1, 2021. Cap excludes acquired fund fees and expenses, interest expense, trading expenses, taxes and extraordinary expenses.

Related Insights

April 10, 2024

March 25, 2024

March 01, 2024

February 16, 2024

January 31, 2024

DISCLOSURE

1Source: https://www.investors.com/news/walgreens-earnings-q2-2020-wba-stock/

2, 4Source: https://www.barrons.com/articles/buy-these-grocery-stocks-they-were-good-bets-before-coronavirusand-still-are-51585850916

3Source: https://www.wsj.com/amp/articles/amazon-has-hired-80-000-workers-out-of-100-000-plan-announced-weeks-ago-11585840027

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

S&P 500® Index: consists of 500 widely held common stocks covering the leading industries of the U.S. economy.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright© 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in a fund. An index's performance is not illustrative of a fund's performance. Indices are not securities in which investments can be made.

An investment in the VanEck Vectors®Retail ETF (RTH®) may be subject to risks which include, among others, investing in retail companies, equity securities, consumer discretionary, consumer staples sector, depositary receipts, issuer-specific changes, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Funds carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read it carefully before investing.

Related Funds

DISCLOSURE

1Source: https://www.investors.com/news/walgreens-earnings-q2-2020-wba-stock/

2, 4Source: https://www.barrons.com/articles/buy-these-grocery-stocks-they-were-good-bets-before-coronavirusand-still-are-51585850916

3Source: https://www.wsj.com/amp/articles/amazon-has-hired-80-000-workers-out-of-100-000-plan-announced-weeks-ago-11585840027

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

S&P 500® Index: consists of 500 widely held common stocks covering the leading industries of the U.S. economy.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright© 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in a fund. An index's performance is not illustrative of a fund's performance. Indices are not securities in which investments can be made.

An investment in the VanEck Vectors®Retail ETF (RTH®) may be subject to risks which include, among others, investing in retail companies, equity securities, consumer discretionary, consumer staples sector, depositary receipts, issuer-specific changes, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Funds carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read it carefully before investing.