EM Policy Rates – Steady Now!

09 March 2023

Read Time 2 MIN

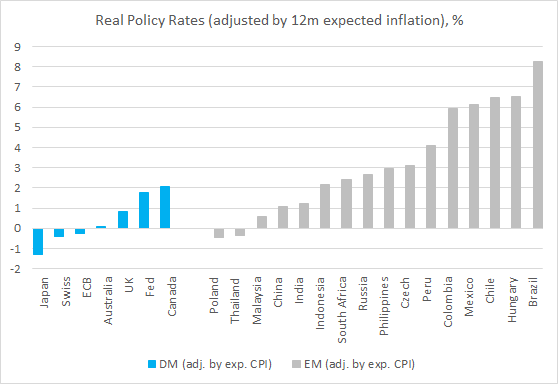

EM Central Banks On Hold

It could have been the shortest emerging markets (EM) daily blog ever. Why are various EM central banks increasingly staying on hold, despite the rising peak rate expectations for the U.S. Federal Reserve and the ECB? Just check the chart below. The End. But, of course, we are not that laconic, so let’s have a closer look. A big takeaway from today’s chart is that EM’s aggressive and timely policy response created an impressive policy cushion – a fundamental “positive” for EM FX, including carry trades (especially against the backdrop of the improving growth outlook). So, even though the U.S. Dollar is up so far this year, several major EM currencies are up (a lot) against the U.S. Dollar. And this creates room for differentiation in the EM space.

EM Disinflation Progress

EM’s disinflation progress is the main driving force here. The high-frequency dataflow can be “jumpy”, but this week’s releases pointed in the right direction – including today’s downside inflation surprise in Mexico. The best part of the release – from the central bank’s point of view in particular – was further moderation in core inflation. The bi-weekly core inflation print looked especially encouraging, easing from 8.38% year-on-year to 8.21%. We don’t think that the Mexican central bank is done hiking yet, but a pause is definitely within reach now. Since we are talking about EM disinflation, we ought to mention China’s surprisingly weak February prints (1% year-on-year vs. 1.9% expected). Even though it might be tempting to interpret them solely as a sign of weak domestic demand, there were several factors – such as seasonality and pork prices (3.8% year-on-year vs. nearly 52% back in October) – that could have led to February’s distortions.

EM External Balances

What else can influence EM’s doves? Well, fiscal consolidation is key, especially in big index names like Brazil. As you can see on the chart below, Brazil’s room for rate cuts is massive in theory – and could increase further if tomorrow’s inflation print meets expectations – but the market needs reassurance about the government’s spending plans and tax reform. We’ll also keep an eye on external balances, as wider current account gaps can increase pressure on FX (and hence on inflation). South Africa’s current account deficit widened more than expected in Q4 (2.6% of GDP), and even though the size is not critical yet, further deterioration might require more action on the central bank’s part. Stay tuned!

Chart at a Glance: EM High Real Rates Create Room For Eventual Rate Cuts

Source: VanEck Research; Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.