Hopes for Hawks?

06 February 2023

Read Time 2 MIN

Fed Policy Expectations

Following the red-hot labor market report, the U.S. relative economic outperformance story is back in the limelight, challenging the rally in U.S. rates and a weaker dollar. The discrepancy between the report and the U.S. Federal Reserve’s “agnostic” guidance at its last meeting is a reason why this week’s Fed speak will be watched closer than usual. January is a tough month for the labor market assessment, due to various adjustments and seasonality (=a lot of noise), but Fed Funds Futures are now back to pricing in two 25bps rate hikes this year (and a smaller Q4 rate cut), leading to some profit taking in emerging markets (EM).

EM Disinflation

A more hawkish Fed might still be a more important headwind for Euro or JPY, while less of a driver for EM, because various EM central banks sound quite cautious and not in a rush to rate cuts. Reason #1 is that EM inflation expectations are still high and require hawkish “nudging” in order to bring them closer to targets. Besides, the process of disinflation can be very bumpy – especially in the beginning of the year, when many governments adjust regulated tariffs and make methodological changes. For example, Czech headline inflation is expected to jump by 5.8% month-on-month in January, temporarily reversing annual disinflation. Mexico’s core and headline inflation are also expected to edge up in January, paving the way for a 25bps rate hike later this week. Brazil’s disinflation appears to be stalling as well, justifying the decidedly hawkish message from the central bank (which apparently upset President Lula and his administration).

Global Growth Outlook

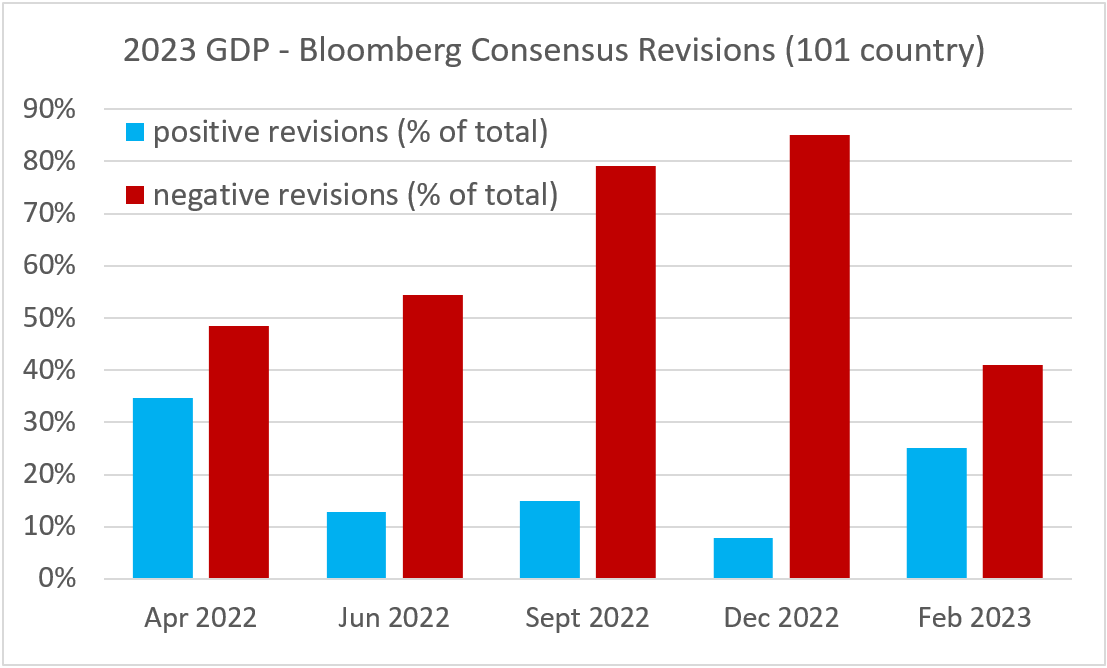

Reason #2 is that the EM growth outlook might not be as dire as was expected a few months ago. China’s rebound is well underway, helping to lift the EM composite PMI (Purchasing Managers Index) further into expansion zone, and the Bloomberg consensus growth survey (we have 101 countries in our sample) shows more upgrades/fewer downgrades, compared to December (see chart below). Arguably, the China rebound factor might be more important than the more hawkish Fed in parts of EM with tighter financial and economic ties to China. So, the U.S. data is a possible headwind to global asset prices, but EM has strong tailwinds that are only beginning. Stay tuned!

Chart at a Glance: Global Growth – Fewer Clouds on the Horizon

Source: VanEck Research; Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.