Inflation Concerns – A Recurring Nightmare?

02 March 2023

Read Time 2 MIN

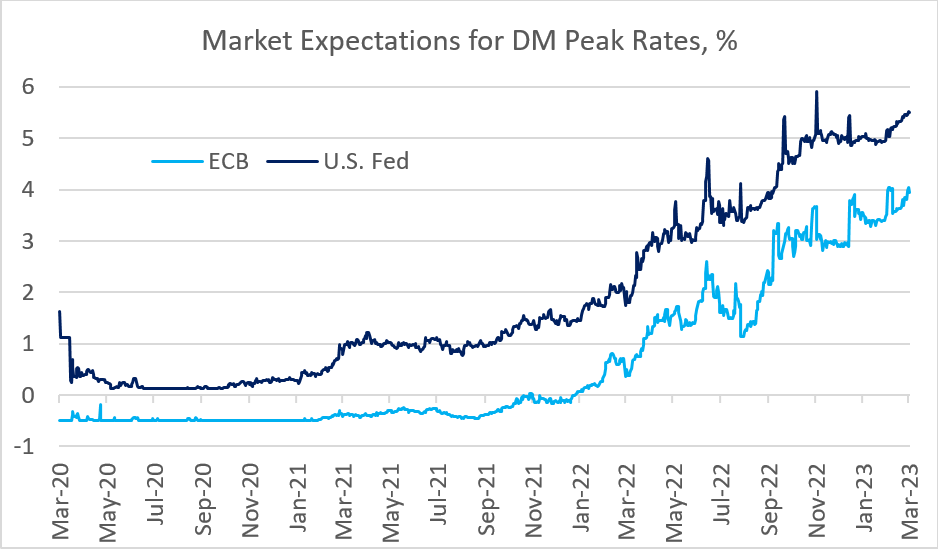

DM Peak Rate Expectations

Developed markets (DM) inflation worries are back, and this means that global rates are under pressure yet again, while the market expectations for DM peak rates are re-testing the past highs (see chart below). This week, an upside inflation surprise in the Eurozone (especially in core prices) was probably the most “visible” indicator. Still, a big jump in the “prices paid” component of February’s ISM manufacturing survey and today’s very unfortunate combo of lower Q4 productivity growth and higher unit labor costs added to concerns about the inflation outlook for the U.S... Tomorrow’s “prices paid” sub-index in the ISM survey for services is likely to attract some extra attention as well.

Inflation Surprises

The inflation surprise index for DMs changed direction recently and started to move higher – much more than a similar index for emerging Ms. Does it mean that EMs are better positioned to escape the inflation “curse”? As you know, we try to look through high-frequency data noise, but we have to admit that the question about potentially diverging longer-term inflation trajectories in EM and DM started to pop up in our discussions more frequently. China aside, EMs’ demographic situation is more favorable than in DM, which means fewer labor supply constraints and the rising middle class (with a greater pool of savings, including pension funds).

EM Inflation Outlook

Another point is that emerging economies, on average, have lower debt/GDP ratios, and EM governments are aware that the market and rating agencies will notice a lack of fiscal discipline. Arguably, this reduces the need for fiscal dominance (which, by the way, tends to produce undesirable side effects), allowing policy rates to do their job properly. Finally, new technologies would require significant future investments both in EM and DM, but many EMs – especially “EM Graduates” – skipped some technological states and have the newer infrastructure (=potentially a better “fit” between the pool of savings and the need for capital). We know that EMs already pay higher real rates, but aren’t recent developments mean further support for EM going forward, not less? Stay tuned!

Chart at a Glance: DM Peak Rate Expectations – Re-Testing the Highs

Source: VanEck Research; Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.