Politics, Growth, Prices – Surprises Abound

24 October 2022

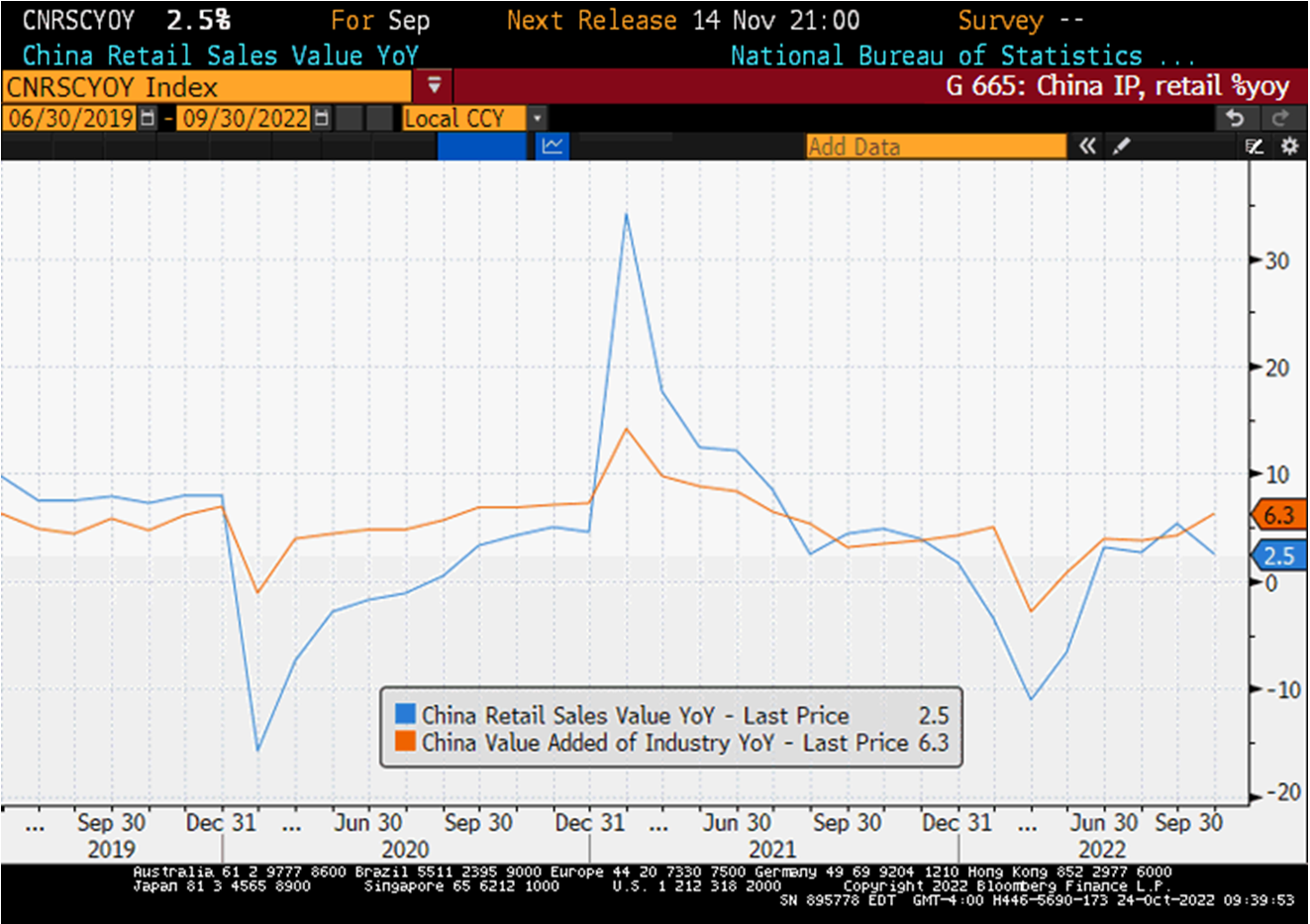

China Political Landscape, Growth

The market completely ignored China’s stronger than expected Q3 GDP print – and for a good reason. Higher-frequency domestic activity indicators were very mixed, while major changes in China’s leadership team (including the economic block) raised questions about the policy direction, as well as about political checks and balances. The next stops are (1) the Central Economic Work Conference in December, and (2) the annual meeting of the National People’s Congress and the National Committee of the Chinese People’s Political Consultative Conference (so-called “Two Sessions”) in March 2023. China’s stronger than expected but uneven GDP rebound (3.9% year-on-year in Q3) provides an interesting - and challenging - backdrop for the Central Conference, which is expected to assess progress towards annual economic targets. Above-consensus infrastructure and industrial production (see chart below) are able to lift the headline growth number, but soft consumption (retail sales), housing, and exports point to persistent headwinds, which might require more policy support.

Mexico Price Pressures

China’s surprises were not the only ones that caught the market’s attention this morning. Mexico’s bi-weekly headline inflation was lower than expected, showing tentative signs of peaking. However, core inflation continued to power ahead (8.39% year-on-year), surprisingly meaningful to the upside, and – in our opinion – making a 75bps rate hike in early November a done deal. The market sees a slower pace of tightening after the November hike (around 75bps through Q1-2023) – a reasonable expectation, given that Mexico’s real policy rate is already positive, based both on headline and expected inflation (a rarity these days).

Brazil Elections Outlook

Investors are also wondering whether there might be an election surprise in Brazil next weekend. Even though the challenger (ex-President Luiz Inácio Lula da Silva) is leading in the polls, the gap between Lula and the incumbent (President Jair Bolsonaro) continues to narrow. The runoff will have major implications for Brazil’s policy agenda, which is why economic releases – such as a wider than expected current account deficit and larger than expected foreign direct investments - are taking a back seat. Brazil’s currency and local debt outperformed most EM peers so far this year, so there is a lot to lose in the case of a policy U-turn. Stay tuned!

Chart at a Glance: China – Consumption Still Struggling

Source: Bloomberg LP

Related Insights

07 April 2025

06 March 2025

20 February 2025

10 February 2026

Debasement is back in focus. Here’s what’s driving it, what could reverse it and how we’re positioning portfolios for both scenarios.

07 April 2025

Trump’s tariffs spark trade war fears, fueling market volatility, inflation risk, and recession threats. With global retaliation likely, near-term growth is clearly at risk.

06 March 2025

Trump’s tariffs, AI’s next phase, and a potential U.S. gold revaluation could shake markets—investors who stay ahead of these transitions will be best positioned.

20 February 2025

China's AI breakthrough, persistent inflation, gold’s outperformance, and rising energy demand underscore a shifting investment landscape.

16 January 2025

In 2025, navigating turbulence means balancing tech innovation, inflation hedges, energy shifts, and risks from spending cuts and inflation.