Disinflation – Causes, Surprises, Prospects

10 November 2022

Read Time 2 MIN

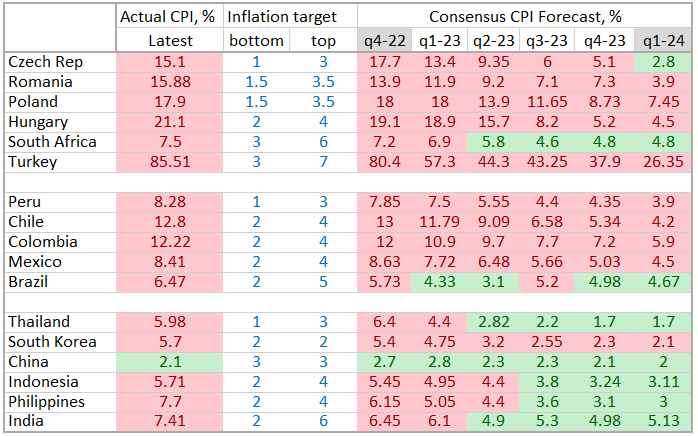

Downside Inflation Surprises

Wow, what a morning! A sizable downside inflation surprise in the U.S. (including core prices), a sharp disinflation move in the Czech Republic, a nervous breakdown in Brazil’s currency and rates (despite on-going disinflation) and “stingy” credit aggregates in China – and we still have the whole day in front of us. Today’s releases confirmed that disinflation is getting more entrenched in parts of both emerging and developed markets (EM and DM) – a fact definitely appreciated by the market. The speed of disinflation, however, will matter more and more going forward. A larger than expected drop in Czech headline inflation (from 18% to 15.1% year-on-year) suggests that prices might indeed return to the target range sooner than in the rest of the region (see chart below), reassuring the market and the central bank that it is safe to remain on hold. Brazil’s prices continued to moderate (to 6%-handle1), but not as fast as expected, and this upside surprise might have been the “last drop” for the market, which is getting wary of the “chimerical” post-election transition team and President-elect spending plans.

China Growth, Stimulus

China’s domestic inflation pressures remain very low – and today’s surprisingly weak credit aggregates explain why: there is a lack of stimulus and a lack of demand. In all fairness, the October moderation was partly seasonal, and authorities did approve numerous measures to prop up growth (especially on the supply side), but the impact will remain muted while the COVID restrictions stay in place (there is a lot of buzz about potential changes, but nothing concrete yet). Mortgage lending suffered a major setback in October – a sizable sequential decline, and a reminder of near-term growth headwinds (real estate and construction account for a significant chunk of gross domestic product).

Global Policy Rate Outlook

Now, what do all these surprises mean for the policy outlook(s)? The dovish pivot narrative got a boost in the U.S., with the Fed Funds Futures now showing a zero probability of a 75bps hike in the December. The Czech swap curve now prices in about 50bps of cuts in the next 12 months, and today’s inflation surprise can encourage Central European neighbors – specifically Poland - to hold on for a bit longer before disinflation (hopefully) kicks in. Mexico and Peru will announce their policy rate decisions in the afternoon – nascent disinflation leaves room for slower rate hikes. And how about EM’s disinflation trailblazer, Brazil? It looks like concerns about the policy direction started to “contaminate” market expectations. The local swap curve now sees only 85-90bps of cuts in the next year – down form 185-200bps just days ago, and compared to ~500bps of cuts priced in for Chile. Stay tuned!

Chart at a Glance: EM Inflation Targets – Progressing At Different Speeds

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.