Policy Reaction to Mixed Data Signals

02 December 2022

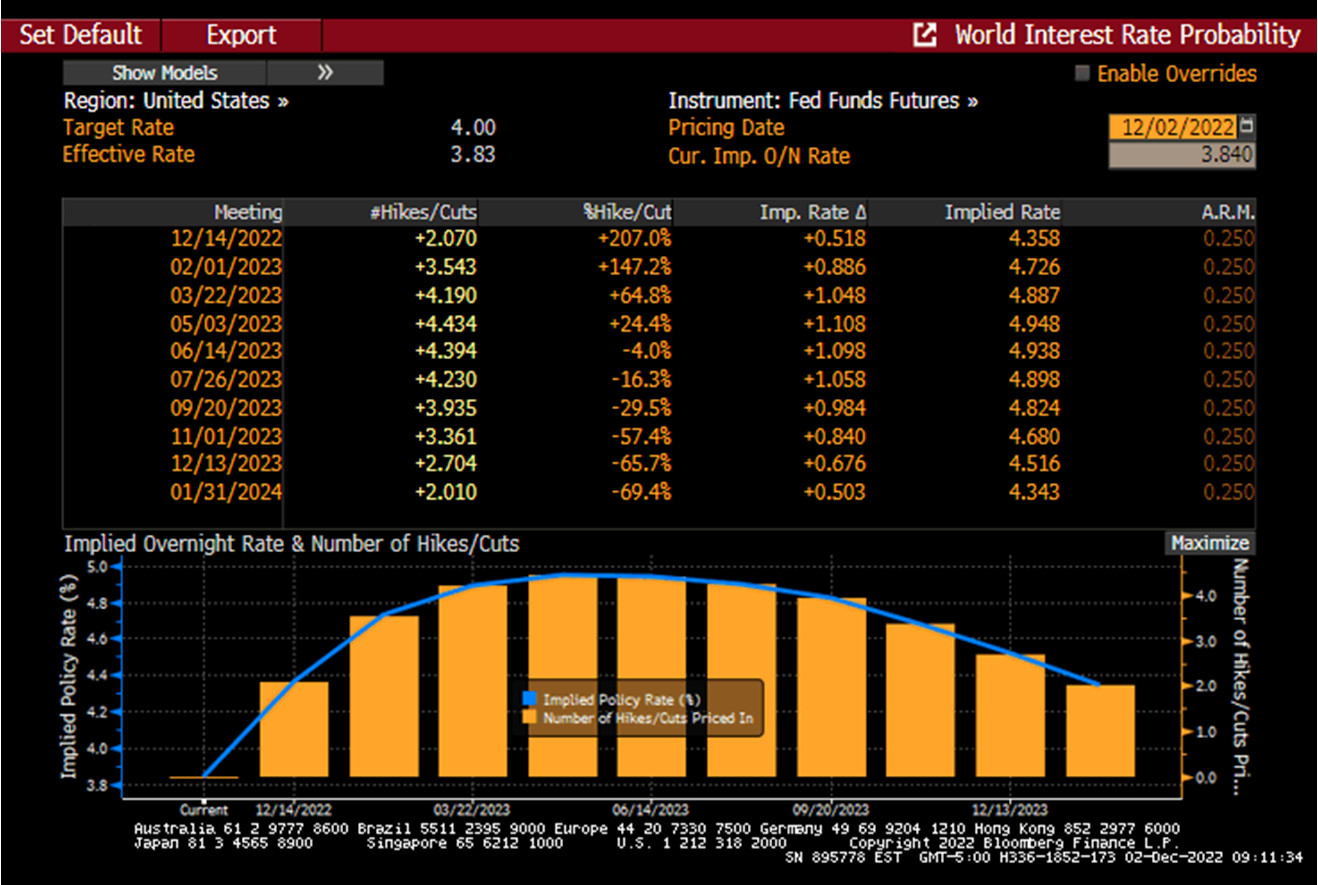

The Pace of Fed Hikes

The global data flow does not challenge the slowdown narrative, but it also shows that the momentum is very uneven – today’s strong labor market report in the U.S. could not have looked more different from this week’s ISM survey, which sent a much weaker signal. Both releases are, however, consistent with the market view that the U.S. Federal Reserve (Fed) can and should continue raising its policy rate, but at a slower pace (see chart below). At the same time, upside surprises like the strong labor market report raise a question mark as to whether the Fed would indeed have room for around 40bps of rate cuts in H2-2023.

EM Disinflation

The data flow in emerging markets (EM) is also not uniform – especially on the inflation front. The overall trend in EM inflation surprises is down, but it does not mean that we do not get an occasional above-consensus print, like in Peru. Peruvian headline inflation unexpectedly accelerated to 8.45% year-on-year in November, interrupting the nascent disinflation trend and signaling that the underlying price pressures may prove more persistent than previously thought. The year-to-date total return on Peru’s local debt (J.P. Morgan’s GBI-EM Peru U.S. Dollar Unhedged Index1) is still positive, but future performance will depend on the central bank’s ability to navigate the situation credibly (and this includes the expected 25bps rate hike next week). South Korea’s inflation print was the opposite of Peru – a nice downside surprise, which can allow the central bank to pause going forward.

EM Growth Slowdown

As regards upside growth surprises, some (if not most) of them require additional context. For example, Chile’s economic activity was stronger than expected in October, but it was still contracting at an accelerated pace (-1.2% year-on-year). In the same vein, today’s upside surprise in the Czech Republic’s Q3 GDP masked another sequential decline (-0.2% quarter-on-quarter), which might get worse going forward judging by the super-weak November PMI (41.6). There is no question that the central bank will stick to its “on hold” stance under these circumstances. Finally, Brazil’s industrial production growth also beat consensus in October, but the new administration’s policy agenda could have an impact (and not necessarily positive) on the business sentiment – a worrying prospect against the backdrop of a sharp decline in Brazil’s manufacturing PMI (to 44.3). Stay tuned!

Chart at a Glance: Market Sticks to Its Policy Rate Expectations for the Fed

Source: Bloomberg LP

1J.P. Morgan GBI-EM Peru U.S. Dollar Unhedged Index is the Peru subset of the GBI-EM Index, defined below.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.