Opportunity in Elevated EM High Yield Corporate Bond Spreads?

29 May 2020

Read Time 2 MIN

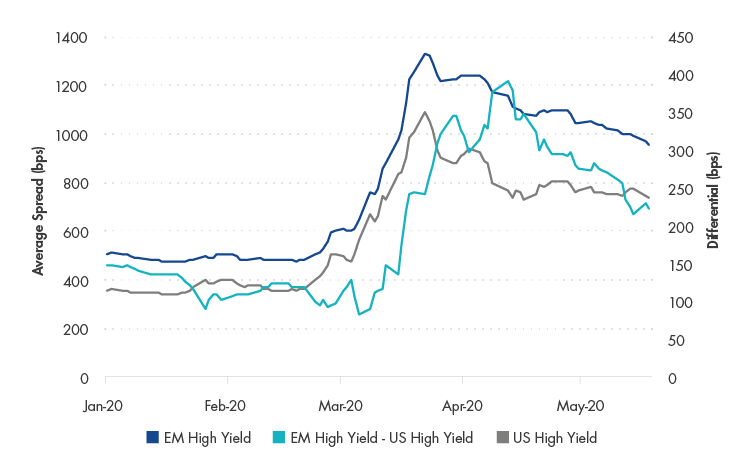

Emerging markets corporate high yield bond spreads continue to stand out following the selloff experienced in March and April. While U.S. high yield bond spreads remain elevated, they are tighter compared to the widest levels reached in late March. In addition to the magnitude of the spreads, which continue to hover around 1,000 basis points, the yield pickup versus U.S. high yield corporate bonds remains historically wide. Since 2004 this differential has averaged 108 basis points, but was 224 basis points as of May 19, 2020, nearly two standard deviations away from this long-term average.

Emerging Markets High Yield Corporate Bond Spreads Remain Elevated

Source: ICE Data Indices as of 5/19/2020. EM High Yield is represented by ICE BofA Diversified High Yield US Emerging Markets Corporate Plus Index, U.S. High Yield is represented by ICE BofA US High Yield Index

Several sectors expected by many to be most impacted by negative global growth are exhibiting distress, including Energy, Basic Industry (particularly Metals & Mining), Retail and Transportation. However, we believe emerging markets energy issuers have held up better than U.S. issuers overall due to the greater presence of quasi-sovereigns. Elevated spreads, however, are not confined to these most impacted sectors, and as shown below, these sectors do not have significantly greater weights within emerging markets compared to the U.S. market, indicating a general re-pricing of risk within emerging markets rather than sector-led weakness.

| Weight (%) | ||

| EM High Yield | U.S. High Yield | |

| Automotive | 0.37 | 5.15 |

| Basic Industry | 13.59 | 9.65 |

| Energy | 13.17 | 12.38 |

| Leisure | 2.53 | 4.81 |

| Retail | 0.71 | 4.45 |

| Transportation | 3.62 | 1.09 |

Source: ICE Data Indices as of 5/19/2020. EM High Yield is represented by ICE BofA Diversified High Yield US Emerging Markets Corporate Plus Index, U.S. High Yield is represented by ICE BofA US High Yield Index

Are these levels attractive? Clearly the market is pricing in a substantial amount of risk at these levels, including a significantly higher probability of defaults. Whether these spreads are adequate compensation will depend on the ultimate impact of the pandemic and the speed at which global growth will recover.

It is worth noting that emerging markets corporates went into this downturn with what we believe are relatively stronger fundamentals compared to U.S. counterparts, including lower levels of leverage and higher coverage ratios to service debt. Further, we expect to see more “fallen angels”—which are high yield bonds that were originally issued with investment grade ratings but subsequently downgraded—emerge. For example, Pemex1, with over $40 billion of index-eligible debt, entered the emerging markets high yield benchmark at the maximum weight of 3% at the end of April (but did not enter U.S. high yield benchmarks due to index eligibility rules). With both corporate and sovereign downgrades likely, we anticipate that more fallen angels will follow. Given the historical propensity of these bonds to sell-off prior to downgrade, enter the index at deep discounts and subsequently recover in value, these fallen angels may provide some tailwinds to the asset class.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.