EM Rate Cuts - Past, Present, Future

11 January 2023

Read Time 2 MIN

EM Disinflation

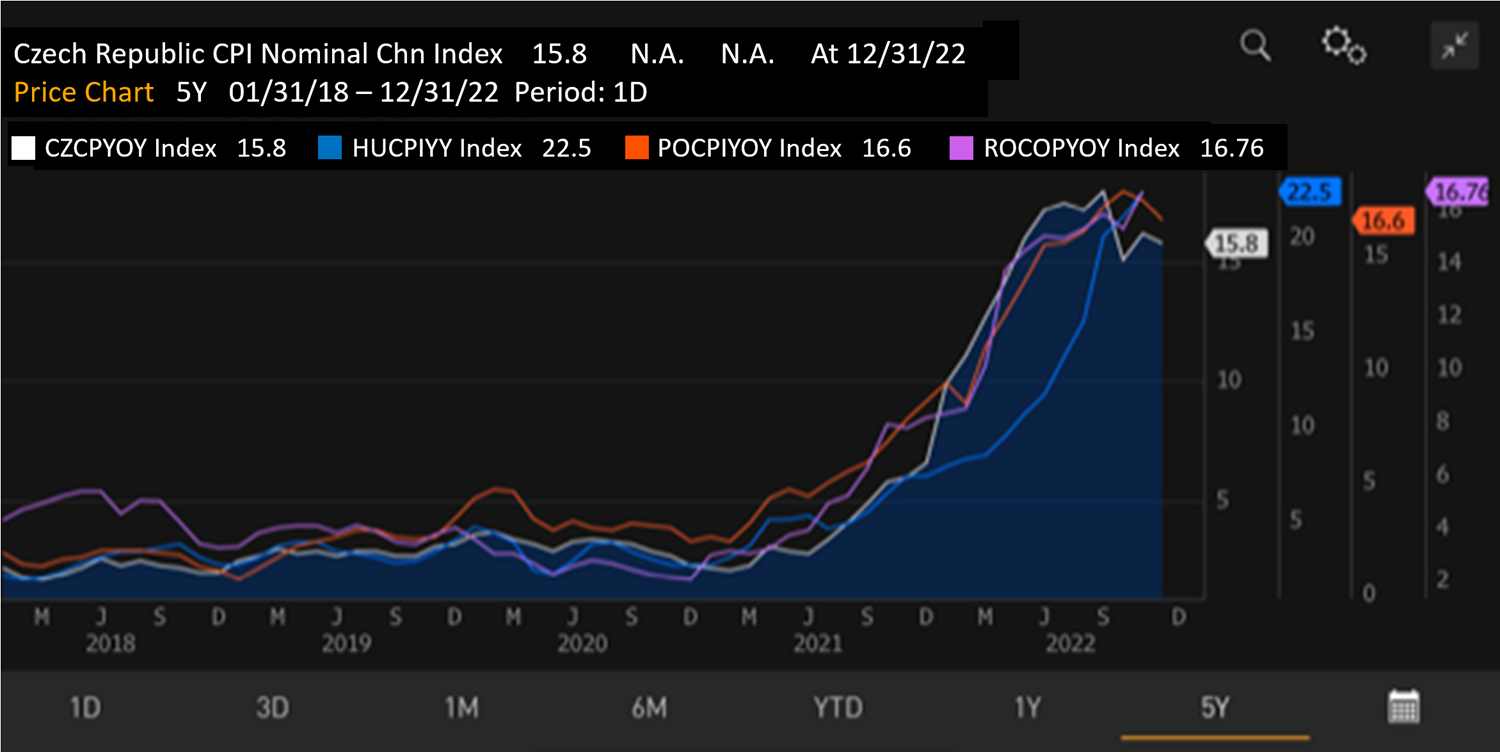

The pace of emerging markets (EM) disinflation is very uneven, with trailblazers and laggards in every region. The Czech Republic leads the way in Central Europe – and today’s sizable downside inflation surprise confirmed this status (see chart below). Czech headline inflation eased to 15.8% year-on-year in December, and it is now expected to moderate to 6.5% by the end of the year. We think this should pave the way for policy rate cuts this year, as the Czech economy is expected to slip into recession and might require additional support (the real policy rate adjusted by expected inflation is currently positive = restrictive).

EM Macro Imbalances

Czech Republic would not be the first major EM to cut in the current cycle – Turkey has already lowered the policy rate from 19% to 9%, trying to boost growth prospects in the run up to the elections. Such dramatic policy easing took place against the backdrop of rapidly accelerating inflation, raising numerous concerns about economic imbalances, including the current account deficit. The current account gap showed signs of improvement in 2022 on the back of lower energy prices and more tourist arrivals, however, core exports are stagnating despite the lira devaluation and stronger domestic credit growth. Gold imports are also quite high due to persistent inflation pressures. A sharp widening of the current account deficit in November is a reminder that rate cuts are not a panacea as long as the overall policy framework remains inadequate.

EM Rate Cuts

A couple of LATAM central banks are also on investors’ monetary policy radars. The inflation and growth outlooks in Chile look very similar to the Czech Republic (a combo of disinflation and expected recession). This fact and a significant reduction in political noise after the constitutional referendum support market expectations of sizable rate cuts in the coming months. Brazil’s very high real rates also create space for rate cuts. And today’s softer than expected retail sales – as well as weaker domestic activity gauges (now in contraction zone) – point to significant growth slowdown in 2023. However, the central bank’s ability to use this space will be determined by the government’s policy agenda – and this in turn might depend on whether President Luiz Inácio Lula da Silva’s (Lula’s) political standing will improve after the weekend’s riots. Stay tuned!

Chart at a Glance: Czech Disinflation - Central European Leader

Source: Bloomberg LP.

CZCPYOY Index: Czech Consumer Price Index YOY.

HUCPIYY Index: Hungary Consumer Price Index YOY.

POCPIYOY Index: Poland Consumer Price Index YOY.

ROCOPYOY Index: Romania Consumer Price Index YOY.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.