FT, EM FX, and A Pinch of Salt

15 February 2023

Read Time 2 MIN

EM FX Devaluations

An FT article caught our attention this morning – but it’s not the one about the sustainability of Japan’s central bank government bond purchases and potential changes in the yield curve control mechanism (YCC) under the new governor (albeit this might have very serious implications for global Fixed Income, especially Investment Grade instruments with their super-tight spreads). “Our” article talks about “a spate” and “a further slew” of emerging markets (EM) FX devaluations caused by the strong U.S. Dollar. We are not sure how well this characterizes EM, especially in light of strong performance of many EM currencies last year or a dramatic repricing lower of Asian interest rates. Further, letting currencies go while accelerating structural reforms and engaging multilateral financial support is probably the best thing that can happen to developing economies from the longer-term perspective. This is the lesson learned by their predecessors – many of whom are now “EM Graduates” - in the wake of the 1997/98 global financial crisis. Egypt is not doing this – yet - and therefore still strikes us as vulnerable to such episodes - it’s really a “classic” setup including the part about learning the hard way.

EM Structural Adjustment

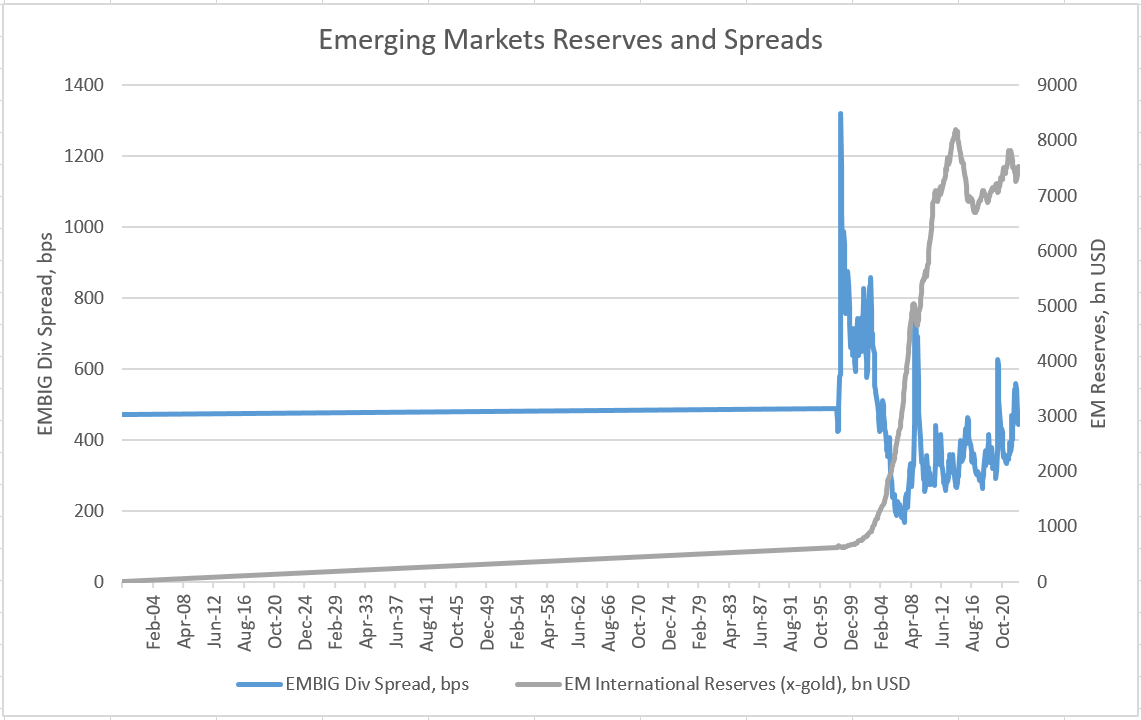

Using FX as a shock-absorber – while relying on interest rates as the primary policy instrument to target inflation – helps to initiate a “textbook” adjustment of the current account balance (less imports and more competitive exports). With fewer FX interventions, this is the fastest way to start rebuilding the international reserves. Over time, the accumulation of reserves and a stronger structural/institutional backdrop should lead to a major decline in sovereign spreads, limiting the extent of potential “flare-ups” in the future. The chart below demonstrates all these points very well (higher reserves/tighter spreads/lower peaks). Many EMs are now net sovereign creditors in U.S. dollars!

EM FX And U.S. Dollar

EMs that used their past devaluation experiences wisely – reforms, accumulation of reserves, inflation-targeting – are now less tied up to the U.S. Dollar cycle. The Brazilian real, the Mexican peso, the Peruvian sol, and the Chilean peso ended up stronger vs. the U.S. Dollar last year. The final point here is that there are different ways to get exposure to emerging markets these days. For example, we don’t like Brazil’s local market currently (due to policy noise), so we just don’t own it…but the current environment can still be positive for Brazilian credits that pay in real and earn in U.S. Dollar (for example). Stay tuned!

Chart at a Glance: EM Reserves vs. Sovereign Spreads in Different Regimes

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.