The Pivot Talk Is Back

04 October 2022

Read Time 2 MIN

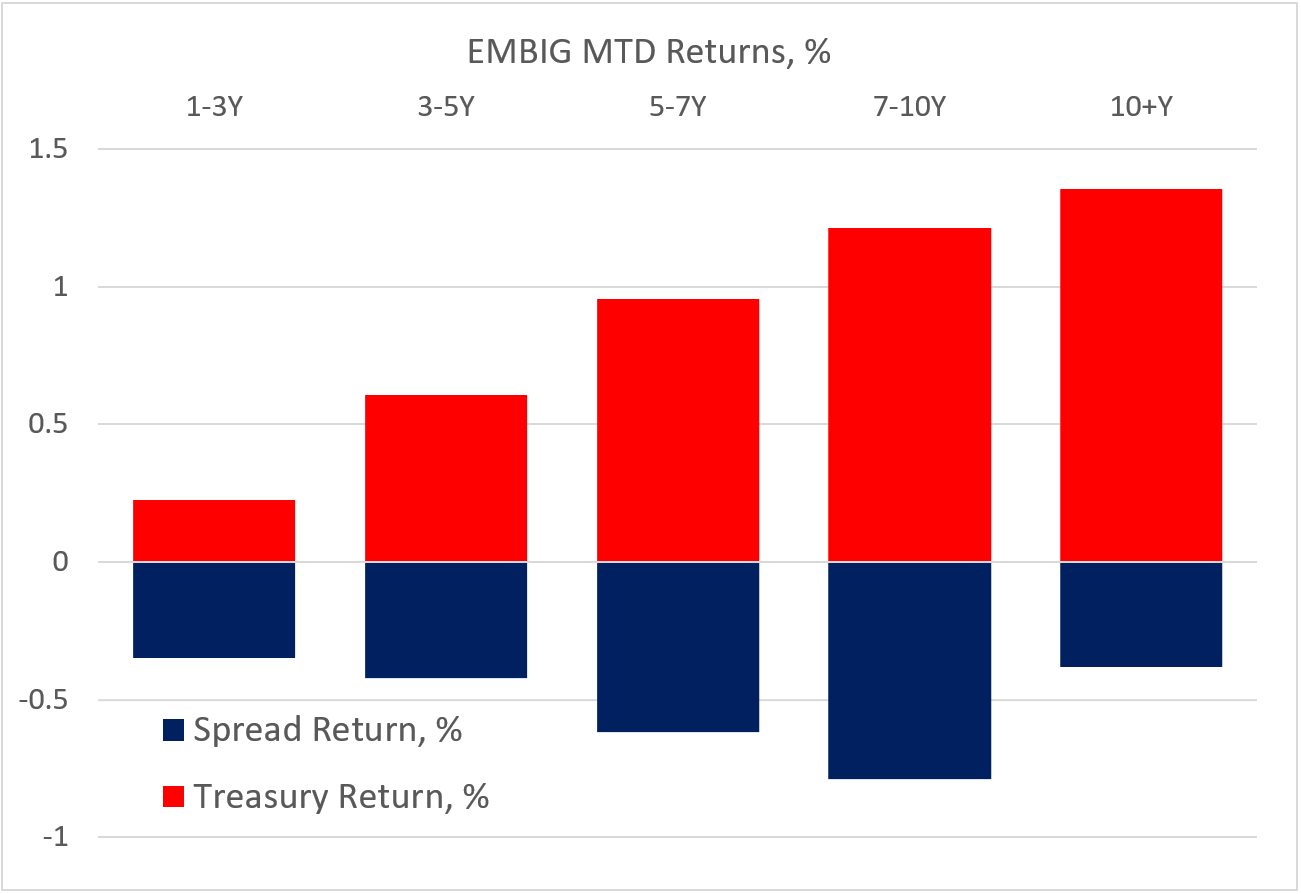

DM Tightening Cycle

Yesterday’s soft ISM (Institute for Supply Management) survey in the U.S. and a smaller than expected overnight rate hike in Australia brought back a specter of the dovish policy pivot. The Fed Funds Futures and European swap curves are still pricing in sizable rate hikes in October (ECB’s +67bps) and November (U.S. Federal Reserve’s 66–68bps). However, the market expectations for terminal policy rates continued to calm down – both in developed markets (DM) and emerging markets (EM), with most notable adjustments in the U.K, the Eurozone, South Korea, Chile, South Africa, Colombia, and Malaysia. Nominal yields staged a big rally this morning and most global equity indices were in the black as well. In emerging markets, duration outperformed big time so far this month, driven by treasury return (see chart below). But is it too early to relax as regards inflation pressures in EM?

LATAM Inflation Pressures

Governor of the Chilean central bank said this morning that the economy needs further adjustment in order to bring inflation back to target – even though the consensus believes that headline inflation peaked in August, and that the September print (out on Friday) should moderate. One way to interpret Governor’s remarks is that the central bank will keep the policy rate sufficiently restrictive to stop overheating, which was partially “fed” by a string of withdrawals from private pension funds. Colombia might have hiked by less than expected last week, but tomorrow’ inflation print is likely to show further acceleration. The just–released central bank minutes sounded reasonably hawkish and signaled more rate hikes, because inflation is still far from the target (un–anchoring inflation expectations), and the economy is growing above potential, contributing to a wide current account deficit (around 6% of GDP), which “might be harder to finance in an environment of more challenging financial conditions”. Mexico’s inflation is also expected to rise more in September, justifying the market expectation of another 75bps of tightening before year–end.

Asia Policy Rates

There will be several inflation releases in EM Asia after the market close in New York today. We will be paying special attention to Thailand, because the central bank is widely perceived as being behind the curve, and Thailand is at the bottom half of the EM local debt “league table” (J.P. Morgan GBI–EM Index) as regards year–to–date total return (U.S. Dollar unhedged). The market expects the central bank to do a lot of catching up in the next 12 months – Thailand’s local swap curve shows the fastest pace of rate hikes in EM Asia (+167bps). But if annual inflation indeed moderates sharply from 7.86% to 6.58% in September (as consensus sees it), the central bank can feel more comfortable with its very gradual pace of tightening going forward. Stay tuned!

Chart at a Glance: EM Duration Drives Sovereign Returns

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.