A Thematic Approach with a Measured Risk Profile

12 October 2023

Share with a Friend

All fields required where indicated (*)Despite being a thematic fund, the VanEck Smart Home UCITS ETF (CAVE) is not as volatile as conventional thematic ETFs. Instead, its risk profile is more similar to a broader multi-theme fund, explains portfolio manager Seb de Feiter, offering investors a thematic bet with a measured risk profile.

Since the Covid-19 pandemic began to spread around the world at the beginning of 2020, financial markets have delivered a rollercoaster ride, shaken by a significant rise in inflation and interest rate volatility. Most funds have felt the impact: thematic funds in particular. That’s because thematic ETFs are often opportunity-driven, with portfolios mostly consisting of growth stocks (which are hit the hardest in a rising interest rate environment).

Looking forward, uncertainty about the direction of inflation, interest rates, economic growth and fiscal policies is causing a disconnect in financial markets. CAVE, however, is an actively-managed fund using a multi-layered thematic approach – as we explained in previous blogs – making it more mindful of the current uncertainty. This enables CAVE to benefit from the performance differences between factors such as value (versus growth) and size (large versus small caps) or industries (cyclicals vs defensive).

Since it is difficult to accurately time and predict the direction of macro-economic variables, and the fact that their influence on different parts of the equity markets is large, Seb makes sure that CAVE’s portfolio is well balanced and diversified across sectors and factors to reduce volatility. He monthly rebalances the portfolio, maintaining its diversification.

Layering Factors Within Themes

How does he do that? Well, Seb explains, the portfolio currently consists of a mix of cyclical sector exposures , such as consumer discretionary stocks like MercadoLibre, and more defensive sector exposures, such as consumer staples (e.g. Nestle) or healthcare (e.g. Option Care Health). Defensive sectors typically have lower volatility. Within those defensive sectors, however, we can also choose between growth and value stocks.

Healthcare, for instance, is an important subtheme within the smart home ETF. We believe that by bringing more technology-related care into our homes, it will be possible to keep costs in check and address the challenges of an ageing society suffering from chronic illnesses and diseases (see also this blog).

Two companies that fit the healthcare sub-theme are Dexcom and Option Care Health. Dexcom is a provider of glucose monitoring systems, whereas Option Care provides home infusion services. Both companies have defensive revenue streams (i.e., not cyclical). Dexcom, however, would have a stronger correlation with the growth factor compared to Option Care.

Seb also takes value and growth stocks into consideration at the overall portfolio level to make sure there is a mix of stocks with varying levels of sensitivity to changes in interest rates. For instance, cyber security growth stocks such as Crowdstrike and Zscaler have higher duration, meaning that a higher proportion of their cash flows lies in the more distant future. As a result, they are perceived to be more sensitive to interest rates. More value-like stocks such as Cisco Systems or gaming company Electronic Arts, have lower duration and are less sensitive to interest rate movements.

Size is a final factor to take into account. CAVE’s multi-layered thematic approach makes it possible to add companies beyond the usual suspects. Naturally, Seb also selects large companies such as Microsoft and Amazon, which both have important roles to play in the smart home. But he also adds smaller less obvious stocks, such as PowerSchool and Franklin Covey. Powerschool provides business software running core applications for educational institutions. Franklin Covey is a coaching company that provides training and assessment services in the areas of leadership, individual effectiveness and business execution for organizations and individuals.

Despite these advantages, Seb warns that thematic investing still comes with some risks that are less dominant in an index-tracking fund. Thematic funds will always be less diversified in most areas compared to a broad stock index with hundreds or thousands of stocks. Moreover, CAVE’s approach also requires the exclusion of sectors such as oil & gas, which can have a strong impact on the performance of a broader index. Additionally, a thematic view implies a longer-term perspective, which introduces some uncertainty. Finally, although we strive to balance relevant investment factors, the thematic angle means that growth plays a more dominant role relative to the broader equity market.

Reaping Results

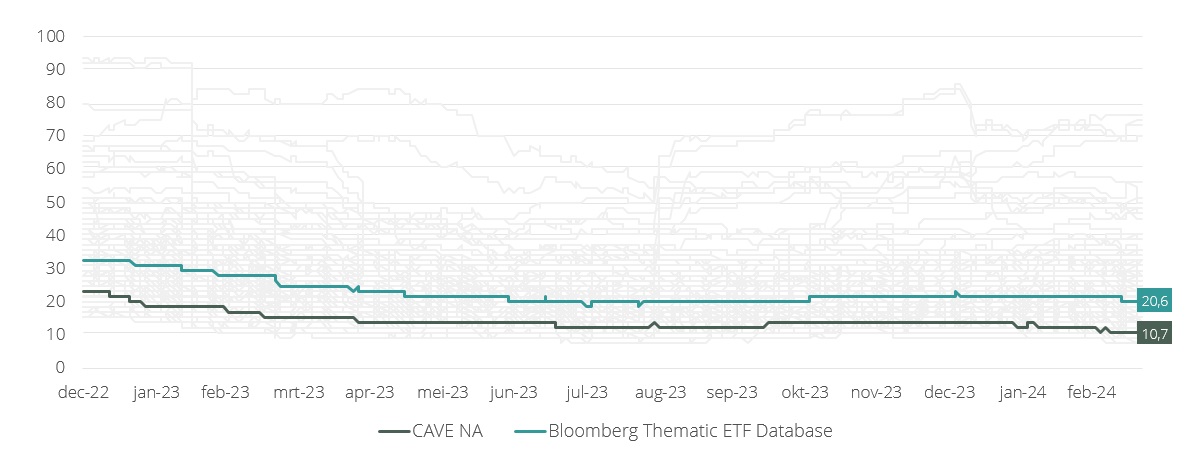

Seb’s strategy is delivering the intended results. In the graph below, we compare the volatility of the Bloomberg thematic ETF database1 to CAVE. It shows that CAVE clearly has a lower volatility than other thematic funds.

Based on Volatility, CAVE’s Risk Profile is Lower Than a Large Portion of Thematic ETFs

Smart Home vs. Bloomberg Thematic ETF database (YtD annualized 90-day volatility)

Source: Bloomberg – ETF database. (selected all ETFs in North America and Europe categorized as thematic, includes both single and multi-theme funds. Only ETFs with complete data for the selected YtD period are included. Excluding CAVE the selection contains 209 ETFs.)

Moreover, when we look at the ETFs with lower volatility than CAVE, it is noticeable that many of them are linked to infrastructure-related investments. Infrastructure is an asset class known for its relatively low volatility. This is due to the stable cash flow of the underlying assets, which are often contractually secured.

Dynamically diversifying the portfolio by investing across sub-themes, industries and factors has helped to reduce volatility in 2023 while safeguarding returns. Moreover, as the graph shows, CAVE has a lower volatility than other thematic ETFs, resulting in a more measured risk profile.

1 Bloomberg ETF selection – contains ETFs in North America and Europe categorized as thematic, includes both single and multi-theme funds. Only ETFs with complete data for the selected YtD period are included. Excluding CAVE the selection contains 209 ETFs.

Important Disclosures

For informational and advertising purposes only.

This website originates from VanEck (Europe) GmbH and VanEck Asset Management B.V., a UCITS Management Company incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH, with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin). The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. All indices mentioned are measures of common market sectors and performance. It is not possible to invest directly in an index.

VanEck Asset Management B.V., the management company of VanEck Smart Home Active UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, engaged Dasym Managed Accounts B.V., an investment company regulated by the Dutch Financial Service Supervisory Authority (AFM), as the investment advisor for the Fund. The Fund is registered with the Central Bank of Ireland. The value of the ETF’s assets may fluctuate heavily as a result of the investment strategy.

Investors must read the sales prospectus and key information document before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the local information agent details to be found on the website.

All performance information is historical and is no guarantee of future results. Investing is subject to risk, including the possible loss of principal. You must read the Prospectus and KIID/KID before investing.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from Dasym Managed Accounts B.V. with registered address at Flevolaan 41 A, 1411 KC Naarden, the Netherlands (DMA), DMA is an investment company incorporated under Dutch law and regulated by the Dutch Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB). The information prepared by DMA is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. The views and opinions expressed in this presentation are those of the author(s) but not necessarily those of DMA. DMA and its associated and affiliated companies (together “Dasym”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Dasym makes no representation or warranty, express or implied, as to the accuracy or completeness of any of the information contained in this blog. Dasym undertakes no responsibility to update the information prepared by it and contained in this blog.

This information is published by VanEck (Europe) GmbH. VanEck (Europe) GmbH, with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin). The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Smart Home Active UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, engaged Dasym Managed Accounts B.V., an investment company regulated by the Dutch Financial Service Supervisory Authority (AFM), as the investment advisor for the Fund. The Fund is registered with the Central Bank of Ireland and actively managed. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

UK - Facilities Agent: Computershare Investor Services PLC

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Discrete performance shows 12-month performance to the most recent quarter-end for each of the last 10 years where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 months period and so on.

Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Dasym and VanEck.

© VanEck (Europe) GmbH / Dasym Managed Accounts B.V.

Sign-up for our ETF newsletter