Bitcoin: Less Volatile Than Many S&P 500 Stocks?

03 August 2020

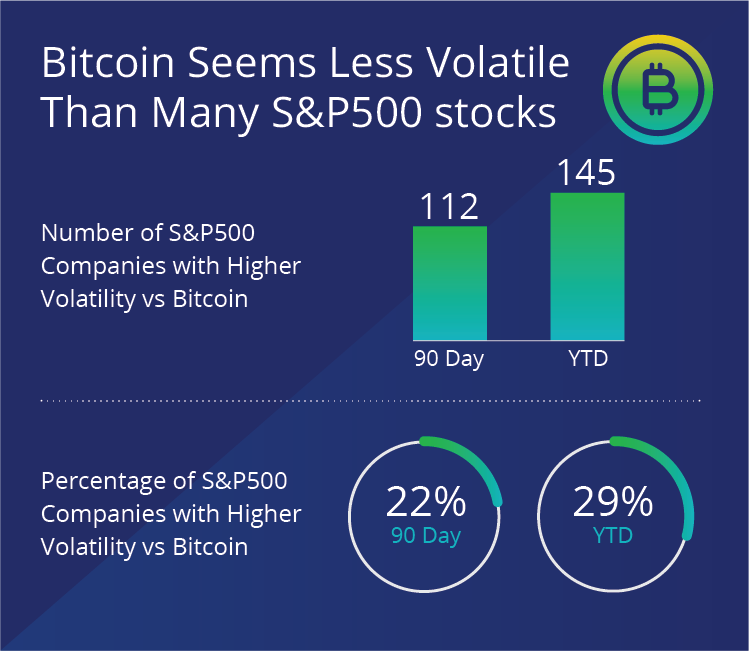

Historically, bitcoin has been discussed in the news and among investors as a nascent and volatile asset outside of the traditional stock and capital markets. Much of the volatility over the past few years can be attributed to sensitivity to small total market size, regulatory hurdles and generally limited penetration in mainstream stock and capital markets. While bitcoin continues to be a volatile asset, it may surprise researchers and investors as to what other major assets have been more volatile than bitcoin.

Source: Factset. Data as of 6/30/2020. Volatility is measured by daily standard deviation.

In our long-term study of bitcoin, we had compared bitcoin correlations to traditional asset classes and now see another interesting recent trend with its volatility. In our current volatility research, we compared the 90 day and year to date volatility—as measured by their daily standard deviation1 as of 30 June, 2020—of bitcoin against the constituents of the S&P 500 Index. We found that bitcoin has exhibited lower volatility than 172 stocks of the S&P 500 in a 90 day period and 155 stocks YTD.

While there are no bitcoin exchange traded funds (ETFs) available today, we believe such products may show similar volatility characteristics—based on the comparison above—as many stocks in well-known indices and ETFs, such as the S&P 500 and related products.

Important Disclosure

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MV Index Solutions GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MV Index Solutions GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount. You must read the prospectus and KID before investing. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

Investments into the Product bear the risk of loss up to the total loss.

© VanEck (Europe) GmbH.

Divulgación importante

Esta es una comunicación comercial. Consulte el folleto del OICVM y el documento de datos fundamentales antes de tomar una decisión de inversión definitiva.

Esta información procede de VanEck (Europe) GmbH, que ha sido nombrada distribuidora de los productos VanEck en Europa por la sociedad de gestión VanEck Asset Management B.V., constituida con arreglo a la legislación neerlandesa y registrada en la Autoridad para los Mercados Financieros de los Países Bajos (AFM). VanEck (Europe) GmbH, con domicilio social en Kreuznacher Str. 30, 60486 Fráncfort del Meno, Alemania, es un proveedor de servicios financieros regulado por la Autoridad Federal de Supervisión Financiera de Alemania (BaFin).

La información está destinada únicamente a proporcionar información general y preliminar a los inversores y no debe interpretarse como asesoramiento de inversión, jurídico o fiscal. VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited y sus empresas asociadas y afiliadas (conjuntamente "VanEck") no asumen ninguna responsabilidad con respecto a cualquier decisión de inversión, desinversión o retención adoptada por el inversor sobre la base de esta información. Los puntos de vista y opiniones expresados son los de los autores, pero no necesariamente los de VanEck. Las opiniones son actuales en la fecha de publicación y pueden variar según la situación del mercado. Ciertas afirmaciones contenidas en el presente documento pueden tratarse de proyecciones, previsiones y otras exposiciones a futuro que no reflejan resultados reales. La información facilitada por terceras fuentes se considera fiable, pero su exactitud o exhaustividad no se ha verificado de forma independiente y no puede garantizarse. Pueden ser de aplicación comisiones de intermediación o transacción.

Toda la información sobre rentabilidad se basa en datos históricos y no predice rentabilidades futuras. Invertir está sujeto a riesgos, incluida la posible pérdida del capital.

Queda prohibida la reproducción total o parcial de este material, así como cualquier referencia al mismo en cualquier otra publicación, sin la autorización expresa por escrito de VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Regístrese para recibir nuestro boletín sobre ETF

Informes relacionados

Informes relacionados

19 septiembre 2024

11 mayo 2023

17 abril 2023

19 septiembre 2024

11 mayo 2023

17 abril 2023

14 marzo 2023