Balanced Multi Asset ETF

VanEck Multi-Asset Balanced Allocation UCITS ETF

Balanced Multi Asset ETF

VanEck Multi-Asset Balanced Allocation UCITS ETF

Fund Description

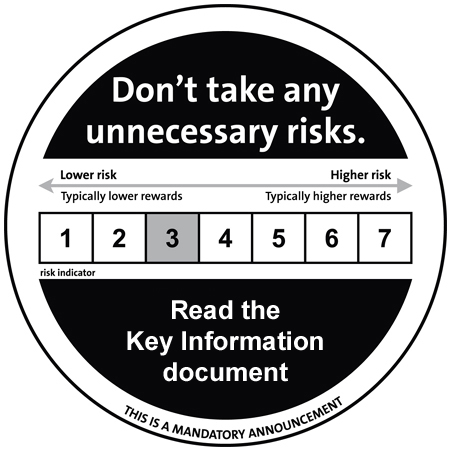

The VanEck Multi-Asset Balanced Allocation UCITS ETF makes multi-asset investing easy, bringing it within reach of the average investor. By investing across stocks, bonds and real estate, it makes investments more defensive, without necessarily eating into returns. This version of the ETF is considered medium risk.

-

NAV€70.23

as of 19 Sep 2024 -

YTD RETURNS8.22%

as of 19 Sep 2024 -

Total Net Assets€37.4 million

as of 19 Sep 2024 -

Total Expense Ratio0.30%

-

Inception Date14 Dec 2009

-

SFDR ClassificationArticle 8

Overview

Fund Description

The VanEck Multi-Asset Balanced Allocation UCITS ETF makes multi-asset investing easy, bringing it within reach of the average investor. By investing across stocks, bonds and real estate, it makes investments more defensive, without necessarily eating into returns. This version of the ETF is considered medium risk.

- One-stop-shop for your investment portfolio

- Tailored to your risk preferences

- Diversified across stocks and bonds from roughly 250 companies and governments

- Annually rebalanced across equities, government bonds, corporate bonds and real estate stocks

- A 12-year record of delivering attractive returns for investors1

- All-in costs of just 0.3% a year

Underlying Index

Multi-Asset Balanced Allocation Index (TTMTINL)

Fund Highlights

- One-stop-shop for your investment portfolio

- Tailored to your risk preferences

- Diversified across stocks and bonds from roughly 250 companies and governments

- Annually rebalanced across equities, government bonds, corporate bonds and real estate stocks

- A 12-year record of delivering attractive returns for investors1

- All-in costs of just 0.3% a year

Underlying Index

Multi-Asset Balanced Allocation Index (TTMTINL)

Capital Markets

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment. For more information about our APs and to contact our Capital Markets team, please visit factsheet capital markets.pdfPerformance

Holdings

Portfolio

Distributions

Literature

Index

Index Description

The Multi-Asset Balanced Allocation Index is composed of different indices with the following weights:

- 40% Solactive Sustainable World Equity Index

- 10% GPR Global 100 Index

- 25% iBoxx SD-KPI EUR Liquid Corporates Index

- 25% Markit iBoxx EUR Liquid Sovereign Diversified 1-10 Index

Index Key Points

Underlying Index

Multi-Asset Balanced Allocation Index (TTMTINL)

Index composition

The index has the followings specifications:

- The indices allocation is reviewed annually on the first Tuesday of September, so that the allocation corresponds to the original ratio again.

- If this is not a trading day, the review will take place on the next following trading day.

- The equity universe of the underlying indices consists of companies from developed countries around the world.

- The bond universe of the underlying indices consists of euro denominated government and corporate bonds.

More information on the rules of the underlying indices is available in the prospectus under ‘documents’ on www.vanecketfs.nl or www.vaneck.com

Index Provider

IHS Markit