Marketing Communication

GOAT

Global Moat ETF

VanEck Morningstar Global Wide Moat UCITS ETF

Marketing Communication

GOAT

Global Moat ETF

VanEck Morningstar Global Wide Moat UCITS ETF

ISIN:

IE00BL0BMZ89

Fund Description

The VanEck Morningstar Global Wide Moat UCITS ETF invests in global equities with powerful competitive advantages and attractive valuations. This concept has delivered successful long-term investment returns.

-

NAV$37.44

as of 13 Feb 2026 -

YTD RETURNS3.82%

as of 13 Feb 2026 -

Total Net Assets$172.2 million

as of 13 Feb 2026 -

Total Expense Ratio0.52%

-

Inception Date07 Jul 2020

-

SFDR ClassificationArticle 6

Overview

Fund Description

The VanEck Morningstar Global Wide Moat UCITS ETF invests in global equities with powerful competitive advantages and attractive valuations. This concept has delivered successful long-term investment returns.

- Based on Warren Buffett´s “economic moats” concept

- Strategy with proven record of outperformance1

- Transparent indexing model from Morningstar, a renowned research partner

- Companies with long-term competitive advantages (switching costs, intangible assets, network effect, cost advantage, efficient scale)

- Targets companies trading at relatively attractive prices

- Could be the core of a global equity portfolio

and the Prospectus for other important information before investing.

Underlying Index

Morningstar Global Wide Moat Focus Index

Fund Highlights

- Based on Warren Buffett´s “economic moats” concept

- Strategy with proven record of outperformance1

- Transparent indexing model from Morningstar, a renowned research partner

- Companies with long-term competitive advantages (switching costs, intangible assets, network effect, cost advantage, efficient scale)

- Targets companies trading at relatively attractive prices

- Could be the core of a global equity portfolio

1Past performance is not a reliable indicator for future performance. Risk Factors: Equity market risk, limited diversification risk, foreign currency risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

Morningstar Global Wide Moat Focus Index

Capital Markets

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment. For more information about our APs and to contact our Capital Markets team, please visit factsheet capital markets.pdfPerformance

Holdings

Portfolio

Documents

Publications

Index

Index Description

The Morningstar® Global Wide Moat Focus IndexSM tracks the overall performance of attractively priced global companies with sustainable competitive advantages according to Morningstar’s equity research team. The rules-based index is reviewed quarterly. Please consult Morningstar Global Wide Moat Focus for detailed index information.

Index Key Points

Underlying Index

Morningstar®Global Wide Moat Focus IndexSM

Index composition:

The Index contains at least 50 companies globally with sustainable competitive advantages trading at attractive valuations according to Morningstar.

Companies eligible for inclusion in the Index:

- Derived from Morningstar® Global Markets IndexSM (Parent Index)

- Assigned an Economic Moat rating of wide by Morningstar’s equity research team

- Assigned a fair value estimate by Morningstar's equity research team

Methodology highlights:

- Momentum screen: securities in the bottom 20% as ranked by 12-month price change at the time of review are excluded

- Staggered reconstitution:

Index is divided into two equally-weighted sub-portfolios, and each is reconstituted and rebalanced semi-annually on alternating quarters.

Each sub-portfolio will contain 50 equally-weighted securities at its semi-annual reconstitution and weights will vary with market prices until the next reconstitution date.

Each sub-portfolio is reweighted to 50% of the total index every six months. - Buffer rule:

At each quarterly review, current index constituents ranked within the top 200% of the eligible universe based on current market price/fair value ratio are given preference for inclusion.

From among the remaining eligible securities, those with the lowest current market price/fair value ratios are included in the index. - Sector cap: The greater of 40% or corresponding weight in Parent Index + 10%

Index Provider

Morningstar Inc.

Awards

Main Risks

Main Risk Factors of a Global Moat ETF

Because all or a portion of the Fund are being invested in securities denominated in foreign currencies, the Fund’s exposure to foreign currencies and changes in the value of foreign currencies versus the base currency may result in reduced returns for the Fund, and the value of certain foreign currencies may be subject to a high degree of fluctuation.

The Fund may invest a relatively high percentage of its assets in a smaller number of issuers or may invest a larger proportion of its assets in a single issuer. As a result, the gains and losses on a single investment may have a greater impact on the Fund's Net Asset Value and may make the Fund more volatile than more diversified funds.

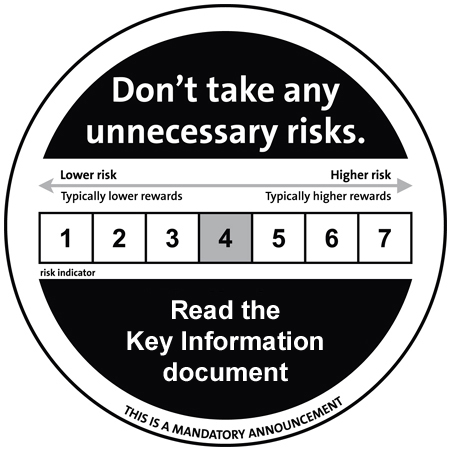

The prices of the securities in the Fund are subject to the risks associated with investing in the securities market, including general economic conditions and sudden and unpredictable drops in value. An investment in the Fund may lose money.