Dividend ETF

VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF

Dividend ETF

VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF

Fund Description

The VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF delivers an attractive regular income through equities.1The Morningstar global research company seeks the top 100 income payers globally, selected for their dividend yields, resilience and likely growth.

-

NAV€39.03

as of 18 Sep 2024 -

YTD RETURNS11.65%

as of 18 Sep 2024 -

Total Net Assets€956.2 million

as of 18 Sep 2024 -

Total Expense Ratio0.38%

-

Inception Date23 May 2016

-

SFDR ClassificationArticle 8

Overview

Fund Description

The VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF delivers an attractive regular income through equities.1The Morningstar global research company seeks the top 100 income payers globally, selected for their dividend yields, resilience and likely growth.

- Currently provides attractive dividend income

- The top 100 developed market equities, selected for dividend yields

- Holdings screened for dividend resilience

- Globally diversified across stocks and sectors

- Screened for ESG Risks, UN Global Compact Principles Violations and controversial product involvement based on Sustainalytics research

1Not guaranteed.

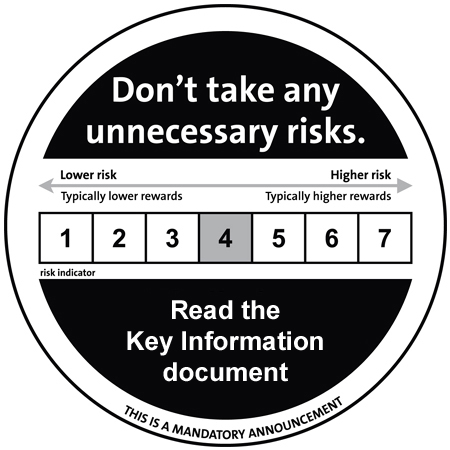

Main Risk Factors: Equity market risk, market risk, foreign currency risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

Morningstar Developed Markets Large Cap Dividend Leaders Screened Select Index (MSDMDLGE)

Fund Highlights

- Currently provides attractive dividend income

- The top 100 developed market equities, selected for dividend yields

- Holdings screened for dividend resilience

- Globally diversified across stocks and sectors

- Screened for ESG Risks, UN Global Compact Principles Violations and controversial product involvement based on Sustainalytics research

1Not guaranteed.

Risk Factors: Equity market risk, market risk, foreign currency risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

Morningstar Developed Markets Large Cap Dividend Leaders Screened Select Index (MSDMDLGE)

Capital Markets

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment. For more information about our APs and to contact our Capital Markets team, please visit factsheet capital markets.pdfPerformance

Holdings

Portfolio

Distributions

Literature

Index

Index Description

The Morningstar® Developed Markets Large Cap Dividend Leaders Screened Select Index™ is composed of the top 100 positions based on dividend yield which satisfy the screening criteria, including companies that display consistency and sustainability in dividend payment patterns. The weight of a share within the Morningstar® Developed Markets Large Cap Dividend Leaders Screened Select Index™ is determined based on the total dividend paid. The index has a 40% sector cap.

Index Key Points

Underlying Index

Morningstar Developed Markets Large Cap Dividend Leaders Screened Select Index (MSDMDLGE)

Index composition

Shares must meet the following criteria to be included in the index:

• The dividend has been paid in the past 12 months.

• The dividend TTM dividend per share is not lower than the TTM dividend per share 5 years ago.

• The forward dividend payout ratio is less than 75%.

• The index then selects the 100 shares with the highest dividend yield. The weight of each share is based on the total dividend paid.

• The maximum weight of a share at the time of review is 5%.

• The maximum weight of a sector at the time of review is 40%.

• The index is reconstituted and rebalanced semi-annually, in June and December.

Index Provider

Morningstar