Fund Description

The VanEck World Equal Weight Screened UCITS ETF is a force for a better world. It invests in the 250 most liquid, most highly capitalised companies globally that comply with the UN Global Compact Principles for responsible corporate behavior. Additionally, it excludes sectors that do not follow responsible business practices, including: alcohol, animal testing for cosmetic products, military, weapons, gambling, pornography, tobacco, nuclear power, oil sands and thermal coal mining.The Fund does not have sustainable investment as its investment objective.

- ESG-screened investing in line with the UN Global Compact Principles

- Broad diversification: global universe, equal weight per stock, regions capped at 40%

- Long-standing track record

- Backed by ESG-intelligence from ISS ESG

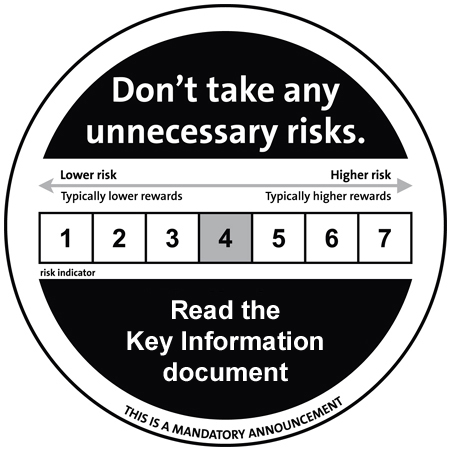

Main Risk Factors: Foreign currency risk, equity market risk. Investors must consider all the fund's characteristics or objectives as detailed in the prospectus or related documents before making an investment decision. Please refer to the sustainability-related disclosures in the document section, to the

KID

and the Prospectus for other important information before investing.

Please note, as of 8th October 2021, the sub-fund VanEck Global Equal Weight UCITS ETF has merged into the sub-fund VanEck World Equal Weight Screened UCITS ETF. You can find more information about the merger in the document section.

Underlying Index

Solactive Sustainable World Equity Index GTR (TTMTTSWE)